What is the tax rate for photovoltaic solar energy? | NenPower

Nov 2, 2024 · The tax rates can dictate the overall cost-effectiveness of investing in solar technology, thus making it essential to understand them thoroughly. This is especially true as

How to Claim Your 2025 Solar Tax Credit | Complete Guide

Jul 14, 2025 · Do battery storage systems qualify? When do I need to install to qualify for the 30% rate? What documentation should I keep? Ready to Start Your Solar Journey? Schedule your

China adjusts its export policies with a 9% tax discount for

Jun 14, 2025 · In a joint statement issued by the Ministry of Finance and the State Taxation Administration, it was revealed that the export tax rebate rate for photovoltaic products, along

MACRS Depreciation for Commercial Solar

Feb 19, 2025 · MACRS Depreciation for commercial solar installs can help businesses maximize tax benefits and invest in huge energy savings. Learn

Solar photovoltaic policy review and economic analysis for

Jun 20, 2019 · The Philippines is an emerging solar photovoltaic (PV) market, installing ∼1 GW in the span of last 2 years. This growth was enabled by the enactment

GST rates on solar power based devices and

Jan 20, 2025 · All renewable energy devices, including solar devices or solar power projects, are covered under the ambit of GST. This article throws light

Tax and Energy Series : China

Jun 3, 2024 · If an eligible energy service company that carries out an energy performance contracting project meets the relevant provisions of the Corporate Income Tax law, it is entitled

30 KWP Consultation regulation ☑️ Tax rate with 0 % VAT ''VAT'' for solar

Dec 14, 2022 · The Annual Tax Act 2022 (Section 12 Para. 3 UstG new) offers a tax reduction of 0% for the supply of solar modules, including the components (e.g. inverters, but not the

What is the tax rate for engineering photovoltaic panels

Jul 8, 2022 · Those who install a PV system between 2022 and 2032 will receive a 30% tax credit. That will decrease to 26% for systems installed in 2033 and to 22% for systems installed in 2034.

Prevailing Wages for Clean Energy and Solar

Mar 26, 2024 · The world of solar construction is seeing a shift as many companies are now subject to prevailing wage regulations and certified payroll

GST on Solar Panel: Renewable Energy Tax Benefits

See current GST rates on solar panels and components. Understand how tax applies to rooftop systems and renewable energy equipment.

SARS 12B Solar incentive for South African

Aug 2, 2024 · 1. Introduction As South African businesses grapple with the ongoing energy crisis and rising electricity costs, many are turning to solar

Understanding China''s Photovoltaic Export Tax Refund Policy

As of December 1, 2024, China''s export tax refund rate for photovoltaic panels stands at 9%, marking a significant reduction from the previous 13% rate. This policy adjustment applies

18% GST applicable on combination of solar

Aug 24, 2022 · As the combination of solar inverter & battery do not make ''Solar Power Generating System'', thus the said supply will be treated as mixed

Maximize Solar Incentives in 2025: Tax Credits, Rebates, Net

May 23, 2025 · Types of Solar Incentives Solar incentives can be categorized into several types, including tax credits, rebates, grants, and net metering. Each type serves a unique purpose

Solar Tax Credit 2025 (Updated May 29)

May 29, 2025 · However, if the proposed legislation is enacted without amendments, the residential solar tax credit would expire on December 31, 2025, nearly a decade ahead of

What is the tax rate for engineering photovoltaic panels

Jul 8, 2022 · you can save with the federal solar tax credit in 2024. The federal tax credit covers 30%of a consumer''s total solar system cost,which means you could get $6,000 for a solar

Tax Equity Financing: The Smart Way to Fund

Mar 22, 2025 · Tax equity financing has emerged as a cornerstone of solar project development, enabling renewable energy initiatives to capitalize on

GST Rates on Solar PV Power Projects

Mar 9, 2024 · GST Rates on Solar PV Power Projects- CBIC Clarification The CBIC issued Circular No. 163/19/2021-GST dated 06th October 2021 clarifying

