Economic benefit evaluation model of distributed energy storage system

Jan 5, 2023 · Firstly, based on the four-quadrant operation characteristics of the energy storage converter, the control methods and revenue models of distributed energy storage system to

Energy storage peak-valley arbitrage case study

The performance The peak-valley price variance affects energy storage income per cycle, and the division way of peak-valley period determines the efficiency of the energy storage system.

Netherlands Energy Storage System Peak-Valley Arbitrage

Peak-valley Arbitrage: There is an obvious difference between peak and valley electricity prices in the Dutch electricity market. The Elecnova energy storage system can take advantage of this

Peak-valley arbitrage energy storage costs

To mitigate the impacts, the integration of PV and energy storage technologies may be a viable solution for reducing peak loads [13] and facilitating peak-valley arbitrage [14]. Concurrently, it

Peak-valley arbitrage of energy storage cabinets

In scenario 2, energy storage power station profitability through peak-to-valley price differential arbitrage. The energy storage plant in Scenario 3 is profitable by providing ancillary services

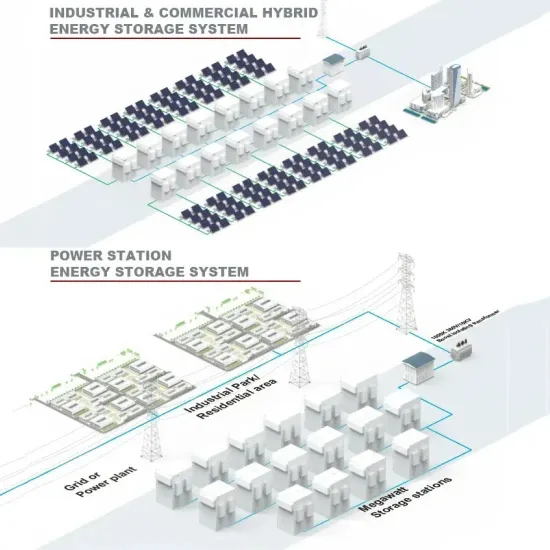

Germany Microgrid Energy System: 4.8MW/9.6MWh BESS

Jul 28, 2025 · Discover the Germany Microgrid Energy System, a 4.8MW/9.6MWh battery energy storage solution designed for peak-valley arbitrage and reliable backup power. Enhance

Optimized Economic Operation Strategy for Distributed Energy Storage

Dec 24, 2020 · Considering three profit modes of distributed energy storage including demand management, peak-valley spread arbitrage and participating in demand response, a multi

CAN ARBITRAGE COMPENSATE FOR ENERGY LOSSES INTRODUCED BY ENERGY STORAGE

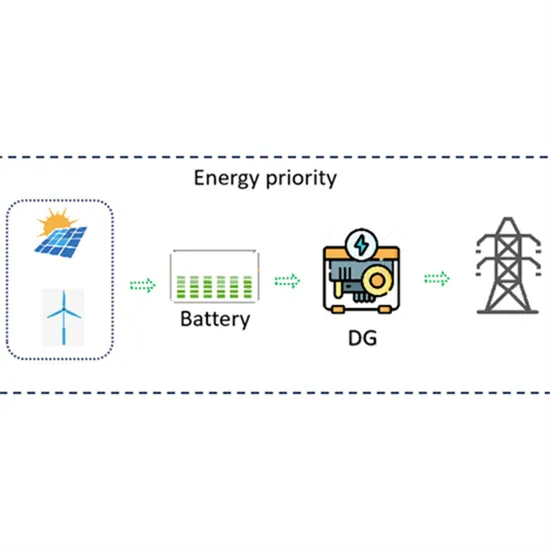

What is Peak-Valley arbitrage? The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted

Optimization analysis of energy storage application based on

Nov 15, 2022 · Revenue of energy storage includes energy arbitrage and ancillary services. The multi-objective genetic algorithm (GA) based on roulette method was employed. Both

Peak-Valley Arbitrage

By strategically charging batteries during low-cost valley periods and discharging them during high-cost peak periods, factories can significantly reduce their

