The best profit analysis of power storage

The best profit analysis of power storage ity in stationary energy storage systems. The NaS battery is best suited for peak shaving, transmission and distribution network management,

Study on profit model and operation strategy optimization of energy

Sep 25, 2023 · With the acceleration of China''s energy structure transformation, energy storage, as a new form of operation, plays a key role in improving power quality, absorption, frequency

Study on profit model and operation strategy optimization of energy

Sep 25, 2023 · With the acceleration of China''s energy structure transformation, energy storage, as a new form of operation, plays a key role in improving power quality, absor

Energy storage station profit

Keywords: electricity spot market, electrochemical energy storage, profit model, energy arbitrage, economic end of life. Citation: Li Y, Zhang S, Yang L, Gong Q, Li X and Fan B (2024) Optimal

The 2020 Cost and Performance Assessment provided installed costs for six energy storage technologies: lithium-ion (Li-ion) batteries, lead-acid batteries, vanadium redox flow batteries,

Business Models and Profitability of Energy Storage

Oct 23, 2020 · We propose to characterize a "business model" for storage by three parameters: the application of a storage facility, the market role of a potential investor, and the revenue

Business Models and Profitability of Energy

Sep 11, 2020 · Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in electricity storage and the

What are the profit analyses of large energy storage

Energy storage can participate in wholesale energy, ancillary, and capacity markets to generate revenue for storage owners. It can also be used by load serving entities for load management

In-depth explainer on energy storage revenue

Jan 25, 2022 · By Michael Klaus, Partner, Hunton Andrews Kurth Battery energy storage projects serve a variety of purposes for utilities and other consumers

How is the profit of energy storage power

Aug 11, 2024 · How is the profit of energy storage power station? 1. Energy storage power stations enhance grid reliability and support renewable

A comprehensive review of the impacts of energy storage on power

Jun 30, 2024 · We conclude with a discussion of future research directions in this field, including the potential for simulation models to improve our comprehension of the complex relations

How is the profit of Hunan energy storage power station?

Feb 20, 2024 · The profit of Hunan energy storage power station can be analyzed through several key aspects: 1. Revenue generation from energy sales, 2. Operational cost efficiencies, 3.

How much is the profit of energy storage power station

Jan 17, 2024 · The profit from constructing an energy storage power station varies significantly based on several factors. 1. Initial investment is substantial, often ranging from millions to

How is the profit model of energy storage power station

Jan 27, 2024 · 1. The profit model of energy storage power stations operates primarily through: 1) frequency regulation, 2) capacity arbitrage, 3) ancillary market services, and 4) participation in

Energy storage cable profit analysis

Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is

What is the annual income of energy storage

Apr 3, 2024 · UNDERSTANDING REVENUE SOURCES Energy storage power stations derive income through multiple avenues, which include demand

Stochastic valuation of energy storage in wholesale power markets

May 1, 2017 · This paper provides a stochastic energy storage valuation framework in wholesale power markets which considers all key revenue streams simultaneously. As part of this

Portable Power Stations of 2025: The Ultimate Energy

Maximize margins with 2025''s most durable portable power stations – 4,000+ life cycles, rapid wholesale fulfillment, and white-label branding for distributors needing reliable, high-profit

Profit model of new energy storage

The model shows that it is already profitableto provide energy-storage solutions to a subset of commercial customers in each of the four most important applications--demand-charge

Profit analysis of new technology energy storage

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset,

Energy storage zhongjun profit analysis

Does energy storage configuration maximize total profits? On this basis,an optimal energy storage configuration model that maximizes total profitswas established,and financial evaluation

profit model of large-scale energy storage power stations

About profit model of large-scale energy storage power stations As the photovoltaic (PV) industry continues to evolve, advancements in profit model of large-scale energy storage power

Ground energy storage power station solution

What is a flexible energy storage power station (fesps)? Firstly,this paper proposes the concept of a flexible energy storage power station (FESPS) on the basis of an energy-sharing

The Battery Specific Science of Revenue

Feb 7, 2024 · Over the last year we became increasingly involved with the "science" of modelling past and future revenues of battery energy storage

Analysis and Comparison for The Profit Model of Energy Storage Power

Nov 7, 2020 · The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of distributed generators continue to increase in the power system. With the

How is the profit of energy storage power

Aug 11, 2024 · Beyond traditional revenue models, energy storage power stations can tap into various emerging market opportunities that characterize modern

