How Storage Makes Money

Aug 15, 2025 · There are two main ways that grid-scale energy storage resources (ESR''s) can make money: energy price arbitrage and ancillary grid services.

How much profit does an energy storage power station have?

Oct 8, 2024 · 1. An energy storage power station typically generates profit through various avenues, which can vary widely based on market conditions, location, and size.2. These

How is Energy Storage Profitable? Unlocking the Billion

Nov 19, 2023 · In 2023, the global market hit $50 billion, and experts predict it''ll double by 2030. So, how do companies turn giant batteries into cash machines? Grab your hard hats – we''re

Hierarchical game optimization of independent shared energy storage

Apr 15, 2025 · However, challenges such as limited revenue streams hinder their widespread adoption. In this study, a joint optimization scheme for multiple profit models of independent

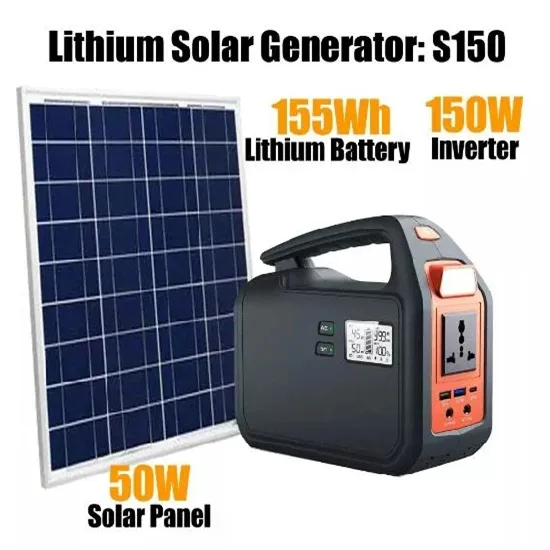

Outdoor energy storage power supply profit

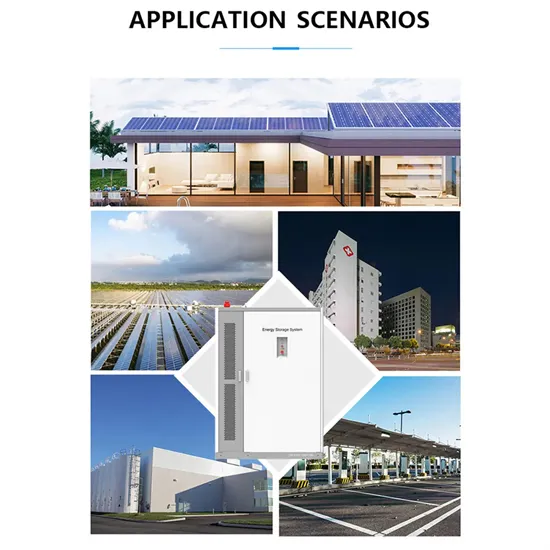

Energy storage stations have different benefits in different scenarios. In scenario 1, energy storage stations achieve profits through peak shaving and frequency modulation, auxiliary

Huge profits from energy storage power supply

The future of Ontario''''s energy supply -- perhaps even Canada''''s -- depends on 10 acres of rugged land wedged between an oil refinery and a steel plant some two hours south of

Benefit allocation strategy for energy storage operators

Energy storage operators can enhance the reliability of power supply and mitigate the losses caused by power outages. To further expand the application scenarios of energy storage for

How do energy storage power stations create profits?

Mar 31, 2024 · Energy storage power stations play a pivotal role in modern electricity grids. At their core, these facilities are designed to accumulate and conserve energy for later use,

How is the profit of energy storage battery cells? | NenPower

Mar 4, 2024 · Energy storage battery cells generate profits through 1. increasing demand for renewable energy solutions, 2. advancements in technology enhancing efficiency, and 3. the

How do energy storage power stations create profit margins?

Jan 26, 2024 · Energy storage power stations generate revenue through various mechanisms, fundamentally transforming energy management in modern economies. 1. The advent of grid

Application value of energy storage in power grid: A special

Dec 15, 2018 · It is difficult to analyze the application value of energy storage for China''s electricity due to the lacking of data. The major contribution of this paper is to evaluate the application

How is the profit of Shandong energy storage power station?

Sep 24, 2024 · The strategic role of energy storage facilities, especially in the context of Shandong, cannot be overstated. By balancing supply and demand, these power stations can

A comprehensive review of the impacts of energy storage on power

Jun 30, 2024 · This manuscript illustrates that energy storage can promote renewable energy investments, reduce the risk of price surges in electricity markets, and enhance the security of

Three Investment Models for Industrial and

Sep 30, 2023 · Risks of. Regarding business models, there are currently three main scenarios: industrial and commercial users installing energy storage

How can energy storage power stations create high profits?