EPC contract for construction of Solar Power Plant is

Sep 30, 2019 · The supply of turnkey Engineering, Procurement and Construction (EPC) Contract for construction of solar power plant wherein both goods and services are supplied can be

Classification of goods and rates of GST

Mar 29, 2023 · Classification of goods and rates of GST - solar inverter - the combination of solar panel, inverter, solar battery and charge controller may qualify as "Solar Power Generating

GST on Solar Power based devices & System

Mar 19, 2022 · The appellant has relied heavily on the guidelines of the Ministry of New and Renewable Energy for Solar Water Pumping Systems to claim that

Solar: double tax exemption | 50% off CAPEX for

May 4, 2021 · When a business purchases a solar PV system (business asset classified under "Plant & machinery"), that qualifies the business for CA; and

One Big Beautiful Bill: The New Rules for Commercial Solar

Jul 21, 2025 · Discover how the 2025 tax bill changes the rules for commercial solar credits. Learn safe harbor deadlines and lock in 30% savings.

Solar Energy Systems Engineers: Building a

Feb 11, 2025 · Solar Energy Systems Engineers are essential in shaping a sustainable future as the world shifts to renewable energy. These

TAXABILITY OF EPC CONTRACTS FOR SOLAR PLANT

Mar 18, 2020 · Further, the contract for Erection, Procurement and Commissioning of Solar Power Plant falls under the ambit "Works Contract Services" (SAC 9954 ) of Notification No. 11/2017

Tax breaks for South Africans who install solar power systems

Aug 21, 2019 · The tax incentives available to businesses for the installation of solar PV systems is certainly something that SAPVIA and other related industry associations should be ''shouting

Solar Power Plants and GST

Aug 30, 2019 · The rate of tax for renewable energy devices and parts of solar power was notified vide Notification No.1/2017-Central Tax (Rate) New Delhi,

Five Points of Impact! China''s PV cuts 4% export tax rebate rate

Nov 18, 2024 · This represents a 4% decrease in the rebate rate for photovoltaic exports, significantly impacting China''s PV market, which heavily relies on exports. Export tax rebates

GST Rate on supply of Solar Power Generating System

Sep 24, 2018 · 6) An overview of all makes us observe that the impugned transaction for EPC Contract for the Solar Power generating system which includes engineering, design,

48E Tax Credit: Claiming the Clean Electricity ITC

Feb 3, 2025 · Benefits of technology-neutral clean electricity tax credits One of the most important changes brought by the 48E investment tax credit and its

Benefits of the U.S. Inflation Reduction Act (IRA) For

Jan 18, 2024 · Benefits of the U.S. Inflation Reduction Act (IRA) For Solar PV Manufacturing, System Performance, Reliability and LCOE Michael Woodhouse, Jarett Zuboy, Brittany Smith,

Understanding GST Rates on Solar Energy

Jul 27, 2024 · Discover the GST rates on solar energy devices and systems in India. Learn about classifications, financial implications, and the latest updates

Navigating Tax Issues in Solar Energy Projects

Explore key federal and state tax issues in solar energy projects, including Investment Tax Credits (ITC), depreciation, and ownership structuring. Stay

What is the solar tax incentive for businesses in

To qualify for the tax relief that comes from a commercial solar installation, your business should consider the following: Costs include the solar system cost,

The importance of internal rate of return (IRR) in

Mar 14, 2024 · What is internal rate of return (IRR) and how does it affect design and investment decisions for solar projects? Read on to find out.

GST on Solar

Jul 14, 2025 · What is the GST rate applicable on solar panels and inverters in India? What is the GST rate applicable on the supply of solar power plant

TDS and TCS applicable on solar plant installation

Aug 29, 2024 · However, this is less common for standard solar plant installations and usually applies to highly specialized services. TDS on Solar System (70%

GST ON CONSTRUCTION OF SOLAR POWER

Jun 19, 2018 · Recently Authority of Advance Ruling (AAR) in the state of Maharashtra has given an order confirming that construction of solar power system is a works contract and GST Rate

6 FAQs about [Solar System Engineering Tax Rate]

Are solar facilities taxable?

