How is the profit of factory energy storage power supply

Jun 28, 2024 · The profitability of factory energy storage power supply can be effectively analyzed through various facets. 1. Profit margins play a crucial role, considering the initial investment in

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their profitability

Overview and Prospect of distributed energy storage

Abstract. The combination of distributed generation and distributed energy storage technology has become a mainstream operation mode to ensure reliable power supply when distributed

Annual Energy Storage Performance Reveals Highest Profit

Apr 30, 2025 · The annual performance of the energy storage sector has been revealed, showing that PaiNeng Technology boasts the highest gross margin, while China Innovation A

Energy Storage Company Profit Margin

Energy Storage Company Profit Margin Brandon Bell/Getty Images News. Tesla, Inc. (NASDAQ:TSLA) has long portrayed itself as "more than a car company" by

Energy Storage Profit Ranking: Which Technologies Are

Mar 16, 2023 · Utilities, startups, and even your neighbor with solar panels want to know: Which energy storage solutions deliver the best ROI? This article cracks open the energy storage

Profit analysis of energy storage potential

The increasing penetration of renewable energy has led electrical energy storage systems to have a key role in balancing and increasing the efficiency of the grid. Liquid air energy storage

Industrial and commercial energy storage profit

Jul 24, 2023 · Commercial and industrial energy storage In the process of building a new type of power system, the important role of energy storage has

Emergence of 2.0 Profit Models for Industrial and Commercial Energy

May 26, 2025 · Xingji Yunneng is constructing a new paradigm for "platform-based power station operation," while Xiamen New Energy is providing future-proof "equipment certainty support."

Development of energy storage technology

Jan 1, 2019 · The installation of large-scale energy storage equipment with good dynamic response, long service life, and high reliability at the power source side may effectively solve

The lowest bidder wins the order. Is energy

Sep 25, 2024 · As for battery companies, in the first half of this year, the gross profit margin of CATL''s energy storage battery system was 28.87%, a year-on

Which profit analysis should be selected for energy

To tackle these challenges, a proposed solution is the implementation of shared energy storage (SES) services, which have shown promise both technically and economically [4] incorporating

What are the profits of energy storage industry analysis

Energy storage roles and revenues in various applications Energy storage is applied across various segments of the power system,including generation,transmission,distribution,and

Electric energy storage system profit margin

The model shows that it is already profitableto provide energy-storage solutions to a subset of commercial customers in each of the four most important applications--demand-charge

Which energy storage has the highest profit? | NenPower

Sep 28, 2024 · 1. Battery energy storage systems (BESS), particularly lithium-ion technologies, tend to offer the highest profitability due to their scalability and efficiency in both grid support

HOW DO ENERGY STORAGE OPERATORS MAKE A PROFIT

How does energy storage work? First, energy storage usually has a low operation cost since no fuel is directly consumed, . Then, the profit-seeking investors will always charge the storage at

How much profit can be gained from exporting energy storage equipment

Jan 21, 2024 · Exporting energy storage equipment presents a lucrative opportunity, driven by the increasing global demand for sustainable energy solutions. 1. Potential profit margins vary

Profitability of lithium battery energy storage

Aug 18, 2025 · On August 23, CATL, ranks first in top 10 lithium ion battery manufacturers, released its report for the first half of 2022. The energy storage

Profit Analysis of Each Energy Storage Branch: Where

Our profit analysis of energy storage branches reveals why lithium-ion isn''t the only player cashing in. Spoiler alert: some storage technologies are making Scrooge McDuck-level profits while

Evaluating energy storage tech revenue

Feb 11, 2025 · Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various

Energy storage sector profit margin

Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is

Energy storage system profit

The model shows that it is already profitableto provide energy-storage solutions to a subset of commercial customers in each of the four most important applications--demand-charge

Energy storage field profit analysis plan

Is energy storage a profitable business model? Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is

How is the profit of factory energy storage power station?

Sep 15, 2024 · Factory energy storage power stations generate profit by 1. optimizing operating costs, 2. providing ancillary services, and 3. capitalizing on dynamic pricing. The profitability

What is the main profit of energy storage? | NenPower

Jan 14, 2024 · The main profit of energy storage lies in several key benefits that enhance the efficiency and reliability of energy systems. 1. Stability in Energy Supply, enabling the

A Review of the Development of the Energy

Mar 19, 2025 · As the global carbon neutrality process accelerates and energy transition continues, the energy storage industry is experiencing

Tesla deployed 4.1GWh BESS in Q1

Apr 26, 2024 · Tesla made "all-time high" energy storage deployments in Q1, "leading to record profitability" for its energy business line.

