What Profit Analysis Does Energy Storage Include? A 2025

Mar 25, 2021 · Let''s crack open the profit pizza of energy storage - where every slice represents a different revenue stream. From California''s solar farms to Guangdong''s factories, energy

Profit analysis of new power grid energy storage

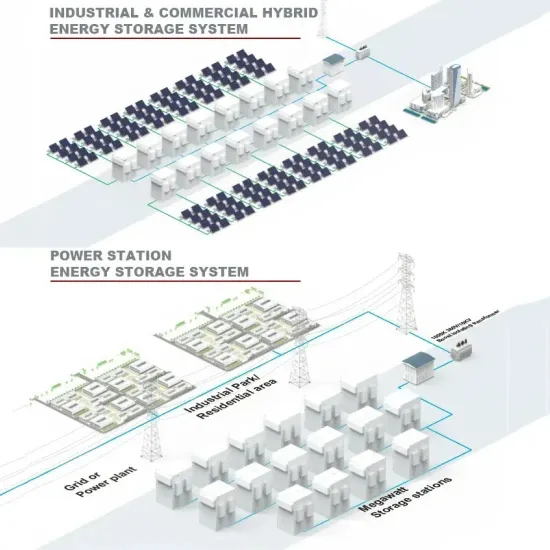

Energy storage is an important link for the grid to efficiently accept new energy, which can significantly improve the consumption of new energy electricity such as wind and photovoltaics

Hierarchical game optimization of independent shared energy storage

Apr 15, 2025 · However, challenges such as limited revenue streams hinder their widespread adoption. In this study, a joint optimization scheme for multiple profit models of independent

Profit analysis of technology equipment manufacturing

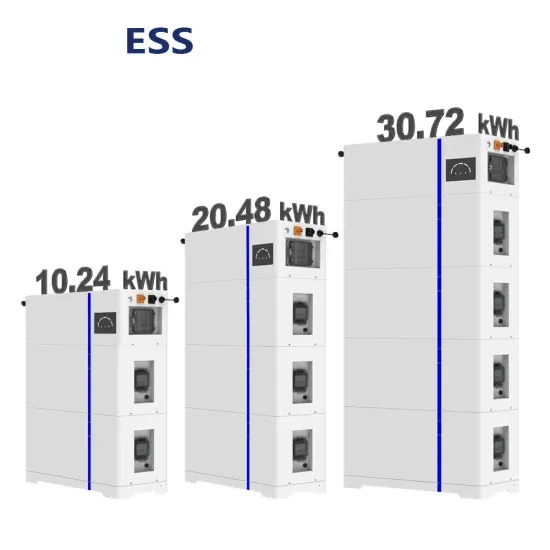

Europe Energy Storage Industry Segmentation. An Energy Storage System, often abbreviated as ESS, is a storage system that captures energy produced at one time from any energy

Evaluating energy storage tech revenue

Feb 11, 2025 · Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various

How much profit does the energy storage equipment have?

Aug 6, 2024 · The energy market exhibits a complex tapestry of prices, availability, and competitive forces that impact storage equipment profitability heavily. As prices fluctuate due

Profit analysis of large-scale power generation and

Energy storage can play an essential role in large scale photovoltaic power plants for complying with the current and future standards (grid codes) or for providing market oriented services.

Energy storage equipment profit analysis method

Energy storage equipment profit analysis method By implementing the concept of shared energy storage assets, which is a novel concept, the optimal allocation utilization of resources can be

How much profit does Tesla''s energy storage power station

Mar 11, 2024 · The integration of energy storage technology not only optimizes energy consumption but also provides a buffer against market volatility. In a world strained by climate

Tesla''s energy storage business ''growing like

Oct 25, 2024 · "It won''t be long" before Tesla''s stationary energy storage business is shipping 100GWh a year, CEO Elon Musk has claimed.

Megapacks drive Tesla''s margins up while EV business slows

Oct 19, 2023 · Tesla''s energy storage business enjoyed highest quarter of deployments as growth of EV business slowed and earnings fell below expectations.

Energy storage equipment profit analysis table

Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is globally on the rise (IEA,2020). One

How do energy storage equipment manufacturers make profits?

Jun 23, 2024 · Energy storage equipment manufacturers thrive in an ever-evolving market driven by increasing demand for renewable energy solutions and the need for grid stability.