In addition to tax credits or grant payments, solar facilities also can generate significant tax losses that can be valuable to owners with other sources of taxable income that can be offset by the losses. MACRS Depreciation.

What is IGST & SGST tax on solar power plant?

Further, the contract for Erection, Procurement and Commissioning of Solar Power Plant falls under the ambit “Works Contract Services" (SAC 9954 ) of Notification No. 11/2017 Central Tax (Rate) dated 28 June, 2017 and attracts 18% rate of tax under IGST Act, or 9% each under the CGST and SGST Acts, aggregating to 18%.

What is the tax basis of a solar facility?

Thus, the tax basis of the qualifying components of a solar facility with respect to which the ITC is claimed generally will be 85 percent of the cost of those components. Recapture of the Credit.

Can a business purchase a solar PV system?

When a business purchases a solar PV system (business asset classified under “Plant & machinery”), that qualifies the business for CA; and can be subtracted from what a business owes in tax. The rates of CA consist of Initial Allowance (IA) of 20% for the first year only. And Annual Allowance (AA) of 14% for six years.

What is double tax exemption for solar projects?

Double tax exemption for businesses going solar. Enjoy a relief of 50% off CAPEX. Double tax incentives (capital allowance + green investment tax allowance). The double tax incentive provides relief of up to 48% of project cost. They are both reliefs in the form of : a. Capital Allowance (CA) and b. Green Investment Tax Allowance (GITA)

Is EPC contract for solar power plant taxable?

Further, since it was ruled that it is a case of works contract, the issue of what is principal supply becomes irrelevant. The appeal was thus dismissed and AAR ruling affirmed holding that EPC contract for Solar Power Plant is a works contract and is taxable @ 18 percent GST.

Industry Information

- Morocco large energy storage battery pump manufacturer

- Uganda professional ups uninterruptible power supply life

- 80kw solar inverter

- Huawei Tripoli photovoltaic panels

- Portable power station 6000w in Pretoria

- New Energy Photovoltaic Flexible Panel

- Existing mainstream energy storage batteries

- Burkina Faso environmentally friendly inverter factory price

- Home circuit breaker for sale in Mauritania

- What is the wholesale price of energy storage cabinets in Azerbaijan

- Photovoltaic inverter production expansion

- Commercial communication base station energy management system manufacturer

- How to use the power of new energy battery cabinet base station

- How much does the China-Africa photovoltaic panel manufacturer quote

- Several types of batteries used in base stations

- Photovoltaic inverter civil engineering foundation

- Container generator costs

- Photovoltaic glass model thickness

- Which company produces energy storage cabinet batteries

- Wholesale 2000 amp switchgear in Vancouver

- Solar-capable tiles in Gothenburg Sweden

- How many kWh of electricity does it take to charge an outdoor power supply in one hour

- 10kv inverter voltage

Commercial & Industrial Solar Storage Market Growth

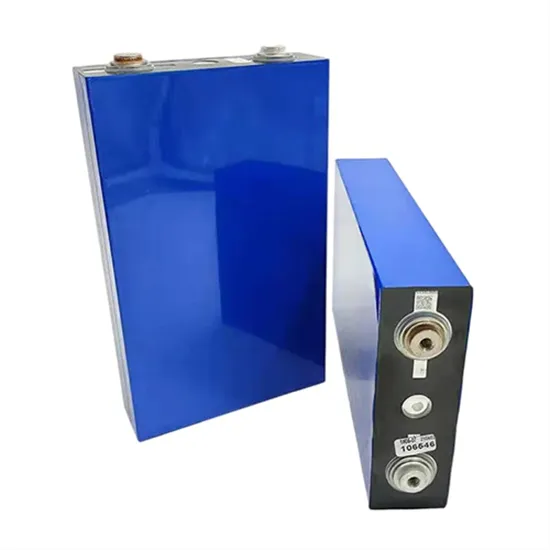

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.