How much profit does the energy storage business have?

Mar 18, 2024 · The energy storage business has emerged as a pivotal component within the broader energy paradigm, particularly in the context of escalating demands for renewable

Container energy storage profit model

The most widely used energy storage system in current industrial applications and commercialization is Battery Energy Storage System (BESS). Due to its fast response

Profit analysis of energy storage giants

The new energy storage, referring to new types of electrical energy storage other than pumped storage, has excellent value in the power system and can provide corresponding bids in

Profit analysis of new power grid energy storage

Energy storage is an important link for the grid to efficiently accept new energy, which can significantly improve the consumption of new energy electricity such as wind and photovoltaics

Battery energy storage with the highest profit efficiency

Abstract Battery Energy Storage Systems (BESS) are crucial for enhancing energy efficiency and reliability in behind-the-meter (BTM) applications across residential, commercial, and industrial

Industry Benchmarks of Gross, Net and Operating Profit

Aug 23, 2024 · Discover the highest (banking) and lowest (auto & truck) average profit margins by industry. Learn how gross, net and operating profit margins impact business.

How is the profit of energy storage battery industry?

Feb 15, 2024 · Financial incentives, such as grants, tax credits, and low-interest loans, encourage businesses and consumers to adopt energy storage solutions. Regulatory frameworks can

How is the profit of lithium battery energy storage equipment?

Jul 1, 2024 · The profitability of lithium battery energy storage equipment is determined by various factors, including initial investments, market demand, technological advancements, and policy

How is the profit of energy storage business? | NenPower

Sep 9, 2024 · Profitability in the energy storage business hinges on several fundamental factors, including technological choice, regional regulations, market structure, and customer demand.

The new economics of energy storage | McKinsey

Aug 18, 2016 · Energy storage absorbs and then releases power so it can be generated at one time and used at another. Major forms of energy storage

Analyzing Market Dynamics in Energy Storage

Dec 15, 2023 · At present, the global energy storage market is experiencing rapid growth, with China, Europe, and the United States emerging as key players,

Profitability of lithium battery energy storage

Aug 18, 2025 · Profitability of lithium battery energy storage products Since the beginning of this year, the energy storage market has continued to boom, and

6 FAQs about [Which link of energy storage equipment has the highest profit]

Are energy storage products more profitable?

The model found that one company’s products were more economic than the other’s in 86 percent of the sites because of the product’s ability to charge and discharge more quickly, with an average increased profitability of almost $25 per kilowatt-hour of energy storage installed per year.

Does energy storage have a good profit margin?

However, the gross profit margin of the energy storage system was only18.37%, down 2.86% year-on-year, and was significantly lower than the gross profit margin of the company’s main business, photovoltaic inverters, which lowered the company’s overall profitability.

Is it profitable to provide energy-storage solutions to commercial customers?

The model shows that it is already profitable to provide energy-storage solutions to a subset of commercial customers in each of the four most important applications—demand-charge management, grid-scale renewable power, small-scale solar-plus storage, and frequency regulation.

Why do companies invest in energy-storage devices?

Historically, companies, grid operators, independent power providers, and utilities have invested in energy-storage devices to provide a specific benefit, either for themselves or for the grid. As storage costs fall, ownership will broaden and many new business models will emerge.

How did the energy storage business perform in 2022?

For the whole of last year, although the gross profit margin of the energy storage business decreased, it also reached 28.52%. In the first half of 2022, the gross profit margin of the energy storage business plummeted to 6.43%, down nearly 30 percentage points year-on-year, which can be described as adisaster.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Industry Information

