Flat Glass Group H1/2023 Revenues Improve

Aug 29, 2023 · The management reports gross profit of RMB 1.85 billion for the reporting period with an 11.87% jump over the same period last year, while gross profit margin dropped 3.52

Why is it the first leading photovoltaic company to turn a profit

Jul 22, 2025 · By deeply cultivating high-value markets and high-value scenarios in Europe, Australia, Japan, etc., the proportion of overseas sales has increased significantly, and the

Follett''s 2023 PV Glass Revenue Increases 40% Gross Margin

Mar 26, 2024 · In terms of gross profit margin, photovoltaic glass, home glass and engineering glass decreased by 0.87 percentage points, 6.44 percentage points and 3.29 percentage

Global PV Glass (Solar Glass & Solar Photovoltaic Glass)

Apr 7, 2024 · In terms of production side, this report researches the PV Glass (Solar Glass & Solar Photovoltaic Glass) production, growth rate, market share by manufacturers and by

Photovoltaic glass faucet crazy roll price, gross margin decline.

Mar 28, 2024 · Public information shows that Follett landed on the Shanghai Stock Exchange in 2019, the company''s main business involves photovoltaic glass, float glass, engineering glass,

信义光能 (0968.HK):FY25全年盈利料回升

As a result, total gross margin and gross margin of photovoltaic glass decreased by 8.6 and 10.1 percentage points to 18.3% and 11.4%, respectively; (ii) Some photovoltaic glass production

Guosen: Maintain XINYI SOLAR (00968) "Outperform" rating, the profit

Feb 28, 2025 · In the first half of 2024, the company''s photovoltaic glass segment achieved operating income of 101.2 billion yuan, a year-on-year increase of 4%; with a gross profit

Global and China Photovoltaic Glass Industry

Apr 26, 2022 · PV glass market segments (ultra-clear patterned glass, TCO glass, etc.); 15 PV glass manufacturers like Xinyi Solar Holdings, Flat Glass Group,

Gross profit margin of photovoltaic battery industry chain

The gross profit margin of Follett''''s photovoltaic industry glass business in 2021 is 35.7%, which is similar to that of Xinyi Solar''''s photovoltaic industry glass business, which is also a leading

Photovoltaic Glass Profit Market Trends and Industry Insights

Summary: The photovoltaic glass industry is booming with profit margins ranging from 18% to 35% in 2024. This article explores market drivers, cost factors, and emerging opportunities –

Xinyi Solar Holdings Limited

Mar 8, 2023 · Gross profit s tood at HK$6,158.5 million (FY2021: HK$7,042.6 million), with gross profit margin of 30.0% (FY2021: 43.8%). The decrease in

Average Gross Profit Margin by Industry – 22

Updated 4/21/2023 Gross profit margin is one of the three main margin formulas in a company''s income statement, which measures a company''s efficiency in

20 April 2012

May 10, 2024 · Especially, driven by short supply in 2020, the gross profit margin of PV glass used to reach 49%, and the diluted ROE was between 18% and 42%. However, the figures

Global Solar Photovoltaic Glass Competitive Landscape

Jan 30, 2025 · This report studies the market size, price trends and future development prospects of Solar Photovoltaic Glass. Focus on analysing the market share, product portfolio, prices,

Follett performance rose gross margin decline: PV glass

Mar 27, 2024 · However, in 2023, the company''s photovoltaic glass gross margin fell significantly, reaching 23.31 percent, down 12.39 percent year-on-year. "Affected by the oversupply of glass

Understanding the Market | XINYI SOLAR falls more than 5%: Photovoltaic

Aug 22, 2024 · It is expected that the gross profit margin will decrease compared to the first half of the year. The bank pointed out that based on the current oversupply situation in the

Solar Photovoltaic Glass Market Size, Demand, Opportunities

The global solar photovoltaic glass market size is expected to reach USD 179.08 billion by 2033, growing at a CAGR of 29.87% from 2025 to 2033 And Asia Pacific dominates the market.

信义光能 (00968.HK):23H2光伏玻璃利润率环比明显改善 超预

The scale of new grid-connected photovoltaic power plants reached a record high in ''23, and the profitability of photovoltaic power generation declined slightly. 23 The company''s solar power

GMT EIGHT

The sales volume of the company''s photovoltaic glass business in the first half of the year increased by 17.5% year-on-year, achieving revenue of RMB 9.474 billion, a decrease of 7.3%

Gross Profit Margin

Jun 6, 2022 · The gross profit margin (also known as gross profit rate, or gross profit ratio) is a profitability measure that shows the percentage left of sales after deducting cost of sales. It

Africa A photovoltaic glass gross profit margin

Follett performance rose gross margin decline: PV glass This is the fifth consecutive year that Follett''''s net profit has increased since 2018. Image source: wind. However, in 2023, the

