Financial Analysis Of Energy Storage

6 days ago · The business case matters The NPV is a great financial tool to verify profitability and overall safety margin between storage as it accounts for many different factors and is lifetime

The Economics of Battery Storage: Costs,

Jan 12, 2024 · Understanding the economics of battery storage is vital for investors, policymakers, and consumers alike. This analysis delves into the

The Profitability Challenges of Utility-Scale

Jul 12, 2025 · Increased energy storage is one of the most promising ways to handle the challenges from introducing lots of non-dispatchable generators to

Optimisation of energy storage for performance

Mar 20, 2024 · The right balance between battery health and profitability is essential for success, writes Laura Laringe, CEO of reLi Energy.

Business Models and Profitability of Energy

Oct 23, 2020 · Summary Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy

Profitability of lithium battery energy storage

Aug 18, 2025 · On August 23, CATL, ranks first in top 10 lithium ion battery manufacturers, released its report for the first half of 2022. The energy storage

Battery energy storage systems | BESS

3 days ago · Battery energy storage (BESS) offer highly efficient and cost-effective energy storage solutions. BESS can be used to balance the electric

Business Models and Profitability of Energy

Sep 11, 2020 · Battery energy storage systems (BESSs) are advocated as crucial elements for ensuring grid stability in times of increasing infeed of intermittent

Evaluating energy storage tech revenue

Feb 11, 2025 · The revenue potential of energy storage is often undervalued. Investors could adjust their evaluation approach to get a true

Battery Storage Is Booming—but Are You Losing

Traders require accurate degradation cost curves to balance profits with battery longevity. In markets like the UK, where arbitrage margins can be tight, even a

GB BESS Outlook Q4 2024: How will battery

Battery energy storage systems in Great Britain earn revenue through a variety of markets with different mechanisms. The revenue stack for batteries has

Australia''s battery storage investments

Dec 12, 2024 · Due to higher power price volatility and changing market dynamics, investments in battery storage within Australia''s national electricity

Increasing the lifetime profitability of battery energy storage

Oct 15, 2023 · Stationary battery energy storage system (BESS) are used for a variety of applications and the globally installed capacity has increased steadily in recent years [2], [3].

January 2025: GB battery energy storage

In January 2025, our battery energy storage research for Great Britain focused on the latest in BESS operations, buildout, and policy updates.

Large-scale battery storage, short-term market outcomes,

Mar 1, 2022 · In addition, we provide evidence that battery deployment in the years 2013 through 2017 lowered average intra-day wholesale price spreads and that current market conditions

Battery Energy Storage System ROI: 3 factors for

Nov 15, 2023 · Battery energy storage systems are a great way for manufacturing facilities to reduce costs and even generate additional revenue. However,

BESS in Great Britain: Ten key trends in 2024

At Solar and Storage Live 2024, Modo presented the current key trends for battery energy storage in Great Britain.

ERCOT Energy Storage | Paths to Profit

Apr 4, 2024 · The profitability of assets within the energy storage fleet can be attributed to three key factors: battery size, operating strategy and location.

Battery electricity storage as both a complement and

Jun 1, 2024 · It estimates the impacts on arbitrage profitability of cross-border interconnectors and battery storage, and the amount of interconnection transmission capacity that is rendered

Understanding the Return of Investment (ROI): battery energy storage

5 days ago · Several key factors influence the ROI of a BESS. In order to assess the ROI of a battery energy storage system, we need to understand that there are two types of factors to

Profitability of energy arbitrage net profit for grid-scale battery

Aug 1, 2024 · Profitability of energy arbitrage net profit for grid-scale battery energy storage considering dynamic efficiency and degradation using a linear, mixed-integer linear, and mixed

How much profit do energy storage batteries

Mar 15, 2024 · Energy storage batteries present lucrative opportunities for profit generation across various sectors, 1. driven by increasing energy demand, 2.

Optimization of Battery Storage Profitability with Wind

Apr 27, 2019 · the battery and efficiency losses in considering profitability of the wind farm. Wind and power data from several locations along with hourly energy pricing data were used to

Battery storage systems: An economic model-based analysis

Apr 1, 2019 · Against this background, this paper has developed and applied an optimization model to assess the profitability of different parallel revenue streams for a battery storage

How is Energy Storage Profitable? Unlocking the Billion-Dollar Battery

Nov 19, 2023 · In 2023, the global market hit $50 billion, and experts predict it''ll double by 2030. So, how do companies turn giant batteries into cash machines? Grab your hard hats – we''re

Battery Storage Profitability in Germany''s Energy Market

Jun 28, 2025 · Analyzing battery storage''s role and profitability in Germany''s energy landscape between 2020 and 2023. Battery storage is an important part of moving...

