Tech Breakdown: What has China achieved in 5G

Apr 14, 2021 · This year, the country intends to build at least 600,000 more 5G base stations, which will greatly expand 5G coverage in counties and towns.

Middle East and Africa RF Filter For 5G Base Station Market

Jul 6, 2025 · The Middle East and Africa (MEA) RF Filter for 5G Base Station Market is witnessing robust growth due to the rapid deployment of 5G infrastructure across emerging economies

5G in the Middle East: Network quality, user experience, and

In 2021, 5G in the Middle East will continue to focus on network quality, user experience, and service innovation. The growth of 5G users is twice as fast as that of the 4G era. The rapid

Middle East & Africa 5G Base Station Market

The development of 5G base stations in the Middle East & Africa (MEA) is gradually increasing. Many countries in the Middle East, such as the UAE and Saudi Arabia, are experiencing rapid

Middle East 5G Infrastructure Market Size and Forecasts 2030

In Middle East 5G Infrastructure Market, offering valuable insights, key market trends, competitive landscape, and future outlook to support strategic decision-making and business growth.

Ken Hu on how Huawei is accelerating 5G deployment

Jul 1, 2019 · "To date, we have signed 50 commercial contracts for 5G around the world, and we have shipped 150,000 5G base stations. This is far more than our industry peers. Many

Where are the US military bases in the Middle East?

Jun 23, 2025 · Tehran has launched missile strikes against a US base in Qatar after vowing to retaliate against attacks on Iranian nuclear facilities. Witnesses reported seeing missiles in the

Middle East & Africa Private 5G Networks Market

The Middle East & Africa private 5G networks market was valued at US$ 90.47 million in 2022 and is expected to reach US$ 1,152.29 million by 2030; it is

5G Availability Around the World

5 days ago · 5G requires vastly more antennas and base stations compared to previous generations due to higher frequency signals that transmit data over shorter distances. Many

Middle East and Africa Battery for 5G Base Station Market

Jul 4, 2025 · The Middle East and Africa are also witnessing a growing trend towards renewable energy solutions for 5G base stations, further promoting the demand for high-performance

5G in the Middle East: The Race for Connectivity and its Impact

Dec 17, 2023 · 5G technology is revolutionizing the Middle East, propelling the region into a new era of hyper-connectivity and innovation. This next-generation wireless technology, renowned

Middle East & Africa 5G Base Station Market Forecast to

Jun 4, 2024 · Middle East & Africa 5G Base Station Market Forecast to 2030 - Regional Analysis - by Component, Frequency Band, Cell Type, and End User - The Middle East & Africa 5G base

Middle East and Africa 5G Base Station RF Front End Module

Jul 5, 2025 · The rapid acceleration of 5G deployment across the Middle East and Africa (MEA) is significantly driving demand for advanced RF front end modules in base stations.

du already deployed ''hundreds'' of 5G-A base stations in UAE

Nov 1, 2024 · Under the strategic cooperation, announced during Mobile World Congress 2024 in Barcelona, Spain, the two parties will work together to build a 5G-A experience network with

What You Need to Know about 5G Deployments

Jul 30, 2020 · However, several Middle East operators are at the forefront of its development. Qatar''s Ooredoo, for instance, was one of the first companies to

Middle East''s First 5G-Advanced Network

Sep 25, 2024 · The deployment of the first indoor 5G-Advanced (5G-A) network in the Middle East marks a significant milestone in the region''s

Middle East And Africa 5G Communication Base Station

Aug 9, 2025 · The geographic segmentation of the Middle East And Africa 5G Communication Base Station Body Market market analyzes consumer behavior and preferences based on

Middle East and North Africa 2023

The Middle East and North Africa (MENA) is home to some of the global leaders in terms of 5G adoption. 5G networks now cover 75% or more of the

5G Base Station Market is estimated to record a CAGR of

Dec 12, 2024 · Geographically, the 5G base station market is segmented into five major regions—North America, Europe, Asia Pacific (APAC), the Middle East & Africa (MEA), and

GSMA SETS OUT 5G ROADMAP FOR MIDDLE EAST

Jan 27, 2022 · Today, mobile operators in the Kingdom of Saudi Arabia (KSA) and UAE have access to more than 1 GHz of licensed spectrum to provide mobile broadband services in the

5G Base Station Growth: How Many Are Active? | PatentPC

Aug 4, 2025 · Explore the rise of 5G base stations worldwide. Get key stats on active installations and how they impact network coverage.

Pioneering 5G solutions by Viettel High Tech for a connected Middle East

Dec 25, 2024 · Viettel High Tech partners with High Cloud Technologies in a multi-million-dollar deal to bring advanced 5G solutions to the Middle East with cutting-edge technology.

5G Revolution: How Middle East Countries are

Aug 4, 2023 · Middle East countries are actively embracing the 5G revolution, recognizing the transformative potential of next-gen connectivity for various

Market Projections for 5G and 5.5G Base Stations Industry

Jun 24, 2025 · The global 5G and 5.5G base station market is experiencing robust growth, driven by increasing demand for high-speed mobile broadband, the proliferation of IoT devices, and

5G Base Station Market Size to Surpass USD 832.42 Billion by

Mar 6, 2025 · The global 5G base station market size is accounted to hit around USD 832.42 billion by 2034 increasing from USD 44.86 billion in 2024, with a CAGR of 33.92%.