Energy storage battery profit analysis equipment

Conclusion Our financial model for the Battery Energy Storage System (BESS) plant was meticulously designed to meet the client''s objectives. It provided a thorough analysis of

The Ultimate Guide to Battery Energy Storage

Apr 6, 2024 · Battery Energy Storage Systems (BESS) have become a cornerstone technology in the pursuit of sustainable and efficient energy

Three business models for industrial and

Aug 16, 2025 · In this article, we explore three business models for commercial and industrial energy storage: owner-owned investment, energy management

Profit Analysis of New Energy Storage Equipment: Why This

Let''s cut through the jargon first. When we talk about new energy storage equipment, we''re essentially discussing the world''s most sophisticated charging banks – think smartphone

Profit analysis of new energy storage equipment

The energy storage of power grids needs to be judged by the demand. Facing energy storage equipment where Page 1/4 Profit analysis of new energy storage equipment B = 15,000 (kW),

Enervis BESS Index: What revenues can and

Mar 13, 2025 · With the large-scale battery storage market in Germany on the cusp of a rapid expansion, consultancy Enervis is examining how revenues

Analysis of future energy storage equipment

What are the roles and revenues of energy storage? Energy storage roles and revenues in various applications Energy storage is applied across various segments of the power

Influences of mechanisms on investment in renewable energy storage

Aug 1, 2022 · The results show that in comparison with RPSM, SM is more conducive to investments in energy storage equipment and will lead to higher profits for electricity supply

How is Energy Storage Profitable? Unlocking the Billion

Nov 19, 2023 · In 2023, the global market hit $50 billion, and experts predict it''ll double by 2030. So, how do companies turn giant batteries into cash machines? Grab your hard hats – we''re

Three Investment Models for Industrial and

Sep 30, 2023 · Risks of. Regarding business models, there are currently three main scenarios: industrial and commercial users installing energy storage

Analysis of potential equipment manufacturing profits in

The large-scale development of energy storage began around 2000. From 2000 to 2010, energy storage technology was developed in the laboratory. Electrochemical energy storage is the

What are the profits of energy storage industry analysis

Energy storage roles and revenues in various applications Energy storage is applied across various segments of the power system,including generation,transmission,distribution,and

How to make profit from exporting energy storage equipment

6 FAQs about [How to make profit from exporting energy storage equipment] How can energy storage be profitable? Where a profitable application of energy storage requires saving of

How much money can energy storage make a profit

Sep 30, 2024 · Energy storage can generate significant profits, influenced by factors such as 1. market demand fluctuations, 2. technology advancements, 3. regulatory frameworks, and 4.

How much profit does the energy storage fan have?

Jun 23, 2024 · 1. Energy storage fans can yield significant financial returns, with profit parameters influenced by various factors, including 1. the installation costs which encompass equipment

Tesla: 9.4GWh of BESS deliveries in Q2 drives

Jul 29, 2024 · Tesla more than doubled its ''all-time-high'' quarterly deployment numbers for energy storage in the second quarter of this year.

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Rapid growth of intermittent renewable power generation makes the identification of investment opportunities in energy storage and the establishment of their profitability

Profit analysis of energy storage scientific research

Although academic analysis finds that business models for energy storage are largely unprofitable,annual deployment of storage capacity is globally on the rise (IEA,2020). One

Analysis of us energy storage equipment profits

6 FAQs about [Analysis of us energy storage equipment profits] How do I evaluate potential revenue streams from energy storage assets? Evaluating potential revenue streams from

What is the Cost of BESS per MW? Trends and 2025 Forecast

Feb 26, 2025 · As of most recent estimates, the cost of a BESS by MW is between $200,000 and $450,000, varying by location, system size, and market conditions. This translates to around

Enabling renewable energy with battery energy

Aug 2, 2023 · The market for battery energy storage systems is growing rapidly. Here are the key questions for those who want to lead the way.

Top 10 Energy Storage Trends & Innovations | StartUs Insights

Jul 17, 2025 · Discover the Top 10 Energy Storage Trends plus 20 out of 3400+ startups in the field and learn how they impact your business.

Analysis of equipment manufacturing profits in the energy storage

6 FAQs about [Analysis of equipment manufacturing profits in the energy storage industry] How do I evaluate potential revenue streams from energy storage assets? Evaluating potential

Analysis of future energy storage equipment

Energy Storage Market Size, Share & Trends Analysis Report By Application, Regional Outlook, Competitive Strategies, And Segment Forecasts, 2019 To 2025. The global energy storage

What 2025 holds for the US energy storage market

Mar 25, 2025 · 2025 is expected to be another significant year for energy storage development and deployment in the US. According to the Energy Information

6 FAQs about [Energy storage equipment profit]

How can energy storage be profitable?

Where a profitable application of energy storage requires saving of costs or deferral of investments, direct mechanisms, such as subsidies and rebates, will be effective. For applications dependent on price arbitrage, the existence and access to variable market prices are essential.

Is energy storage a profitable business model?

