Department of Energy Shares Applicant Self

Jan 17, 2025 · Department of Energy Shares Applicant Self-Disclosed Projects Receiving Clean Energy Manufacturing Investments in America''s Industrial

Energy Storage Stocks: Investment Opportunities in

Mar 28, 2025 · As the world increasingly transitions towards renewable energy, the importance of energy storage has never been more pronounced. This article explores various energy storage

Energy Storage

6 days ago · The Office of Electricity''s (OE) Energy Storage Division accelerates bi-directional electrical energy storage technologies as a key component of

Energy Storage Reports and Data

4 days ago · Energy Storage Reports and Data The following resources provide information on a broad range of storage technologies. General U.S. Department of Energy''s Energy Storage

127135|123800

Aug 19, 2025 · Across sectors, commercial and industrial facilities are benefiting from the implementation of renewable energy generation, storage, and energy eficiency projects.

Investment decisions and strategies of China''s energy storage

Sep 1, 2023 · Based on the characteristics of China''s energy storage technology development and considering the uncertainties in policy, technological innovation, and market, this study

ENERGY STORAGE PROJECTS

2 days ago · LPO can finance commercially ready projects across storage technologies, including flywheels, mechanical technologies, electrochemical

Key Projects, Initiatives and Market | JRC SES

The EU is advancing several key projects and initiatives in the energy storage field to boost renewable energy integration, stabilize the grid, and support clean energy goals. These

GE''s Reservoir Solutions

Jul 25, 2025 · GE APPROACH GE''s broad portfolio of Reservoir Solutions can be tailored to your operational needs, enabling efficient, cost-effective storage distribution and utilization of

State Power Investment Corporation Operates 132 New Energy Storage

Apr 23, 2025 · As of March 2025, China National Energy Group has successfully implemented 132 new energy storage projects with a total capacity of 4934 MW and 10956 MWh. This

ENERGY STORAGE – FOLLOW THE MON

Jun 2, 2023 · Energy storage has become a critical component of the renewable energy infrastructure and general electric power markets in recent years. Energy storage is seen as

An option game model applicable to multi-agent cooperation investment

Mar 1, 2024 · This paper proposes an option game model that is applicable to multi-agent cooperation investment in energy storage projects. A power grid enterprise

Investment Models for Energy Storage Projects: Which One

Mar 1, 2022 · We''ll break down energy storage investment models with real-world examples—because let''s face it, nobody wants to gamble on a "maybe" in this $20 billion

Institutional investment in energy storage projects

Why should we invest in energy storage? By providing low-cost funding for breakthrough storage solutions,we help bring clean electricity to millions of people when they need it. The rapid

Global Energy Storage Program | CIF

Aug 3, 2025 · Global Energy Storage Program (GESP) supports clean energy storage technologies to expand integration of renewable energy into

Gresham House Energy Storage Fund plc

Dec 31, 2024 · Gresham House Energy Storage Fund plc (GRID) invests in a portfolio of utility-scale operational battery energy storage systems in Great

Next step in China''s energy transition: energy

Jun 27, 2024 · China''s industrial and commercial energy storage is poised for robust growth after showing great market potential in 2023, yet critical

Energy Storage Projects: a global overview of trends and

Consumers are demanding more options. Expert commentators like Navigant Research estimate that energy storage will be a US$50 billion global industry by 2020 with an installed capacity of

Sustainable Battery Storage Projects – An Investment with a

Apr 30, 2025 · Large-scale battery storage in Europe: How to invest in the energy transition with power storage. Sustainable, secure, future-oriented. Here''s how it works.

Innovative transmission, energy storage projects

Aug 6, 2024 · The projects include about 600 miles of new transmission and 400 miles of reconductored wiring as well as grid-enhancing technologies, long

Overview of compressed air energy storage projects and

Nov 30, 2022 · Energy storage (ES) plays a key role in the energy transition to low-carbon economies due to the rising use of intermittent renewable energy in electrical grids. Among the

SSE welcomes UK Government scheme unlocking investment

Oct 9, 2024 · An appropriately designed cap and floor scheme will provide a revenue stabilisation mechanism aimed at unlocking significant private investment in long duration electricity

Energy Storage Investments – Publications

Mar 7, 2025 · As investment in renewable energy generation continues to rise to match increasing demand so too does investment, and the opportunity to invest, in energy storage. Estimates

How do ordinary people invest in energy storage projects?

Aug 28, 2024 · 1. Ordinary individuals can engage in energy storage initiatives through several avenues: 1) purchasing shares of publicly traded companies focused on energy storage

10+ Countries Join First-of-Its-Kind Consortium

Dec 2, 2023 · Nayer Fouad, CEO, Infinity Power "Our own portfolio of renewable energy projects already includes battery storage facilities in Senegal, and we

What are the investment models for energy storage projects?

Feb 23, 2024 · Investment in energy storage projects has become a focal point in efforts to enhance grid resilience, support renewable energy integration, and ensure energy availability.

Which companies will invest in energy storage?

Aug 21, 2024 · The investment landscape for energy storage is expanding rapidly, and several key players are likely to take significant steps in this area. 1.

The 360 Gigawatts Reason to Boost Finance for Energy Storage

Jan 14, 2024 · One large missing piece has been funding. Storage projects are risky investments: high costs, uncertain returns, and a limited track record. Only smart, large-scale, low-cost

An optimal sequential investment decision model for

Apr 1, 2024 · However, the uncertainties in the investment decision process pose a challenge for investment evaluation of ESS. This study develops a sequential investment decision model for

Draft Energy Storage Strategy and Roadmap

Dec 20, 2024 · WASHINGTON, D.C. – The U.S. Department of Energy (DOE) today released its draft Energy Storage Strategy and Roadmap (SRM), a plan

6 FAQs about [General investment in energy storage projects]

How to choose the best energy storage investment scheme?