HK Stock Market Move | Xinyi Solar (00968) rises more than

The sales volume of the company''s photovoltaic glass business in the first half of the year increased by 17.5% year-on-year, achieving revenue of RMB 9.474 billion, a decrease of 7.3%

Flat Glass further strengthens its market

Apr 20, 2023 · Photovoltaic glass provider Flat Glass Group has secured two major orders in the past few days, of which the sales amount has exceeded

Global Solar Photovoltaic Glass Competitive Landscape

Focus on analysing the market share, product portfolio, prices, sales, revenue and gross profit margin of global major manufacturers, as well as the market status and trends of different

Global Solar Photovoltaic Glass Competitive Landscape

Jun 17, 2024 · This report studies the market size, price trends and future development prospects of Solar Photovoltaic Glass. Focus on analysing the market share, product portfolio, prices,

1.45 Billion Yuan!Kibing Group Plans to Invest in Photovoltaic Glass

Apr 26, 2024 · Among them, ultra-clear photovoltaic glass products achieved revenue of approximately 3.412 billion yuan, a year-on-year increase of 114.13%, with a gross profit

Low Solar Glass Prices Pull Down Xinyi Solar''s FY2024 Net Profit

Mar 5, 2025 · The sharp decline in solar glass prices negatively impacted Chinese supplier Xinyi Solar''s net profit in FY2024 as it reported a 73.8% year-on-year (YoY) decline with RMB 1.01

Xinyi Solar Holdings Limited

Mar 1, 2022 · Gross profit was up 14.7% to HK$7,548.5 million witha gross profit margin of 47.0%, mainly due to a lower average selling price (" ASP ")of the

HK Stock Market Move | FLAT GLASS (06865) fell more than

HK Stock Market Move | FLAT GLASS (06865) fell more than 4% after performance, with annual net profit attributable to shareholders decreasing by 63.53% year-on-year. Sales revenue and

Global Tempered Photovoltaic Glass Market Research

Aug 1, 2025 · This report studies the market size, price trends and future development prospects of Tempered Photovoltaic Glass. Focus on analysing the market share, product portfolio,

XINYI SOLAR-信义光能:中报符合预期,下半年短期承压但长期

Core Views - The company''s profit in H1 2024 grew year-on-year, driven by an increase in photovoltaic glass sales, despite a weak supply-demand relationship in the industry [2].

6 FAQs about [Photovoltaic glass sales gross profit margin]

How big is the Solar Photovoltaic Glass market?

The Market Size and Forecasts for the Solar Photovoltaic Market are Provided in Terms of Volume (tons) for all the Above Segments. The Solar Photovoltaic Glass Market size is estimated at 27.11 Million tons in 2024, and is expected to reach 63.13 Million tons by 2029, growing at a CAGR of 18.42% during the forecast period (2024-2029).

Which region will dominate the Solar Photovoltaic Glass market?

The Asia-Pacific region is expected to dominate the solar photovoltaic glass market. In developing countries like China, India, and Japan, the crisis in electricity supply has resulted in increasing the scope for self-producing electricity using solar photovoltaic glass.

Who are the major players in the Solar Photovoltaic Glass market?

The solar photovoltaic glass market is consolidated in nature. The major players in this market include Xinyi Solar Holdings Limited, Flat Glass Group Co., Ltd, AGC Inc., Nippon Sheet Glass Co., Ltd, and Saint-Gobain, among others (not in a particular order). Need More Details on Market Players and Competitors?

What is Solar Photovoltaic Glass?

Solar photovoltaic glass is a technology that enables the conversion of light into electricity. The glass is incorporated with transparent semiconductor-based photovoltaic cells, also known as solar cells. These cells are sandwiched between two sheets of glass, which enables them to capture these solar rays and convert them into electricity.

Where are solar photovoltaic glasses made?

The largest producers of solar photovoltaic glasses are in the Asia-Pacific region. Some of the leading companies in the production of solar photovoltaic glasses are Jinko Solar, Mitsubishi Electric Corporation, Onyx Solar Group LLC, JA Solar Co. Ltd, and Infini Co. Ltd. China is the world’s largest solar photovoltaic glass manufacturer.

Which countries use solar Photovoltaic Glass?

In developing countries like China, India, and Japan, the crisis in electricity supply has resulted in increasing the scope for self-producing electricity using solar photovoltaic glass. The largest producers of solar photovoltaic glasses are in the Asia-Pacific region.