Map of radio stations in the Middle East

Jul 30, 2025 · Map of radio stations in the Middle East الخريطة البث العالمية: الشرق الأوسط / نقشه رادیویی جهانی: خاورمیانه / מפה הרדיו את עולם: המזרח התיכון Click on a city to review full AM/FM frequency list for

5G Virtual Networks: What is happening globally

Dec 29, 2021 · Lack of awareness: Although there is an interest in adopting 5G services, enterprises in the region are not fully aware of the advantages of

Middle East and Africa Copper Clad Laminate for 5G Base

Jul 6, 2025 · What are the potential factors driving the growth of the Middle East and Africa Copper Clad Laminate market for 5G base stations?

Intel collaborates with local government bodies

Oct 4, 2023 · Intel Xeon Scalable processors also incorporate advanced security features to protect sensitive network data. FPGA Solutions: Intel offers Field

Saudi Arabia 5G Technology Analysis Report

Nov 14, 2024 · This includes the installation of 5G base stations and antennas in key urban and rural areas to ensure comprehensive network coverage and

3G / 4G / 5G coverage in United Arab Emirates

Discover detailed mobile internet coverage maps for all operators. Check 2G, 3G, 4G, 5G, and fiber availability in your area and worldwide.

China has more than 3.8 million 5G base stations

Jun 28, 2024 · China''s 5G base stations account for 60 percent of the global total, Zhao added. In China, more than half of all mobile phone users are 5G users, Zhao told MWC Shanghai.

GSMA says Europe is falling behind on 5G

Jan 16, 2025 · Europe''s score on the network pillar highlights the need to accelerate the deployment of 5G base stations (with 11 of the 15 European

The State of 5G Deployment Around the World (2024)

Sep 19, 2024 · Benchmarking data of mobile operators wordwide. Latest news from the world of telecommunications and new technologies.

Middle East & Africa 5G Base Station Market

Middle East & Africa 5G Base Station Market is growing at a CAGR of 15.3% to reach US$ 4,592.84 million by 2030 from US$ 1,468.31 million in 2022 by Component, Frequency Band,

4g 5g lte base station Competitive Strategies: Trends and

Feb 2, 2025 · Market Overview The global 4G/5G LTE base station market size is anticipated to reach USD 46.7 billion by 2033, registering a CAGR of 6.7% from 2025 to 2033. The market

5G Base Station market size will be USD 183.98 Billion by 2030!

Middle East 5G Base Station Market Analysis As per the current market study, out of 35.6 Billion USD global market revenue 2025, Middle East market holds 4.76% of the market share. The

China speeds up 5G-A rollout in multiple major cities; move

May 11, 2025 · According to the China Business Journal, the plan targets the construction or upgrade of more than 35,000 5G-A-enabled base stations citywide by the end of 2027, aiming

6 FAQs about [There are 5G base stations in the Middle East]

Which countries have 5G in the Middle East?

After the UAE, the next four MEA countries to get 5G were all in the Middle East, with launches in Bahrain, Kuwait, and Qatar in July 2019, followed by Saudi Arabia in the fourth quarter of that year. Africa’s first 5G network was launched by wholesale operator Liquid Telecom South Africa in March 2020, using its 3.5GHz spectrum holdings.

How many 5G base stations are there in the world?

In addition, a total of 819,000 5G base stations have been built by these three telecom giants, accounting for 70% of the world's total. As China has played a leading role in 5G technology, its 5G development has extraordinary significance for other countries.

Which countries will get 5G in 2021?

Du claimed 90% population coverage for 5G by end-2021, rising to 94% 12 months later. After the UAE, the next four MEA countries to get 5G were all in the Middle East, with launches in Bahrain, Kuwait, and Qatar in July 2019, followed by Saudi Arabia in the fourth quarter of that year.

How many countries are served by 5G?

He has a particular interest in wireless broadband and was responsible for TeleGeography’s 4G Research Service until it was integrated into GlobalComms. According to the latest data from our GlobalComms Database Service, as of March 2023, 18 countries in the Middle East and Africa region are served by commercial 5G services.

Is 5G available in UAE?

The UAE government confirmed the award of 5G-capable 3.3GHz–3.8GHz spectrum to Etisalat and Du in November 2018. In May 2019, with 5G-capable handsets now available to UAE customers, the Etisalat network was opened for full mobile use.

Who is the largest 5G provider in Saudi Arabia?

The largest 5G provider in Saudi Arabia—and the MEA region—is Saudi Telecom Company (stc), which claimed 5.6 million 5G subscriptions by December 2022. Having inked network rollout agreements with equipment suppliers like Huawei, Nokia, and Ericsson, stc has more than 75 cities and towns in its 5G footprint.