- How big an inverter should I buy to convert to 220v

- 385W photovoltaic panel price

- Dhaka PV combiner box quotation

- Serbia Super Smart Capacitor Factory

- Castrie high performance energy storage battery

- Latest price of photovoltaic modules

- Singapore Energy Storage Cabinet Container Price

- Zambia household energy storage standards requirements

- The internal composition of the UPS uninterruptible power supply cabinet

- Several types of photovoltaic glass

- BESS outdoor power charging

- Solar photovoltaic panel strings

- Mw container energy storage

- Boston Outdoor Communication Battery Cabinet Custom Shop System

- Tashkent outdoor energy storage battery pack

- Hytera Base Station Power Supply

- Photovoltaic glass large installation

- Energy storage cabinet battery Chinese enterprises

- Photovoltaic inverter of the Fifth Hydropower Bureau

- Middle East Photovoltaic Power Station Energy Storage Manufacturer

- Home inverter system in China in Hungary

- Battery energy storage box source factory

- Are all double-glass panels now

Commercial & Industrial Solar Storage Market Growth

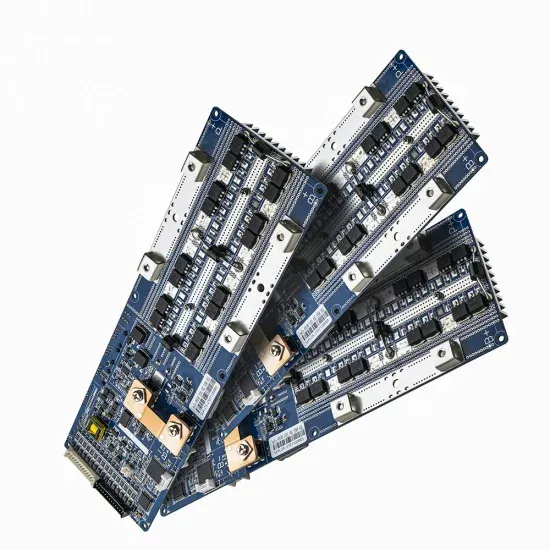

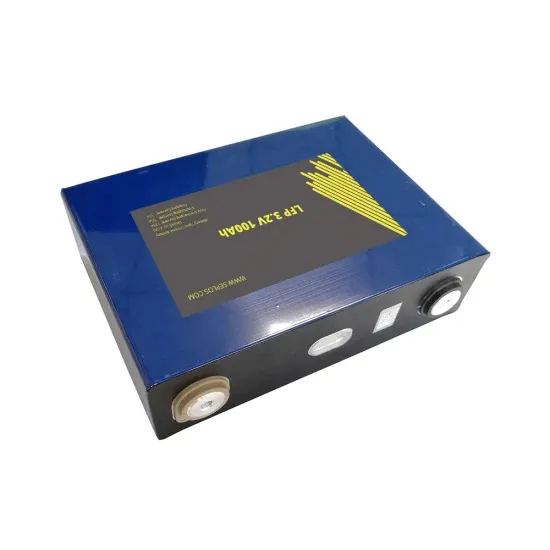

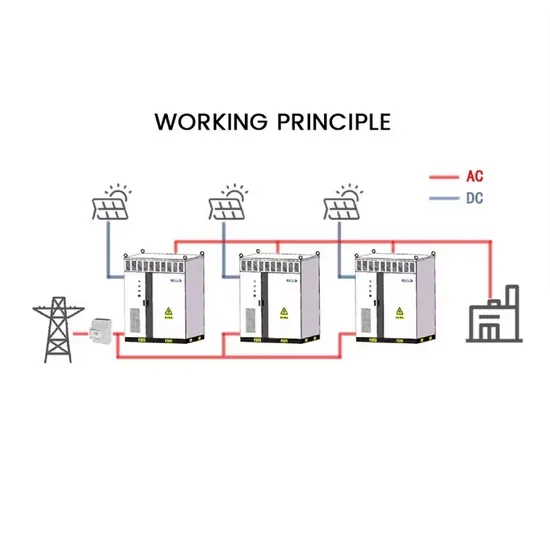

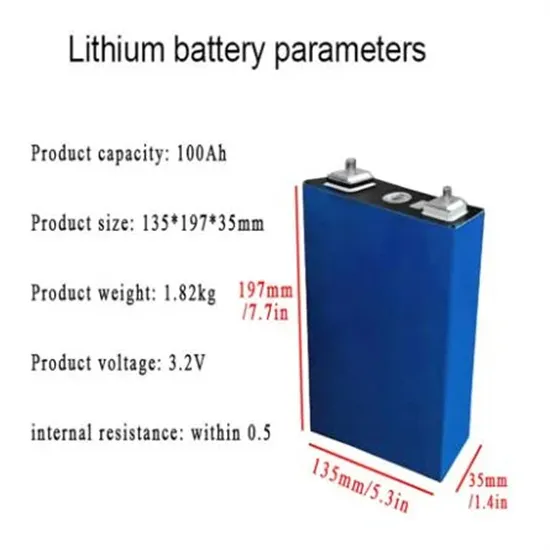

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.