European Market Outlook for Battery Storage 2025-2029

May 7, 2025 · The European Market Outlook for Battery Storage 2025–2029 analyses the state of battery energy storage systems (BESS) across Europe, based on data up to 2024 and

Profitability of battery energy storage system coupled with

Jun 15, 2025 · Research papers Profitability of battery energy storage system coupled with photovoltaic at behind-the-meter Pranuda Jivaganont, Pimpa Limthongkul, Jiravan

Profitability of batteries in day-ahead and intraday electricity

Aug 1, 2025 · By 2023, total battery storage capacity in the energy sector exceeded 2,400 GWh, marking a fourfold increase since 2020 (IEA, 2024). The amount of batteries and their role in

Battery Energy Storage System ROI: 3 factors for

Nov 15, 2023 · Continuously monitoring battery health is vital for preserving long-term performance and reliability, as early detection of degradation or faults

The role of battery storage in the energy market

Electricity storage systems play a central role in this process. Battery energy storage systems (BESS) offer sustainable and cost-effective solutions to

Profitability Analysis of Battery Energy Storage in

Feb 13, 2025 · Despite the massive increase of renewable energy generation in Greece, large-scale battery energy storage systems (BESS) are yet to be

6 FAQs about [Battery Storage Profitability]

How does battery cost affect energy storage?

From the perspective of the cost structure of the energy storage system, the battery cost accounts for the highest proportion, reaching 60%. Therefore, thesubstantial increase in the cost of batteries will inevitably lead to a substantial increase in the cost of the energy storage system.

Is battery storage a good investment?

The economics of battery storage is a complex and evolving field. The declining costs, combined with the potential for significant savings and favorable ROI, make battery storage an increasingly attractive option.

Are battery storage projects financially viable?

Different countries have various schemes, like feed-in tariffs or grants, which can significantly impact the financial viability of battery storage projects. Market trends indicate a continuing decrease in the cost of battery storage, making it an increasingly viable option for both grid and off-grid applications.

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Why is battery storage important?

The global shift towards renewable energy sources has spotlighted the critical role of battery storage systems. These systems are essential for managing the intermittency of renewable sources like solar and wind. Understanding the economics of battery storage is vital for investors, policymakers, and consumers alike.

How has the cost of battery storage changed over the past decade?

The cost of battery storage systems has been declining significantly over the past decade. By the beginning of 2023 the price of lithium-ion batteries, which are widely used in energy storage, had fallen by about 89% since 2010.

Industry Information

- What power supply does the AP base station need

- Transportation Uninterruptible Power Supply Purchase Quote

- How much is the wholesale price of energy storage batteries in Managua

- Industrial energy storage 1c discharge

- Kigali Energy Storage Power Supply

- Photovoltaic PPA Energy Storage

- Kigali Power Station Energy Storage

- Is this electrochemical energy storage

- Uninterruptible power supply equipment for Skopje transportation

- Field Solar Inverter

- New photovoltaic panel manufacturer in Thimphu

- Monrovia RV Solar Air Conditioner Price

- Energy storage system 3s integration

- North African communication base station inverter battery standard

- 4 2 kw solar inverter factory in Tanzania

- Argentina Cordoba Energy Storage Battery Lithium 5 degrees

- Battery pack structure price

- What energy storage devices are used in distribution networks

- West Asia Home Energy Storage

- Warsaw inverter high power

- Nepal glass photovoltaic

- Indoor base station distribution battery example

- Beautiful solar photovoltaic panels in Lesotho

Commercial & Industrial Solar Storage Market Growth

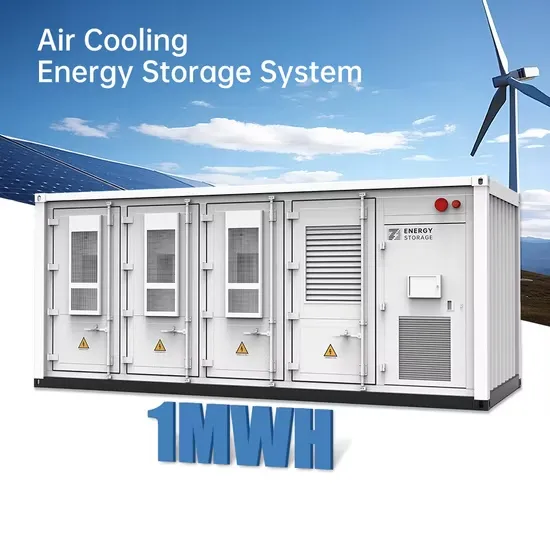

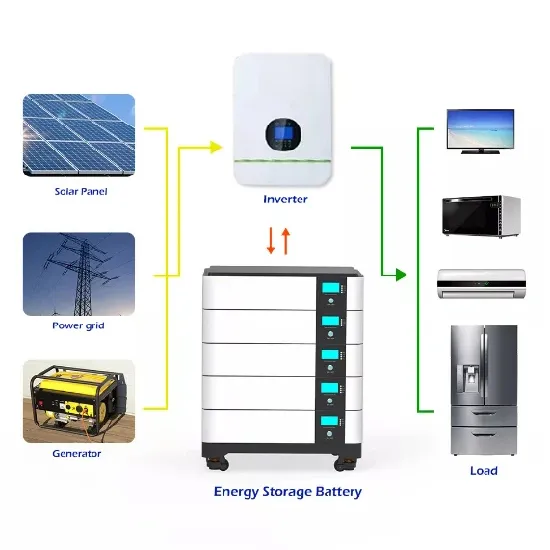

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.