Renewable Energy in Syria

Dec 13, 2021 · B. Indicators of Electricity During the War (from 2011 till the end of 2020): Production: electricity production decreased from /49/ billion (kWh) in 2011 to about /19/ billion

Renewable Energy in Syria

Dec 13, 2021 · B. Indicators of Electricity During the War (from 2011 till the end of 2020): Production: electricity production decreased from /49/ billion (kWh) in 2011 to about /19/ billion

SYRIA. SOLAR SYSTEMS. TECHNICAL REPORT (17773

Jan 16, 2025 · The rates are: SP 0.305/kWh for the first 100 kWh/2-mths, SP 0.55/kWh for crnsu111ption over the above limit. If the fi~ed charges are included, it is reasonable to take a

Turkey Says It''s Ready to Supply Electricity to

Dec 30, 2024 · Turkey has offered to provide electricity to Syria and is exploring opportunities to cooperate in the country''s oil and gas sector following the

Guide for the Partnership Information Return (T5013 Forms)

9 hours ago · Find out if this guide is for you This guide gives general information on how to fill out the partnership information return, its related schedules and forms, and the T5013 slips and

Turkey Says It''s Ready to Supply Electricity to

Dec 30, 2024 · Turkey is working to resolve the energy supply issues in Syria and is ready to provide electricity to the country, where Ankara supported the

Syrian Arab Republic 2017

Mar 2, 2018 · The Syrian energy sector is characterized by fossil fuel dominance, aside from the role of renewable sources and full exploitation of domestic

Syrian Arab Republic 2017

Mar 2, 2018 · In accomplishing this goal, Syrian energy policy is faced with three main challenges, namely expanding the gas market, sustaining the oil production and developing country''s

Renewable Energy in Syria

Dec 13, 2021 · Production: electricity production decreased from /49/ billion (kWh) in 2011 to about /19/ billion (kWh) in 2016. It then increased to /27/ billion (kWh) during the year 2020 due to the

Saudi Electricity company

Apr 10, 2022 · The proposed Mobile Substations (20MVA and 10MVA) are to provide alternative source of supply to customrs temporarily, in case of loss of regular supply due to damage/fault

6 FAQs about [Syria outdoor power supply 1 25 kWh]

What is the energy sector in Syria?

The energy sector is a robust component of domestic economic activities, and the main contributors in the Syrian energy sector are the Ministry of Petroleum and Mineral Resources, the Ministry of Electricity and the Atomic Energy Commission of the Syrian Arab Republic.

Does the Syrian Arab Republic have a good energy balance?

For the time being, the Syrian Arab Republic has maintained a reasonable energy balance. However, as primary energy demand in the Syrian Arab Republic increases by an average annual rate of 5%, while at the same time oil production is steadily decreasing and NG production is limited, the country will depend more and more on energy imports.

Is there a nuclear power plant in Syria?

There is no nuclear power plant in operation, under construction or decommissioned in the Syrian Arab Republic. According to the long term energy planning studies in the Syrian Arab Republic, the nuclear option was anticipated to contribute to the national electricity production in 2020.

Is the Syrian Arab Republic self-sufficient in energy?

Despite severe damages to domestic energy infrastructure, leakage and illegal consumption in addition to the sanctions imposed on the country, the Syrian Arab Republic can still be considered self-sufficient in energy. For example, in 2015, a total of 18 580 Mtoe was ready for transmission.

Why does the Syrian Arab Republic have a low energy demand?

This is due to the fact that the supply strategy, which had been developed recently, indicated that the Syrian Arab Republic was going to encounter serious problems in covering its future energy demand after 2015. For the time being, the Syrian Arab Republic has maintained a reasonable energy balance.

Should Syria consider a nuclear option for electricity generation?

The Syrian energy supply strategy recently highlighted the competitive role of the nuclear option in the future energy supply mix. There is acceptance and willingness to consider the nuclear option for electricity generation.

Industry Information

- Photovoltaic distributed energy storage device

- Home circuit breaker for sale in Namibia

- Ljubljana Energy Storage Battery Framework Company

- Minsk 20kw off-grid inverter supply

- Victoria PV combiner box price

- Which company does the BMS battery come from

- High quality wholesale solar power storage producer

- Chile energy storage module equipment price

- Niamey Sunshine Energy Storage Power Supply Purchase

- Communication base station passive solar installation

- New Energy Storage Product Launch Plan

- Photovoltaic panel manufacturer for export in Alexandria Egypt

- Battery pack lightweight

- Mozambique MW energy storage container

- Does the battery in the energy storage cabinet have current

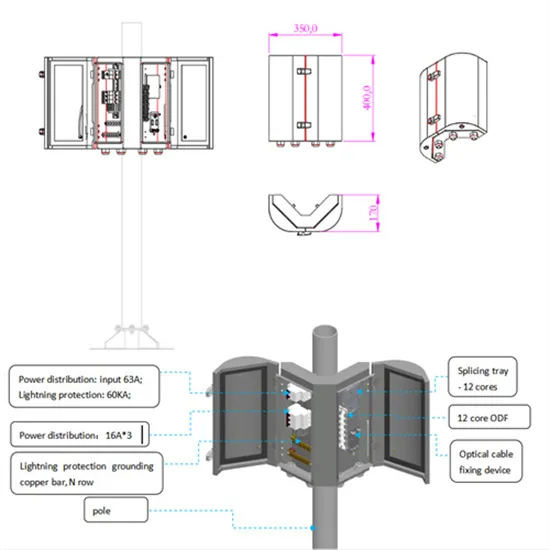

- Power supply for wind-solar hybrid cabinets of Maldives communication base stations

- Northern Photovoltaic Glass

- Alofi Photovoltaic Power Generation and Energy Storage Prospects

- Sine wave of inverter

- Congo 5G communication base station inverter grid layout solution

- Slovakia communication base station inverter grid connection approval

- Guatemala Hospital Industrial and Commercial Energy Storage System

- New Zealand Industrial and Commercial Energy Storage Cabinet Manufacturer

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.