Industry Information

- Photovoltaic energy storage station sales

- Lobamba Energy Storage Distribution Station

- Photovoltaic power station inverter wattage specifications

- Huawei Gambia Energy Storage Products

- Saint Lucia Super Farad Capacitor

- New solar air conditioner in Cote d Ivoire

- What is the Namibian energy storage container

- Hot sale home battery storage in China distributor

- Juba Solar Energy Company System Manufacturer

- Return ratio of investing in energy storage equipment

- Small-scale industrial energy storage

- Double-glass photovoltaic module project

- Communication base station inverter grid-connected construction company

- Recommendations for household energy storage systems

- Portable Power Bank in 2025

- Maintenance-free lead-acid battery cabinet installation

- Battery cabinet secondary protection

- Best inverter manufacturer in Belgrade

- Small solar inverter for sale in Cairo

- Japan Osaka PV Inverter Comparison Manufacturers

- Photovoltaic energy storage system bcp

- Lithuania 3000w inverter sales manufacturer

- How many hours does the outdoor power supply discharge

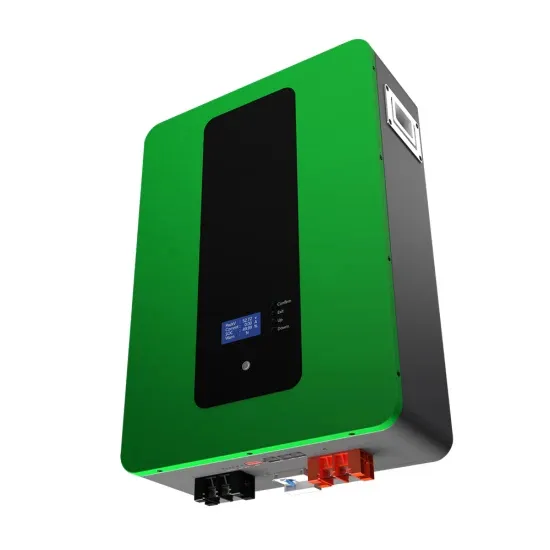

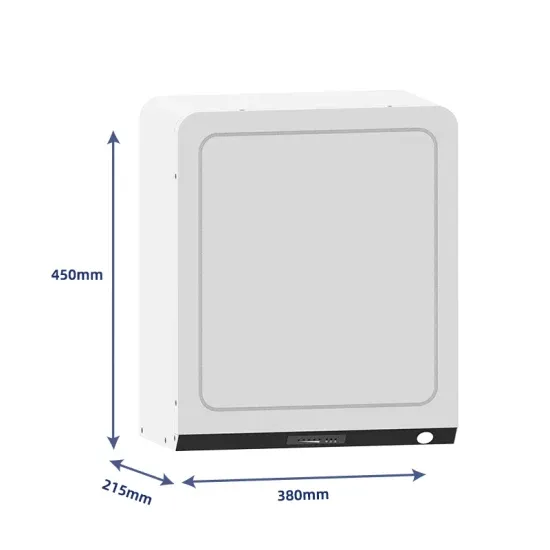

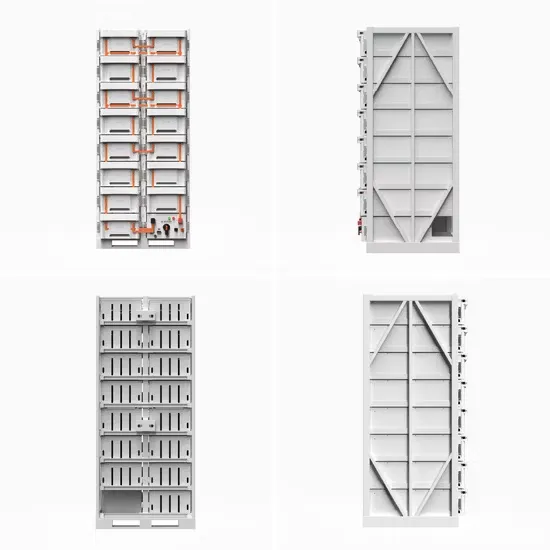

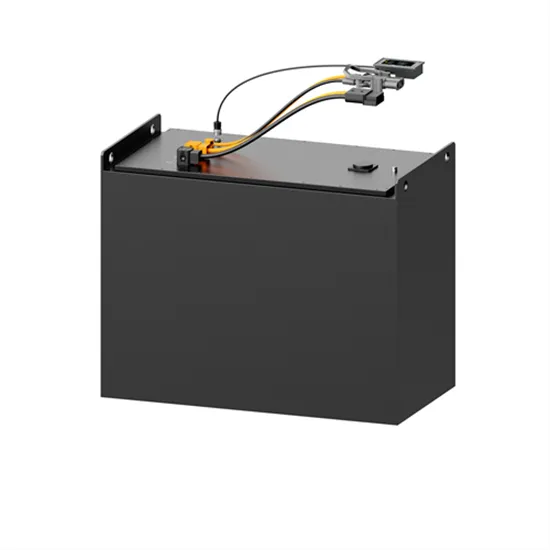

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.