Profit analysis of power storage computing power

The calculation example analysis shows that compared with the traditional model, the "three-stage" model can bring better benefits to the pumped storage power station, and when the

The role of Electrical Energy Storage (EES) is becoming increasingly important in the proportion of distributed generators continue to increase in the power system. With the deepening of

Analysis of shanghai and shenzhen energy storage

We propose to characterize a "business model" for storage by three parameters: the application of a storage facility, the market role of a potential investor, and the revenue stream obtained from

The profit model of independent energy storage power stations

Our range of products is designed to meet the diverse needs of base station energy storage. From high-capacity lithium-ion batteries to advanced energy management systems, each

Profit analysis of energy storage industry

Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is globally on the rise (IEA,2020). One

6 FAQs about [The profit model of energy storage power station wholesale]

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

What is a business model for storage?

We propose to characterize a “business model” for storage by three parameters: the application of a storage facility, the market role of a potential investor, and the revenue stream obtained from its operation (Massa et al., 2017).

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

How would a storage facility exploit differences in power prices?

In application (8), the owner of a storage facility would seize the opportunity to exploit differences in power prices by selling electricity when prices are high and buying energy when prices are low.

What is a power storage facility?

In the first three applications (i.e., provide frequency containment, short-/long-term frequency restoration, and voltage control), a storage facility would provide either power supply or power demand for certain periods of time to support the stable operation of the power grid.

Industry Information

- Solar power solutions factory in Iraq

- Turkmenistan energy storage battery container factory is in operation

- Solar energy storage cabinet companies

- Al jameel switchgear in China in Hungary

- Barbados RV lithium battery bms structure

- Industrial and commercial energy storage solution for French administrative buildings

- China 5kwh hybrid inverter for sale Buyer

- 500Kw inverter directly connected to the grid

- Battery requirements for container energy storage power stations

- Wellington lithium battery station cabinet manufacturer with the most

- Macedonia 12v to 220v inverter

- 20kv photovoltaic grid-connected inverter

- Photovoltaic inverter in Rotterdam the Netherlands

- Energy Storage Financing BESS Price Trend

- Battery size specifications for communication base stations

- Athens energy storage cabinet battery life

- Sri Lanka solar power tiles

- High quality home circuit breaker for sale company

- 48v outdoor power smart box

- Solar 400W Inverter

- Container battery cabinet manufacturer

- North Korea lithium battery management

- What is the appropriate inverter PV voltage

Commercial & Industrial Solar Storage Market Growth

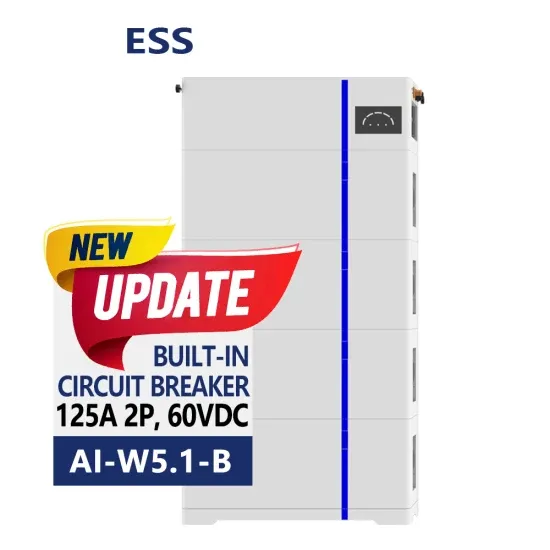

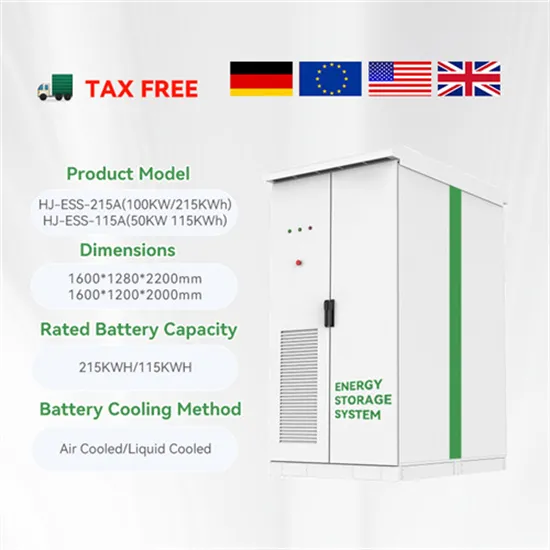

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.