By solving for the investment threshold and investment opportunity value under various uncertainties and different strategies, the optimal investment scheme can be obtained. Finally, to verify the validity of the model, it is applied to investment decisions for energy storage participation in China's peaking auxiliary service market.

Should you invest in future energy storage technologies?

Additionally, the investment threshold is significantly lower under the single strategy than it is under the continuous strategy. Therefore, direct investment in future energy storage technologies is the best choice when new technologies are already available.

Is there a realistic investment decision framework for energy storage technology?

Therefore, in order to provide a more realistic investment decisions framework for energy storage technology, this study develops a sequential investment decision model based on real options theory, which can consider policy, technological innovation, and market uncertainties.

Is there a real option model for energy storage sequential investment decision?

Propose a real options model for energy storage sequential investment decision. Policy adjustment frequency and subsidy adjustment magnitude are considered. Technological innovation level can offset adverse effects of policy uncertainty. Current investment in energy storage technology without high economics in China.

How to promote energy storage technology investment?

Therefore, increasing the technology innovation level, as indicated by unit benefit coefficient, can promote energy storage technology investment. On the other hand, reducing the unit investment cost can mainly increase the investment opportunity value.

Is energy storage a good investment strategy?

However, for new technologies, the investment cost is lower and the benefit is higher, which has a better investment value than the current energy storage technologies. Additionally, the investment threshold is significantly lower under the single strategy than it is under the continuous strategy.

Industry Information

- Brunei has a communication base station inverter connected to the grid

- Belgrade 3000w solar power system wholesale

- Can Apiawa be equipped with solar energy

- Wholesale 2000 amp switchgear in Sweden

- Which is the best outdoor communication battery cabinet in Iraq

- Uninterruptible power supply sales in Palikir computer room

- The role of container photovoltaic panels in Port Vila

- Paraguay special energy storage battery price

- Which energy storage battery is more cost-effective

- Reliable energy storage containers for sale in France

- Mauritania Compression Energy Storage Power Station

- China 16kw sunsynk inverter factory exporter

- China factory price 220 amp breaker company

- Base station solar panel unit price

- Battery cabinet maximum charging power calculation

- Which telecommunications company has more base stations in Tripoli

- Uninterruptible Power Supply for Democratic Republic of Congo Telecom

- Energy Storage Fire Prevention System

- Kampala aluminum acid energy storage battery brand ranking

- Dhaka Photovoltaic Glass Shed BESS Information

- Lisbon Heavy Industry Energy Storage Cabinet Wholesaler

- Hot sale China drawout circuit breaker for sale

- Warsaw Electric Mobile 5G Base Station

Commercial & Industrial Solar Storage Market Growth

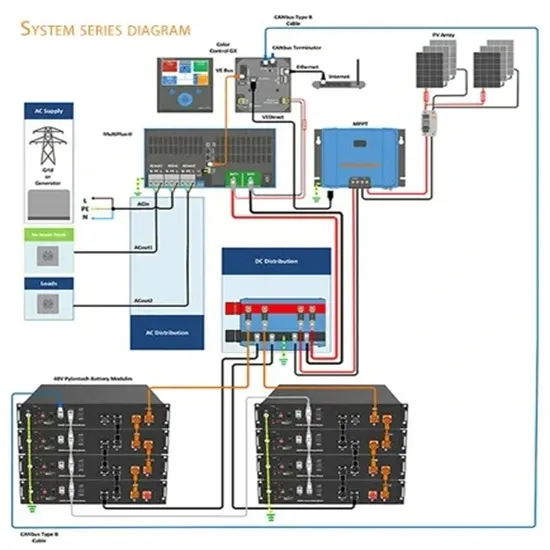

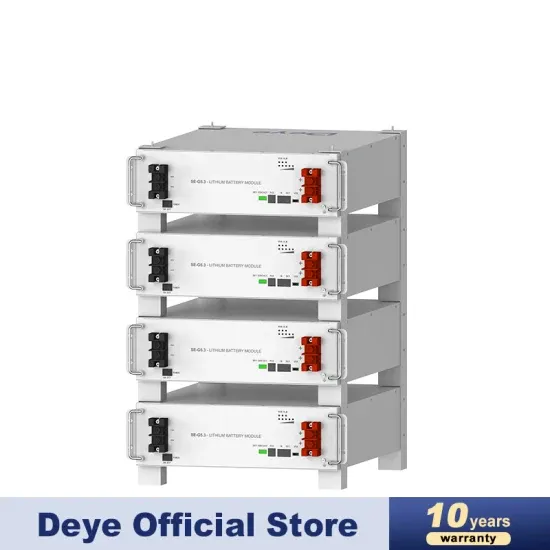

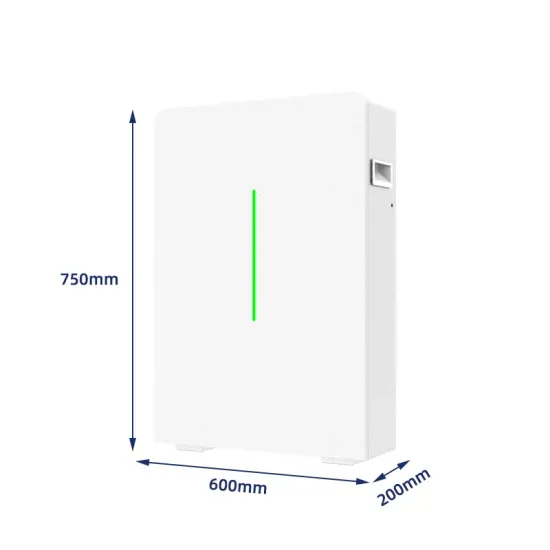

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.