Indonesia''s Electric Battery Industrial Strategy

Feb 2, 2024 · Indonesia''s ambitious targets in the electric battery industry offer a prime opportunity for strategic investments and partnerships. Foreign

Hyundai & LG Open Indonesia''s First EV Battery

Jul 5, 2024 · Indonesia, renowned for its vast nickel reserves, has inaugurated Southeast Asia''s first EV battery manufacturing plant in Karawang, West Java.

BatteryHouse Sdn Bhd

BatteryHouse is a Lithium LiFePO4 Battery Assembler based in Malaysia. LiFePO4 Lithium Battery for Solar, Golf Buggy, AWP, Floor Care and ..

China''s REPT Battero to build battery

Jan 15, 2025 · REPT Battero''s wholly owned unit, Infinitude International Investment Limited, will contribute $83.7 million, maintaining its 60% stake in

Hyundai Motor, LG Energy Solution launch

Jul 3, 2024 · South Korea''s Hyundai Motor Group and LG Energy Solution (LGES) on Wednesday inaugurated Indonesia''s first battery cell production

Indonesia Battery Market 2025-2033 Overview:

Jan 7, 2025 · The size of the Indonesia Battery Market was valued at USD 233.20 Million in 2023 and is projected to reach USD XXX Million by 2032, with an

EV Battery Indonesia: The Prospects and

Jul 3, 2025 · A lithium-ion battery is a rechargeable battery type with high energy density levels and high safety levels. This type of battery is most commonly

Official Site

Trimitra Baterai Prakasa is The Biggest Automotive Batteries Manufacturer in South East Asia with Production capacity up to 5 million units per year with

Daftar Perusahaan Pembuat Baterai Listrik di

Jan 16, 2023 · 1. LG Energy Solution Ltd Perusahaan teknologi asal Korea ini telah memulai pembangunan pabrik sel baterai kendaraan listrik di Indonesia

Recovering Valuable Elements, Warfy Revitalizes

Oct 27, 2023 · As a distributor and manufacturer of electric vehicles, we will greatly benefit from this collaboration. "We will continue to improve battery

Top Lithium Battery Manufacturers in 2025: Who

Mar 12, 2025 · Are you navigating the booming electric vehicle (EV) and energy storage markets and wondering which battery manufacturers are powering the

Rept Battero to develop 8GWh Indonesia BESS cell gigafactory

Jan 17, 2025 · Image: REPT via LinkedIn Chinese battery manufacturer Rept Battero has announced plans to develop an 8GWh gigafactory in Indonesia specialising in lithium-ion cells

Top 5 solar battery storage companies in

Jan 22, 2024 · Indonesian solar battery storage companies mainly include energy storage system integrators, charging infrastructure providers, battery

Birubatt | PT. Indo Energi Elektrik – Your Energy Solutions

PT. INDO ENERGI ELEKTRIK started in Indonesia in 2018. The company is engaged in research and development, production and sale of energy distribution systems, standard lithium battery

Here are five of the top battery storage

Jun 22, 2018 · The company offers turnkey energy storage systems for connection to medium- or high-voltage grids. In 2014, it announced a

Top 14 Battery Storage Companies in Indonesia (2025) | ensun

Discover all relevant Battery Storage Companies in Indonesia, including PT Merdeka Battery Materials Tbk and CNGR Indonesia

Top 3 Lithium Battery Companies in Indonesia in

In 2024, Indonesia stands at the forefront of the rapidly evolving lithium battery industry, catalyzed by its significant reserves of raw materials essential for

Indonesia Battery Market

Jan 23, 2025 · Indonesia Battery Market Size - Industry Report on Share, Growth Trends & Forecasts Analysis (2025 - 2030) The Indonesia Battery Market

PT GS BATTERY

PT GS Battery support the automotive industry and energy storage systems on environmental sustainability and become the battery manufacturer and preferred partner for energy storage

KIJO Group

Kijo Group is a professional energy storage battery (lithium battery & VRLA Battery) company that integrates science, industry, and trade with production

Topak energy – PT. Topak Energy Indonesia

Topak Energy Indonesia fokus pada penyediaan produk baterai Lithium secara terintegrasi dengan BMS (Battery Management System) yang dapat

Lithium Battery Cell, Module, EV Battery System Manufacturer

LITHIUM STORAGE is a lithium technology provider. LITHIUM STORAGE focuses on to deliver lithium ion battery, lithium ion battery module and lithium based battery system with BMS and

Global Network

Aug 19, 2025 · We are introducing the global manufacturing sites, global sales sites, and global business offices of Panasonic Energy Co., Ltd.

Top 14 Battery Storage Companies in Indonesia (2025) | ensun

PT Merdeka Battery Materials Tbk (IDX:MBMA) specializes in manufacturing battery materials, particularly through the extraction of nickel and cobalt, which are crucial for battery storage.

Birubatt | PT. Indo Energi Elektrik – Your Energy

PT. INDO ENERGI ELEKTRIK started in Indonesia in 2018. The company is engaged in research and development, production and sale of energy

Indonesia owns nine companies supporting EV

Jul 15, 2021 · The main advantage of EV manufacturing in Indonesia is the battery made from nickel-based Lithium Ion Batteries. "The EV manufacturing

China''s REPT BATTERO plans 8-GWh battery

Jan 16, 2025 · Chinese lithium-ion battery manufacturer REPT BATTERO Energy Co Ltd (HKG:666) has decided to invest in the construction of a battery factory

Rept Battero to develop 8GWh Indonesia BESS cell gigafactory

Jan 17, 2025 · Chinese battery manufacturer Rept Battero has announced plans to develop an 8GWh gigafactory in Indonesia specialising in lithium-ion cells for battery energy storage

6 FAQs about [Indonesia Surabaya Energy Storage Lithium Battery Manufacturer]

Will PT Rept battero build a battery factory in Indonesia?