Although academic analysis finds that business models for energy storage are largely unprofitable, annual deployment of storage capacity is globally on the rise (IEA, 2020). One reason may be generous subsidy support and non-financial drivers like a first-mover advantage (Wood Mackenzie, 2019).

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

Why should you invest in energy storage?

Investment in energy storage can enable them to meet the contracted amount of electricity more accurately and avoid penalties charged for deviations. Revenue streams are decisive to distinguish business models when one application applies to the same market role multiple times.

How do business models of energy storage work?

Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream earned from the operation and the market role of the investor.

Industry Information

- Must be equipped with energy storage equipment

- Armenia Energy Storage Power Station Wholesale Manufacturer

- How much does a new battery for a communication base station cost

- Power battery energy storage performance

- Unit price of container energy storage

- Huawei Moscow large energy storage cabinet supplier

- How much electricity can 40 000 watts of solar energy generate

- Ultra-large energy storage power supply

- Blown circuit breaker factory in Bangkok

- High quality power breaker switch factory Factory

- DC 220v mobile power box

- Belarusian solar panel inverter

- Land use regulations for communication base station inverter grid-connected projects

- Household Energy Storage Products Electrical

- Aluminum-based lead-carbon energy storage project

- BESS outdoor energy storage power supply

- Dominican Republic by Solar Photovoltaic Panels

- 1kw photovoltaic off-grid system

- Solar power generation Small home energy storage

- Cadmium telluride photovoltaic glass building materials

- Lithium battery with bms

- Generator switchgear for sale in Chad

- Doha Andorra Battery Cabinet Manufacturer

Commercial & Industrial Solar Storage Market Growth

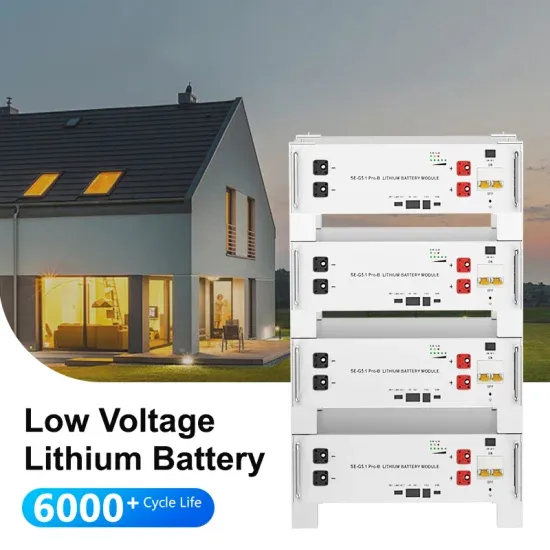

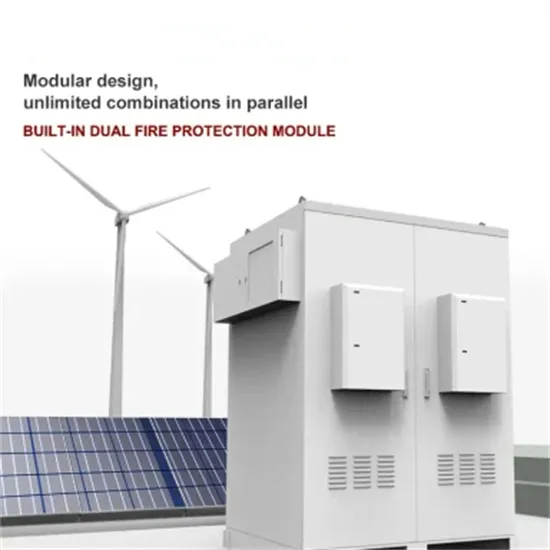

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

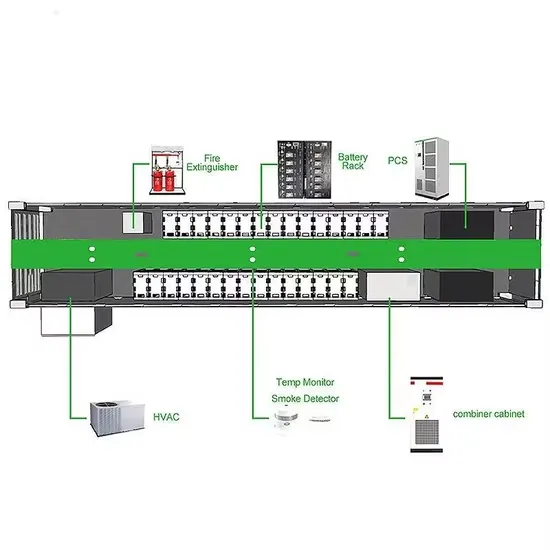

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.