Investigating Europe''s energy storage financing landscape

Mar 28, 2024 · In this edition of the Power Playbook column, Yusuf Latief explores energy storage financing and recommendations from industry experts.

Eliminate Battery Storage Costs with Energy

Energy storage financing with a no-cost, shared savings model that eliminates battery storage costs and offloads market risks. Learn how it works.

Financing battery storage: Navigating a

Feb 14, 2022 · Battery storage is the fastest growing segment of the renewable energy sector. It is projected to be a trillion dollar market. Installation of stand

How do you pay for a solar battery installation?

Mar 30, 2023 · But storage isn''t free: to take advantage of the myriad benefits batteries offer, you''ll first need to pay for your energy storage system. When paired with a solar panel system, a

What is the concept of energy storage

Jan 19, 2024 · The financing of energy storage systems emerges as a fundamental aspect in the transition to a more sustainable energy landscape.

Energy Storage Power Station Financing Models: A

renewable energy developers scratching their heads over battery costs, institutional investors hunting for the next green goldmine, and policymakers trying to balance grid stability with

Eolian Closes First-Of-Its-Kind Standalone Battery Energy Storage

Feb 12, 2023 · This pioneering financing is the first use of the Investment Tax Credit (ITC) structure by a standalone utility-scale battery energy storage system and is possible due to

How to finance battery energy storage | World Economic

May 10, 2024 · Battery energy storage systems (BESS) can help address the challenge of intermittent renewable energy. Large scale deployment of this technology is hampered by

Financing energy storage projects: assessing risks

In part one of this article, we discussed the types of energy storage and the incentives that are supporting its development. Now let''s look at the financing issues and the project risks

Navigating energy storage financing amidst rising interest

Jul 14, 2025 · Unlocking Investment in Battery Energy Storage Through Innovation Battery energy storage projects face distinct technical challenges that complicate their development and

What Investors Want to Know: Project-Financed Battery Energy Storage

Jun 20, 2023 · Battery energy storage systems (BESS) store electricity and flexibly dispatch it on the grid. They can stack revenue streams offering arbitrage, capacity and ancillary services

Financing Battery Storage » Connected Energy

Aug 18, 2025 · Financing battery energy storage is a long term investment, which is why Connected Energy offers leasing and Battery as a Service with Capitas

$837M Battery Energy Storage System (BESS)

Jul 17, 2024 · Intersect Power announced the closing of two separate transactions representing an aggregate of $837 million of Battery Energy

Eku Energy finances battery storage project in

Aug 5, 2024 · Macquarie-backed Eku Energy has completed the financing on its first battery energy storage system (BESS) project in Japan.

What Investors Want to Know: Project-Financed Battery

6 days ago · Battery energy storage systems (BESS) store electricity and flexibly dispatch it on the grid. They can stack revenue streams offering arbitrage, capacity and ancillary services

Battery Energy Storage Financing Structures and

4 days ago · This Practice Note discusses changes to financing structures for battery storage projects after the enactment of the Inflation Reduction Act. This Note also discusses the fixed

How to Finance Energy Storage Projects

Learn how to secure energy storage financing for $100M+ projects. Explore project finance, PPAs, green finance incl. incentives, and key industry trends

Your Guide To Solar Battery Storage Financing

Aug 16, 2025 · Solar battery storage has become increasingly popular as homeowners and businesses seek energy resiliency. Energy storage systems

Energy Storage Financing for Social Equity

Jul 22, 2022 · Abstract Energy storage technologies are uniquely qualified to help energy projects with a social equity component achieve better financing options while providing the needed

Boralex closes financing for Canada''s largest

Dec 17, 2024 · An industrial battery storage system being installed in Ontario, Canada. Image: Sungrid. Developer Boralex and its partner Six Nations of the

Structuring a bankable project: energy storage

Jun 15, 2022 · This note explains the principal technologies used for energy storage solutions, with a particular focus on battery storage, and the role that energy storage plays in the

Battery Storage Funding Critical to Europe''s Energy

Jun 27, 2024 · In our view, there is a need for greater collaboration between sponsors developing the batteries, regulators and national policymakers setting renewable targets, and the

Making project finance work for battery energy storage

The second, bigger obstacle to the project financing of storage assets is that the revenue stack for batteries is more complicated than for generating assets. Unlike wind and solar projects,

What are your options for financing a home battery?

There are plenty of benefits to investing in a solar battery for your home, including energy independence, cost savings, and environmental sustainability. And to make sure you''re

Project Financing and Energy Storage: Risks and

Mar 8, 2023 · The United States and global energy storage markets have experienced rapid growth that is expected to continue. An estimated 387

Financing Battery Storage Systems: Options and

Aug 15, 2023 · Thinking about Financing Battery Storage Sytems for your commercial or industrial facility? Learn about strategies you have available in

1 GWh Texas battery portfolio secures financing

Sep 6, 2024 · Four Texas battery energy storage (BESS) projects with a combined capacity of 730 MW / 1,049 MWh have secured $315.7 million in