Industry Information

- Which is the best liquid cooling energy storage in Abuja

- Does Sinosteel Power Supply have energy storage function

- What is a new energy battery cabinet

- Photovoltaic solar panels in rural Ljubljana

- Hungarian energy storage cabinet assembly

- Communication base station inverter grid connection approval document

- Iceland double glass photovoltaic curtain wall supplier

- M16r1 portable power bank

- How many companies are there in the field of communication base station inverters

- Energy Storage Container Environmental Assessment

- Micronesia Photovoltaic Home Energy Storage

- What is the purchase price of the battery in the energy storage cabinet

- 20 feet outdoor energy storage cabinet

- How much does a container energy storage cabinet cost

- Official battery replacement price for battery cabinet

- Spanish energy storage projects

- How long will it take for photovoltaic energy storage to be commercialized

- Paris Home System Energy Storage Battery

- Damascus RV Energy Storage Power Supply

- Which mobile outdoor power bank charges faster

- Inverter voltage halved

- Huawei Portugal factory energy storage project

- Which UPS is the cheapest in South Africa

Commercial & Industrial Solar Storage Market Growth

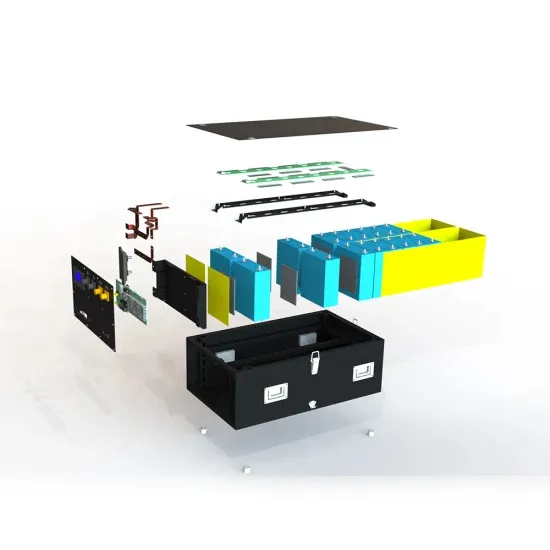

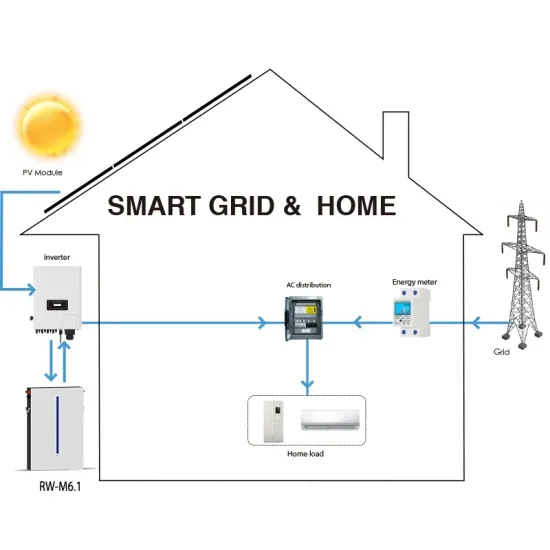

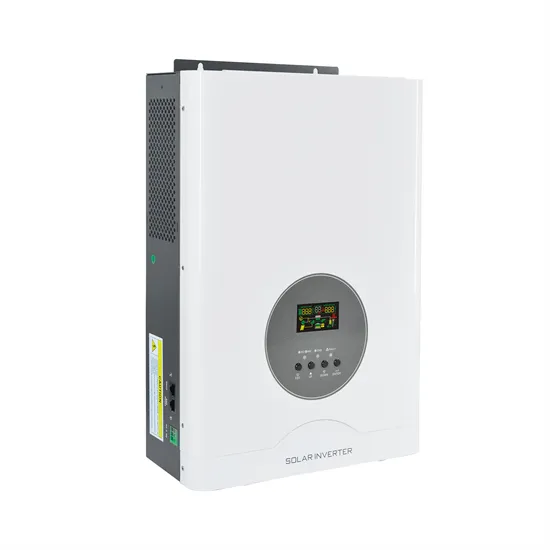

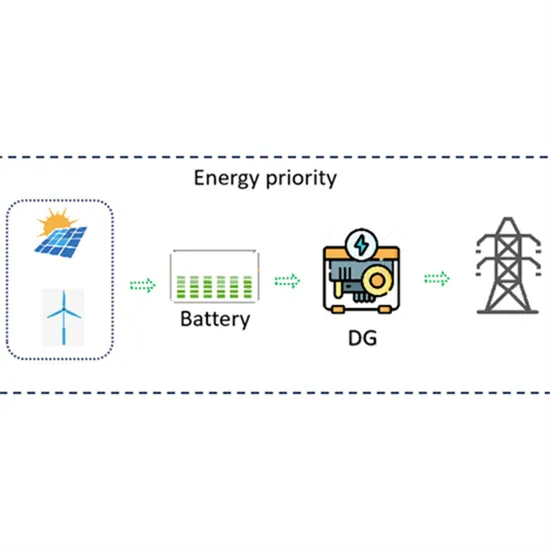

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.