Image: REPT via LinkedIn Chinese battery manufacturer Rept Battero has announced plans to develop an 8GWh gigafactory in Indonesia specialising in lithium-ion cells for battery energy storage systems (BESS). Rept Battero’s non-wholly-owned subsidiary, PT Rept Battero Indonesia, will invest in and construct the Indonesian Battery Factory.

Why is Indonesia a leader in the lithium battery industry?

In 2024, Indonesia stands at the forefront of the rapidly evolving lithium battery industry, catalyzed by its significant reserves of raw materials essential for battery production and a growing focus on renewable energy sources. As Southeast Asia's largest economy, Indonesia has strategically positioned itself as a

How will Greenway develop a lithium battery factory in Indonesia?

In terms of technological capabilities, Greenway will inject its globally leading lithium battery technology and PACK production expertise into the Indonesia factory. Using this as a starting point, the company aims to gradually achieve localized production of battery cells.

Is battery storage taking off in Indonesia?

Despite the opportunities for manufacturing, from a deployment perspective, battery storage has not yet taken off in Indonesia beyond a handful of projects, including a 5MW pilot announced by the government in March 2022. Rept Battero has announced plans to develop an 8GWh gigafactory in Indonesia specialising in lithium-ion cells for BESS.

How many GWh will Indonesia's battery factory produce?

The first phase of the Indonesian battery factory is expected to achieve an annual production capacity of 8 GWh of lithium-ion batteries and components. Hong Kong-listed REPT Battero has announced plans to invest in a new battery production facility in Indonesia.

Who is PT Indo Energi Elektrik?

PT. INDO ENERGI ELEKTRIK started in Indonesia in 2018. The company is engaged in research and development, production and sale of energy distribution systems, standard lithium battery modules, a lithium battery energy storage system (ESS), a battery management system (BMS) and a power location platform.

Industry Information

- New Energy Base Station Battery Strength Standard

- What is the cooling machine of the liquid-cooled energy storage cabinet

- 400W foldable solar panel

- Outdoor power supply b62

- Typical battery energy storage system

- Photovoltaic panel manufacturer in Mombasa Kenya

- Flywheel energy storage device composition

- Yerevan Communication Green Base Station Photovoltaic Power Generation Outdoor Unit

- Wholesale transformer breaker in Finland

- ASEAN Portable Programmable Power Supply Price

- Jerusalem lg lithium battery pack

- 20kw dual axis solar tracking system

- Motor uses uninterruptible power supply

- Lome Solar Air-conditioned RV

- Factory price solar powerbox in Nepal

- Tonga portable energy storage power supply price

- Size of photovoltaic panel

- Moscow imported photovoltaic panel prices

- Generator protection for power stations

- Tonga Smart Inverter Manufacturer

- Electricity storage container screen converted into solar panels

- Battery cabinet composition introduction base station

- Small solar inverter for sale in Kuala-Lumpur

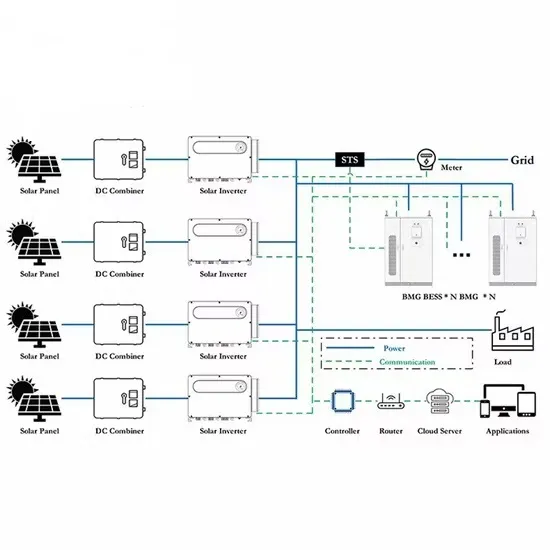

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

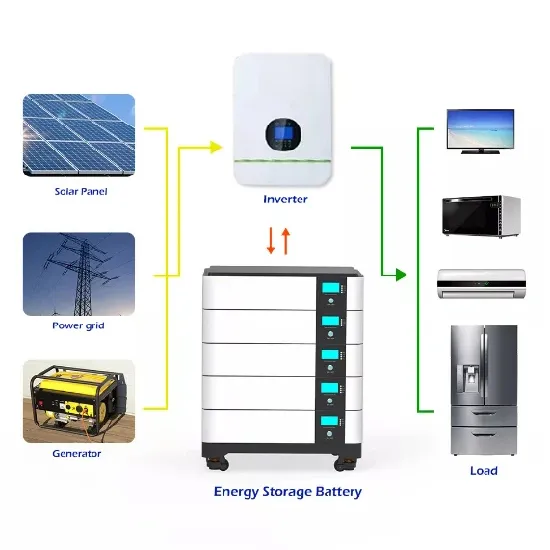

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.