Energy and Natural Resources M&A | Bain

M&A in Energy and Natural Resources: Beating the Odds in Energy Transition Deals At a Glance Acquisitions to advance an energy transition now represent

Recent M&A Deals, Upcoming & Largest Deals

Aug 6, 2025 · Explore recent M&A deals across tech, healthcare, and energy. Stay updated with the biggest mergers and acquisitions in 2025 and beyond.

Energy and Natural Resources M&A | Bain

After three years of steady growth, energy transition deals plateaued in the first nine months of 2023. Energy and natural resources companies are balancing

mergers & acquisitions Archives

Dec 25, 2024 · Hitachi Energy was ''looking for a long time'' to add power conversion architecture to its offerings before its acquisition of Eks Energy (EKS), ESN Premium has heard.

Energy Storage Mergers and Acquisitions

May 3, 2024 · Understanding the market dynamics and developing a robust strategy is paramount in the realm of energy storage mergers and acquisitions. FasterCapital, with its extensive

World Energy Storage Acquisition History: Powering the

Welcome to the $33 billion global energy storage arena, where acquisition moves shape our planet''s energy future [1]. In 2023 alone, over 40 major acquisitions reshuffled the deck in this

The Mergers and Acquisitions in the Solar

Mar 17, 2025 · The solar energy sector has experienced a dynamic landscape of mergers and acquisitions (M&A) over the past decade, reflecting the industry''s

Mergers and Acquisitions in the Energy Sector

Nov 6, 2023 · Welcome to the Institute for Mergers, Acquisitions, and Alliances'' overview of the Top Global M&A Deals 2023: Energy and Power Industry. This

Yicheng New Energy: Seize the opportunity of capital

New Energy New Energy> Yicheng New Energy: Seize the opportunity of capital operation to promote mergers and acquisitions and reorganizations, and develop the industry''s most

mergers and acquisitions Archives

Mar 8, 2023 · Oil and gas major Shell is putting its residential battery storage and virtual power plant (VPP) company sonnen up for sale, according to German outlet Handelsblatt. US-listed

Investment of $67 billion! Energy storage mergers and acquisitions

They aim to become a major competitor to existing lithium-ion technology in the fast-growing global energy storage market. The combined companies will be renamed Invinity Energy

Largest Mergers and Acquisitions (M&A) Deals Data

Aug 11, 2025 · Discover which companies led the largest mergers and acquisitions in 2025. Subscribe to Intellizence to get insights on top M&A data by value, industry, and region.

Clean Technology Mergers in Battery Energy

Aug 14, 2025 · The past 18 months have witnessed several clean energy mergers and acquisitions, especially amongst energy storage and electric vehicle (EV)

Impact analysis of mergers and acquisitions on the

Jan 1, 2024 · The development of new energy industries is crucial to a nation''s energy transition to carbon neutrality, while photovoltaic, wind power, lithium battery, and new energy vehicles

M&A Opportunities in the Energy Transition

The energy and natural resources industry''s reliance on M&A in 2022 to deliver the energy transition will play out across seven themes. Greening existing

Oil and Gas Mergers and Acquisitions List [10

Dec 6, 2024 · The list of most notable recent oil and gas acquisitions includes ExxonMobil and Pioneer Natural Resources, Chevron and Hess,

Energy industry mergers and acquisitions reaches new

Jun 20, 2025 · Wedding bells are ringing in the energy industry, just as warning sirens blare over the power grid. Mergers and acquisitions in the fossil gas, oil, and electricity sectors

Insights on renewable energy mergers and

A five-year lookback on renewable acquisitions and four-year forecast of new generation capacity paint an interesting picture for the M&A market.

List of 6 Acquisitions by NextEra Energy (Jul

Jul 21, 2025 · Discover NextEra Energy''s complete list of acquisitions with year-wise trends, sector-wise breakdowns, geographic insights, and related M&A

Sustainability | Free Full-Text | Can Mergers and Acquisitions

Aug 8, 2023 · Sustainability | Free Full-Text | Can Mergers and Acquisitions Promote Technological Innovation in the New Energy Industry? An Empirical Analysis Based on

How energy storage M&A performed in the power industry

Nov 27, 2024 · Analysis of the key themes driving M&A activity reveals that energy storage accounted for 52 power deals announced in Q3 2024, worth a total value of $7.8bn. The

8/21/24: Mergers, Acquisitions & Major

Aug 21, 2024 · Kicking off our Deals & Dollars series, we''re focusing on the latest mergers, acquisitions, and major investments in the energy and sustainability

Developments and Trends of Mergers and

Mar 12, 2021 · Developments, trends, business climate, conditions, factors influencing the efficiency and results of mergers and acquisitions (M&A) in the

mergers and acquisitions

Jul 13, 2022 · Reliance New Energy Limited, part of the massive Indian conglomerate, has acquired LFP battery manufacturer Lithium Werks for US$61 million two months after buying a