Feb 4, 2024 · Elaborating on the integration of renewable energy sources, energy storage systems (ESS) play a crucial role in stabilizing energy supply by storing excess renewable

Energy Storage Technologies for Modern Power Systems: A

May 9, 2023 · Power systems are undergoing a significant transformation around the globe. Renewable energy sources (RES) are replacing their conventional counterparts, leading to a

What 2025 holds for the US energy storage market

Mar 25, 2025 · The Minety BESS project, developed by Luminous Energy and at one time the largest BESS in Europe. Image: Shell Energy Europe / Penso

Profit analysis of energy storage power supply

In order to promote the deployment of large-scale energy storage power stations in the power grid, the paper analyzes the economics of energy storage power stations from three aspects of

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their profitability

What Profit Analysis Does Energy Storage Include? A 2025

Mar 25, 2021 · Let''s crack open the profit pizza of energy storage - where every slice represents a different revenue stream. From California''s solar farms to Guangdong''s factories, energy

How is the profit of energy storage power

Aug 11, 2024 · Delving deeper, energy storage power stations play a pivotal role in stabilizing the grid and balancing supply and demand. Their capacity to

How is the profit of factory energy storage power station?

Sep 15, 2024 · Factory energy storage power stations generate profit by 1. optimizing operating costs, 2. providing ancillary services, and 3. capitalizing on dynamic pricing. The profitability

How much profit does energy storage power supply have

Jun 4, 2024 · The profit potential associated with energy storage power supply emerges not only from the direct sale of stored energy but also from ancillary services that enhance grid

Overview on hybrid solar photovoltaic-electrical energy storage

May 1, 2019 · This study provides an insight of the current development, research scope and design optimization of hybrid photovoltaic-electrical energy storage systems for power supply

How much profit is appropriate for energy storage power supply

Jan 12, 2024 · 1. The appropriate profit margin for energy storage power supplies is influenced by multiple factors, including market demand, operational costs, and investment risk

How is the profit of pumped storage power

Jan 31, 2024 · The profit of a pumped storage power station is influenced by several factors: 1. Energy price differentials, 2. Operational efficiency, 3.

Business Models and Profitability of Energy

Oct 23, 2020 · Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the

What is the main profit of energy storage? | NenPower

Jan 14, 2024 · In contemporary power systems, fluctuations in both supply and demand are common, presenting challenges to maintaining a balanced energy flow. The availability of

Optimized scheduling study of user side energy storage in cloud energy

Nov 1, 2023 · With the new round of power system reform, energy storage, as a part of power system frequency regulation and peaking, is an indispensable part of the reform. Among them,

How do energy storage power stations distribute profits?

Jun 28, 2024 · Energy storage power stations, integral to modern energy grids, primarily distribute profits through a nuanced combination of diverse income sources derived from their

Impact of Energy Storage Systems on the Operation of Electricity Supply

Sep 24, 2021 · The main prospects for the application of energy storage systems in high-voltage power supply networks are examined. An analysis of the impact of energy storage systems on

6 FAQs about [Energy storage power supply profit]

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

Why should you invest in energy storage?

Investment in energy storage can enable them to meet the contracted amount of electricity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when one application applies to the same market role multiple times.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Can energy storage provide multiple services?

The California Public Utilities Commission (CPUC) took a first step and published a framework of eleven rules prescribing when energy storage is allowed to provide multiple services. The framework delineates which combinations are permitted and how business models should be prioritized (American Public Power Association, 2018).

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

Industry Information

- Factory price safety breaker in Sudan

- Al hassan switchgear in China in Afghanistan

- Solar panel production power generation system

- 30kw hybrid inverter for sale in Australia

- Malawi cylindrical lithium battery environmental protection

- South African power tool lithium battery manufacturer

- 120KTL inverter power

- Price of a solar photovoltaic panel

- Main breaker switch for sale in Croatia

- Conakry New Energy Power Supply

- Huawei Paraguay photovoltaic panels

- Producing photovoltaic electricity using solar panels

- Thimphu Wind and Solar Energy Storage Power Station

- 5G Base Station Sungrow Power Supply

- Huawei photovoltaic wind power inverter

- North Macedonia Container Energy Storage Company

- 4 000W photovoltaic panel price

- East Asia Photovoltaic Inverter Company

- Colombia inverter 12v to 220v

- Port Louis Local Outdoor Power Supply

- Rabat photovoltaic curtain wall customization

- Solar powered battery charger in Ecuador

- The DC component of the inverter exceeds the standard

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.