Which companies are investing in the energy storage market?

Aug 9, 2024 · 1. Significant corporations are actively allocating resources towards the energy storage sector, including Tesla, LG Chem, and Panasonic. 2. These firms are mot

Who are the main investors and drivers of the

Jun 18, 2024 · These funds seek investments that provide stable, long-term returns, which makes battery companies attractive due to the expected growth

U.S. Energy Storage Industry Commits $100

WASHINGTON, D.C., April 29, 2025 – Today the American Clean Power Association (ACP), on behalf of the U.S. energy storage industry, announced

Batteries have become VC and PE''s most electric

May 6, 2022 · One after another, OEMs began partnering with and investing serious money in battery companies. GM, for example, has invested in SES,

Companies investing in energy storage batteries

Investing in battery storage stocks can provide exposure to the growing energy storage marketand the potential for long-term growth as the demand for renewable energy continues

Top 10 Best Indian Companies In Energy Storage

Jan 4, 2025 · Explore the top 10 Indian companies in energy storage solutions in 2025. Discover innovative technologies driving sustainable energy and

6 Best Battery Stocks to Buy and Hold | Investing

Aug 5, 2025 · Its cost-effective Battery Energy Storage System makes it easier for companies to handle all stages of battery usage and recycling.

Top 10 Energy Storage Companies in 2025

Jul 27, 2025 · Discover the top 10 energy storage companies of 2025, driving clean energy with BESS solutions, grid stability, and global renewable

12 Best Energy Storage Stocks (Ultimate 2025

Jun 10, 2022 · Therefore, many companies are investing heavily in energy storage solutions and research, such as more efficient batteries, new and

Top Renewable Energy & Battery Storage Stocks Worth Investing

Mar 17, 2025 · From an investor''s perspective, choosing companies from the renewable energy and battery storage space should be a profitable opportunity. This is because demand for

Powering the Future: Top Venture Capitalists

Mar 19, 2023 · These companies are developing novel energy storage technologies, such as long-duration batteries and solid-state batteries, which

How To Invest In Energy Storage

Dec 23, 2021 · Energy storage is a fast-emerging sector and a potential new growth path for the next decade. Learn more about energy storage and how to

Top 10 Energy Storage Companies to Watch in 2025

Aug 13, 2025 · Across Europe, hybrid energy storage systems are emerging that combine multiple storage types for optimized flexibility and performance. At the same time, falling battery costs

Top 10 Energy Storage Companies in 2025

Jul 27, 2025 · That''s exactly where utility-scale energy storage companies come into play. These innovators are building large-scale battery systems and

7 Energy Storage Stocks to Invest In | Investing

Jul 9, 2025 · One of the largest lithium battery producers on the planet, Panasonic is the go-to company for firms that need energy storage products for EVs, grid

Best Energy Storage Stocks

Jun 16, 2025 · Investing in energy storage stocks like GNRC, ENS, EOSE, and FLNC could provide a remarkable gain to investors as energy storage companies can lead the future.

10 Energy Storage Companies to Know in 2025

Jan 21, 2025 · Below, we spotlight 10 companies innovating in energy storage, categorized by their unique technologies and contributions to the industry. 1. NextEra Energy Resources. Key

iShares Energy Storage & Materials ETF | IBAT

5 days ago · The iShares Energy Storage & Materials ETF seeks to track the investment results of an index composed of U.S. and non-U.S. companies involved in energy storage solutions

Energy Storage Investment: Top 2025 Trends & Companies

Jun 21, 2025 · Energy Storage Investment insights for 2025: discover top trends and leading companies shaping the future of energy storage beyond the battery boom.

12 Best Energy Storage Stocks to Buy in 2025

Oct 5, 2022 · Energy storage stocks are companies that produce or develop energy storage technologies, such as batteries, capacitors, and flywheels. These technologies can store

Grid-Scale Battery Storage Companies Make

Apr 30, 2025 · A coalition of companies making and using large batteries for energy storage on the electric grid announced Tuesday a $100 billion

Giants Compete in the Lithium Iron Phosphate Battery Track

Jun 7, 2024 · As more companies invest in LFP batteries, their adoption in vehicles is accelerating. CITIC Securities predicts that by 2025, LFP batteries will hold a 43% share in the

10 Best Battery Energy Storage Companies in 2025

Oct 5, 2024 · Discover the top 10 best Battery Energy Storage Companies of 2025, leading the way with innovative technologies and global market presence.

Top Energy Storage Batteries Stocks

Get to know which energy storage stocks are the most attractive for buying. Here you can find a detailed list of companies who specialize in the battery making industry. Make the right choice

Top Energy Storage Stocks 2025: Pure-Play

Jun 27, 2025 · Silicon-rich lithium-ion batteries are the near-term step-change in performance. They fit today''s factories and supply chains, yet promise 20-40%

Top Battery Storage Companies to Watch in

Jun 1, 2025 · The Companies to Watch: Our Curated List of Battery Storage Innovators The following list presents a curated selection of leading

7 Innovative Energy Storage Companies for Our

Jun 8, 2025 · Contemporary energy storage companies are harnessing new technologies to improve and establish energy storage facilities to meet an

6 FAQs about [Companies investing in energy storage batteries]

Should you invest in battery storage stocks?

Investing in battery storage stocks can provide exposure to the growing energy storage market and the potential for long-term growth. As the demand for renewable energy continues to expand, investing in well-known energy storage companies like Tesla, Panasonic, and LG Chem can be a strategic move.

Are battery storage systems a good investment?