Complete List of Recent Energy Mergers And Acquisitions

Usearch found 5529 recent M&A deals involving energy companies. The most recent M&A deals within the energy industry are: • BKV Corporation is acquiring Bedrock Energy Partners''

Economic effects by merger and acquisition types in the renewable

Oct 1, 2013 · This study classifies the types of mergers and acquisitions (M&A) carried out in the renewable energy industry and explores their effects on enterprise value. Both the generalized

Deals, mergers and acquisitions – Energy Storage Journal

February 7, 2019: Deals, mergers and partnerships: Tesla to buy into supercapacitor technology; SUSI and ABB partner to deliver microgrid and ESS projects; Partnership to deploy VRFB

M&A in Energy and Natural Resources | Bain

Feb 4, 2025 · The energy sector saw more than $400 billion in acquisitions—a three-year high—with more than 10 megadeals, the biggest of which was the

Mergers and Acquisitions in the Energy Sector

Mergers & Acquisitions The energy sector is witnessing a surge in mergers and acquisitions (M&A) activity, driven by the need to adapt to changing market conditions, mitigate risk, and

mergers and acquisitions

Following last year''s acquisition, independent power plant developer Green Frog Power has rebranded as Pulse Clean Energy and unveiled a target of 1GW+ of energy storage assets in

Mergers and Acquisitions in the Energy Sector

Nov 6, 2023 · From dominant players in fossil fuels expanding into renewable sectors to emerging startups developing groundbreaking energy storage

Energy storage industry sees 117% increase in corporate

Jul 23, 2024 · Storage deal volume reached $15.4 billion in the six months ending June 30, but funding for smart grid companies dropped 11% to $1.8 billion, Mercom Capital Group said. The

Battery storage M&A powers into 2024 | M&A

May 21, 2024 · Battery energy storage systems (BESS), which enable utility companies and grid operators to access pools of surplus renewable energy on

Can Mergers and Acquisitions Promote

Aug 8, 2023 · Abstract and Figures The advancement of technological capabilities within lithium battery enterprises crucially facilitates the high-quality

6 FAQs about [New Energy Storage Mergers and Acquisitions]

How much money did energy storage companies make in 2022?

Corporate funding of energy storage companies exceeded US$26 billion worldwide in 2022, a 55% jump from 2021’s total US$17 billion. Masdar acquires UK battery storage developer Arlington Energy October 26, 2022 Masdar has acquired battery storage developer Arlington Energy in a bid to expand its presence in UK and European renewables markets.

What are the most recent M&A deals involving energy companies?

Usearch found 5488 recent M&A deals involving energy companies. The most recent M&A deals within the energy industry are: • Baker Hughes is acquiring Chart Industries. • Hecate Holdings is acquiring Hecate Energy. • Tamarack Valley Energy is acquiring PrivateCo.

How many battery storage M&A deals were announced in 2023?

According to Inframation, 227 battery storage M&A deals were announced in 2023, up 15.8 percent from the year before. These transactions were worth a combined US$24.1 billion, nearly triple the value recorded in 2022. In both volume and value terms, 2023 represented a new dealmaking high for the subsector.

Who owns Blackstone battery energy storage system?

In Q4 2023, renewable energy company Octopus Investments Australia, which is majority owned by the UK-based Octopus Group, acquired the Blackstone Battery Energy Storage System. With an expected enterprise value of US$514 million once operational, it is the largest proposed battery project in the state of Queensland.

What is the future of battery storage?

The US is leading the global race in the development of battery storage, with demand for BESS expected to increase sixfold by the end of the decade. Capacity is expected to almost double in 2024 to more than 30 GW, as development of energy storage projects accelerates in line with the rapid growth of variable solar and wind assets.

What is a battery energy storage system?

Battery energy storage systems (BESS), which enable utility companies and grid operators to access pools of surplus renewable energy on demand that would otherwise be wasted, play a central role in the global energy transition.

Industry Information

- Dushanbe Energy Storage Lithium Battery Company

- Application prospects of titanium flow batteries

- 5kw on grid inverter for sale in Congo

- Lithium battery power station in Spain

- Energy storage charging pile low-power battery cabinet

- China home inverter system in China company

- Does the battery energy storage system of a communication base station use a rectifier module