Mizuho Closes Landmark Financing for KKR and Infracapital''s

Mar 19, 2025 · This deal marks a significant milestone as the first BESS financing in EMEA for Mizuho, reinforcing the bank''s commitment to supporting energy transition and

Financing Battery Energy Storage Systems –

Jan 16, 2025 · In this article we consider the role and application of battery energy storage systems (BESSs) in supporting renewable energy power generation

The 360 Gigawatts Reason to Boost Finance for Energy Storage

Jan 14, 2024 · The gap to fill is very wide indeed. The International Renewable Agency (IRENA) ran the numbers, estimating that 360 gigawatts (GW) of battery storage would be needed

Making project finance work for battery energy storage

It has traditionally been difficult to secure project finance for energy storage for two key reasons. Firstly, the nascent nature of energy storage technology means that fixed income lenders and

Sector Spotlight: Energy Storage

Jun 14, 2024 · Finally, the Tribal Energy Financing program can support energy storage technologies in eligible projects to federally recognized tribes and

Navigating energy storage financing amidst rising interest

Jul 14, 2025 · Developers, investors, and policymakers now have a unique opportunity to redefine how storage projects are financed, deployed, and monetized. From revenue stacking

India''s battery storage boom: Getting the

Aug 18, 2025 · The government can also encourage RE + BESS contracts for Corporate PPAs to expedite energy storage deployment and increase the

Energy storage 2023: biggest projects, financings, offtake deals

Dec 27, 2023 · A roundup of the biggest projects, financing and offtake deals in the energy storage sector that we have reported on this year. It''s been a positive year for energy storage

6 FAQs about [Energy Storage Battery Financing]

What is a battery energy storage system?

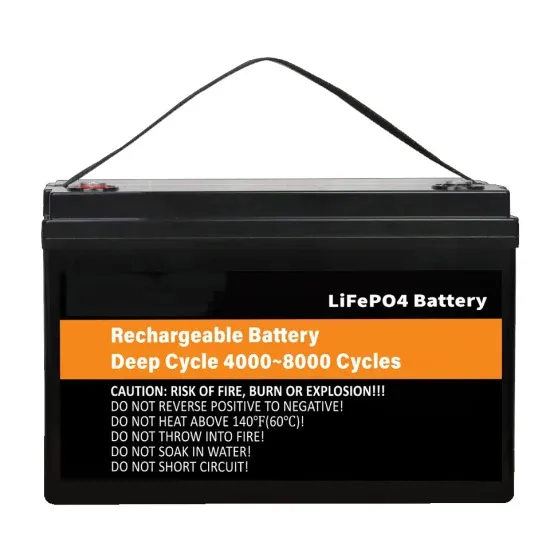

Battery energy storage system. Battery energy storage systems (BESS) can help address the challenge of intermittent renewable energy. Large scale deployment of this technology is hampered by perceived financial risks and lack of secured financial models.

Is battery storage a risky investment?

Firstly, the nascent nature of energy storage technology means that fixed income lenders and senior debt providers are naturally risk averse. Battery storage has less of a track record than other renewable energy assets such as solar and wind power.

Why is project finance difficult for energy storage?

It has traditionally been difficult to secure project finance for energy storage for two key reasons. Firstly, the nascent nature of energy storage technology means that fixed income lenders and senior debt providers are naturally risk averse.

What is battery energy storage system (BESS)?

Battery energy storage systems (BESS) are accepted as one of the key solutions to address these challenges. BESS can respond to real-time renewable energy fluctuation challenges through its fast response capability (congestion relief, frequency regulation, wholesale arbitrage, etc.).

Are battery projects generating electricity?

Unlike wind and solar projects, battery projects are not generating electricity. Rather, they provide a service and act as arbitrage assets. With a battery storage asset, electricity is bought and sold at different times of day to make money by storing electricity when prices are low and discharging it when prices are high.

Why is energy storage investment restricted?

The traditional approach to energy storage projects has restricted investment because it requires financiers to carry out significant due diligence whenever they fund a scheme – because of this, most energy storage investment has historically been off balance sheet or via specialist funds.

Industry Information

- Construction technology of supercapacitors for communication base stations

- 455wp specification photovoltaic panel

- Energy storage cabinet intelligent manufacturing battery price

- China Ministry of Industry and Information Technology Communications 5G Base Station

- 15kWh large outdoor power supply

- Wholesale 5kwh battery backup in Bolivia

- Tunisia Photovoltaic Energy Storage Project

- Disadvantages of current lithium battery energy storage systems

- The most advanced energy storage product currently

- Glass photovoltaic ratio

- The largest energy storage photovoltaic power station in Pretoria

- Power plant battery energy storage frequency regulation

- Factory price bus tie breaker in Melbourne

- Advantages of building photovoltaic curtain wall

- 320kW photovoltaic inverter

- Solar lamp home energy saving foldable

- Sodium ion energy storage photovoltaic

- China Mobile 5G base stations and hybrid energy sharing

- Which is the best low-carbon photovoltaic curtain wall in Myanmar

- Bangi Distributed Energy Storage System

- How many volts is the grid-connected inverter

- Lithium iron phosphate energy storage battery modification

- Tunisia energy-saving energy storage equipment

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.