With advancements in technology and decreasing costs, battery storage systems are becoming more accessible and efficient, allowing for greater integration of renewable energy sources into the grid and reducing reliance on fossil fuels. Identifying top energy storage stocks in an industry with many players can be challenging.

What is the broader sector that battery storage stocks belong to?

Battery storage stocks are a subset of the broader energy sector. These stocks are shares in companies that specialize in energy storage solutions through the use of batteries.

Which companies have pioneered the world's largest lithium-ion battery projects?

Key Innovation: Development of lithium-ion battery projects like Hornsdale Power Reserve. A trailblazer in battery innovation, Neoen has pioneered iconic energy storage installations, including one of the world’s largest batteries in Australia, enabling grid stabilization and renewable energy integration. 3. Enphase Energy

Which companies are leading the electric vehicle battery market?

Companies such as CATL, LG Energy Solution, Panasonic, Samsung SDI, and BYD are primarily recognized for their dominance in the Electric Vehicle (EV) battery market. However, available information explicitly indicates their significant investments and expansion into “energy storage solutions” or “grid-scale storage”.

What are the top energy storage companies?

Energy storage companies specialize in developing and implementing technologies and strategies to store energy for later use. As demand for renewable energy sources like solar and wind power increases, these companies are expected to grow. Some of the top energy storage companies include Tesla, LG Chem, and Fluence Energy.

Industry Information

- Bern EK Battery Energy Storage Cabinet

- Home inverter system for sale in Pretoria

- Solar power automatic water pump

- Price of lithium battery for energy storage cabinet

- Proportion of lead-acid batteries in communication base stations

- 9V output voltage range of photovoltaic panel

- How much does a 200 kWh energy storage device cost

- Best wholesale old circuit breaker Factory

- Energy storage cabinet industry development prospects

- Dhaka Solar Photovoltaic Module Factory

- New power signal base station in Amman

- Photovoltaic off-grid inverter parameters

- Uninterruptible power supply scr

- Finland energy storage lithium battery custom manufacturer

- Energy storage container battery price

- Sao Tome and Principe 12W Solar Street Light

- Large Uninterruptible Power Supply Sales

- How many photovoltaic panel manufacturers are there in Ho Chi Minh Vietnam

- Energy storage batteries over 10 000 yuan

- Original function of photovoltaic combiner box

- Main circuit breaker for sale in Honduras

- Practical operation of flywheel energy storage in communication base stations

- Africa can place outdoor power supply

Commercial & Industrial Solar Storage Market Growth

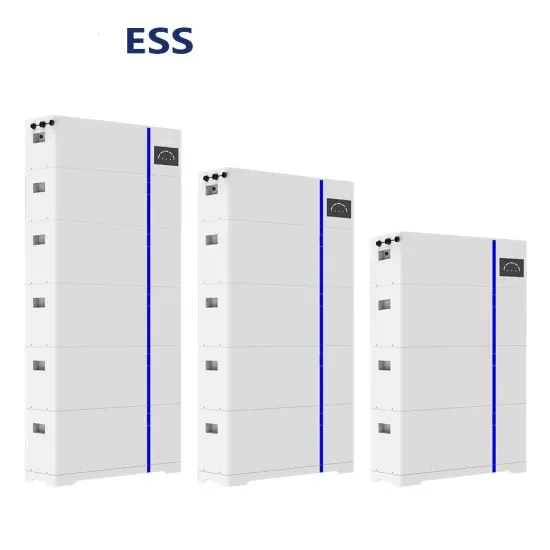

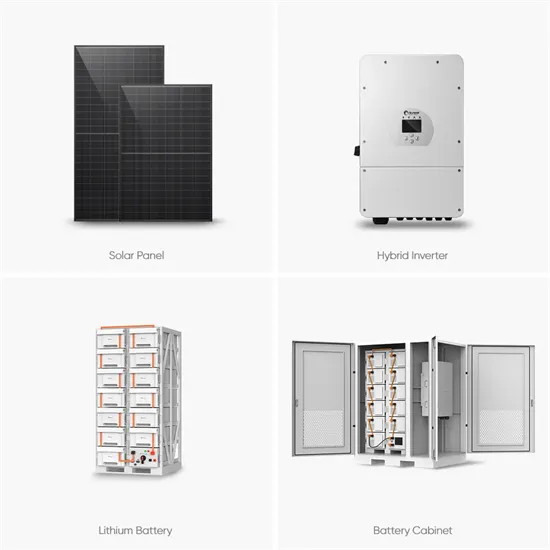

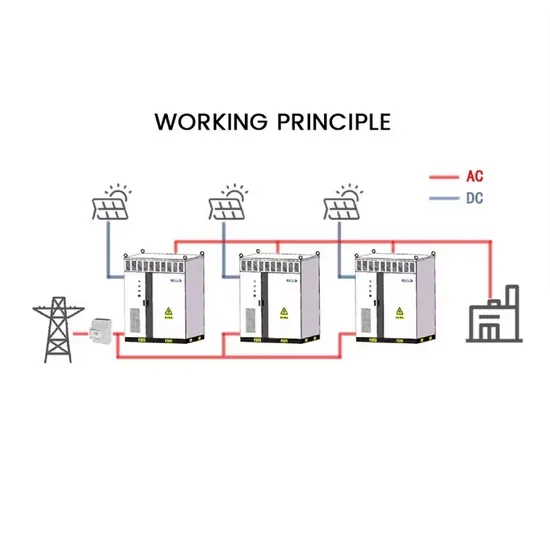

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.