- Tunisia outdoor container Chinese inverter manufacturer

- Processing of simple photovoltaic panels for household use

- Moroni Compressed Air Energy Storage Power Station

- Energy storage system factory in Paraguay

- Cheap factory price single breaker Buyer

- 12 volt 1600w inverter

- Photovoltaic power station inverter location

- New solar photovoltaic lighting system

- El Salvador Energy Storage Frequency Modulation Power Station

- 60V solar panel power storage device

- Factory price 480v switchgear in Burundi

- Ashgabat lithium battery energy storage equipment manufacturer

- Slovenia 12v400ah energy storage battery

- The relationship between power supply equipment and energy storage

- Wind and solar energy storage motor price

- Manufacturers of off-grid inverters

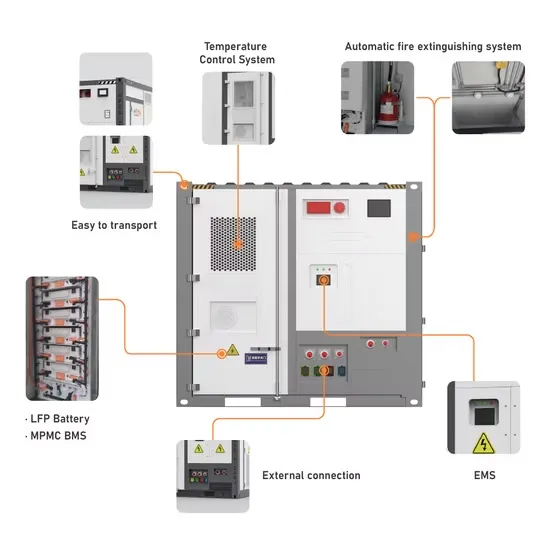

Commercial & Industrial Solar Storage Market Growth

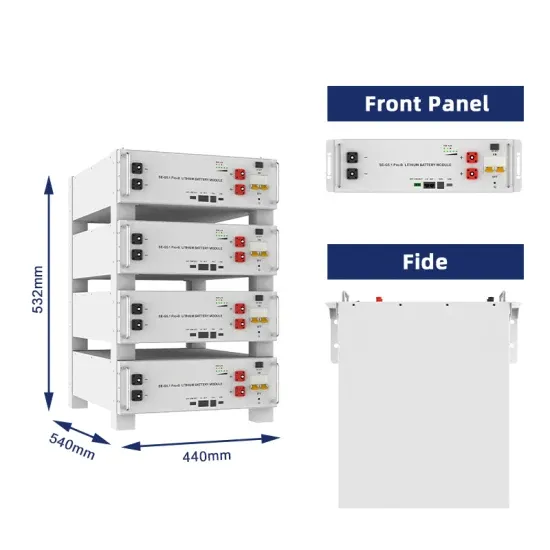

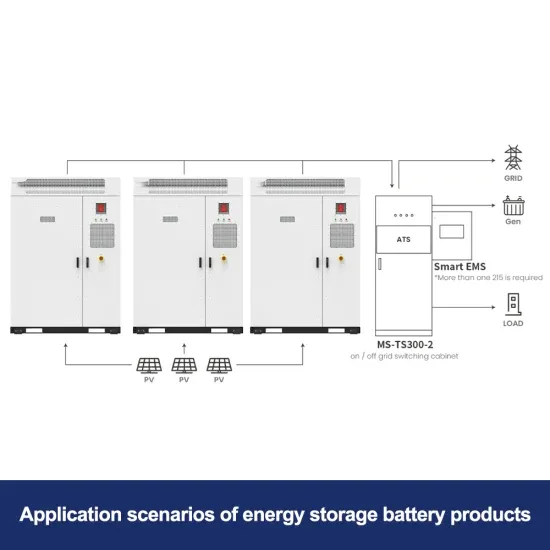

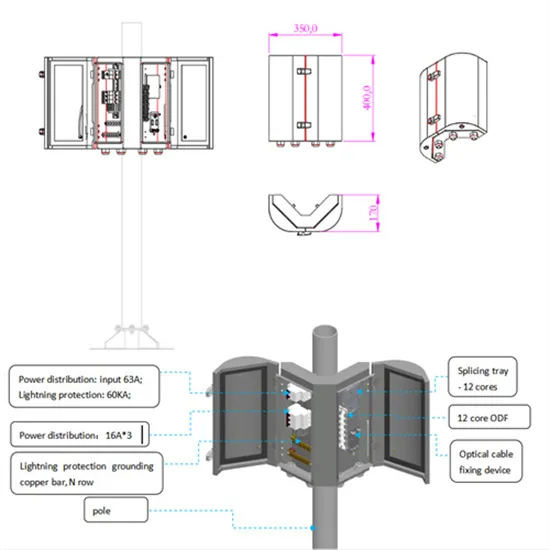

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

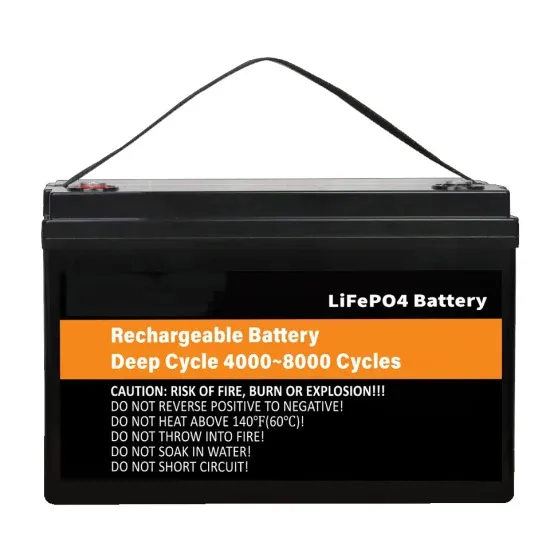

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.