考虑储能峰谷价差套利的综合能源系统策略性经济配置

May 6, 2023 · An example analysis verifies the effectiveness of the proposed strategic economic allocation method for integrated energy systems, and discusses the critical peak valley price

C&I energy storage to boom as peak-to-valley spread

Aug 31, 2023 · In China, C&I energy storage was not discussed as much as energy storage on the generation side due to its limited profitability, given cheaper electricity and a small peak-to

A Joint Optimization Strategy for Demand Management and Peak-Valley

Jun 25, 2025 · Demand reduction contributes to mitigate shortterm peak loads that would otherwise escalate distribution capacity requirements, thereby delaying grid expansion,

What Is Energy Arbitrage and How Does It

4 days ago · Energy arbitrage optimizes EV charging costs by storing electricity during low-demand periods and using it during peak demand. Click here to

2MW/4MWh Energy Storage Project(New Materials

The energy storage power station exploits peak - valley arbitrage, charging and discharging twice a day to supply electricity to the factory area load. It ensures the reliable operation of the

Profitability analysis and sizing-arbitrage optimisation of

Apr 15, 2024 · • The retrofitting scheme is profitable when the peak-valley tariff gap is >114 USD/MWh. • The retrofitted energy storage system is more cost-effective than batteries for

CLOU Wins A New Project In the USA

Jul 26, 2023 · CLOU won a new energy storage system project in the USA. The project is mainly applied to the peak valley arbitrage of power grid.

iraq energy storage peak-valley electricity arbitrage

2.3 Peak-valley arbitrage The peak-valley arbitrage is the main profit mode of distributed energy storage system at the user side (Zhao et al., 2022). The peak-valley price ratio adopted in

Energy storage system: an excellent choice for corporate peak

From the perspective of corporate social responsibility and sustainable development, using energy storage systems for peak-to-valley arbitrage is also an active green energy practice. By

energy storage achieves peak-valley arbitrage

Participation in reactive power compensation, renewable energy consumption and peak-valley arbitrage can bring great economic benefits to the energy storage project, which provides a

Schematic diagram of peak-valley arbitrage of energy storage.

An energy storage system transfers power and energy in both time and space dimensions and is considered as critical technique support to realize high permeability of renewable energy in

Schematic diagram of peak-valley arbitrage of energy storage.

Download scientific diagram | Schematic diagram of peak-valley arbitrage of energy storage. from publication: Combined Source-Storage-Transmission Planning Considering the Comprehensive...

Energy Storage Arbitrage Under Price Uncertainty:

Jan 16, 2025 · We propose a general uncertainty-incorporated storage arbitrage formulation that can accommodate a variety of price uncertainty models and risk preferences. We present a

Peak-shaving cost of power system in the key scenarios of

Jun 30, 2024 · On the other hand, references [35,36] do not consider the impact of energy storage utilizing peak and off-peak electricity price arbitrage on the peak-shaving cost of the power

Capacity tariff mechanism design for grid-side energy storage

Aug 1, 2025 · In recent years, China has been developing large-scale grid-side energy storage facilities. However, the deployment of grid-side energy storage has primarily depended on

A Multi-Scheme Comparison Framework for

Apr 27, 2025 · Grid capacity constraints present a prominent challenge in the construction of ultra-fast charging (UFC) stations. Active load management

is there a future for peak-to-valley arbitrage in energy storage

Grid-Scale Battery Energy Storage for Arbitrage Purposes: A The BESS energy arbitrage model is based on [8,14,15,20], where the objective is to maximize the profits that an energy storage

Peak shaving and valley filling energy storage

2 days ago · There is a huge difference in the load of two transformers in a large commercial project in a certain area during operating hours and non-operating

Industry Peak-Valley Arbitrage

Peak-Valley Arbitrage For Industry Electricity Saving Maximize Factory Savings with Peak and Valley Energy Arbitrage In today''s dynamic energy market, managing costs is more critical

Energy storage peak-valley arbitrage case study

This study seeks to determine a suitable arbitrage strategy that allows a battery energy storage system (BESS) owner to obtain the maximum economic benefits when participating in the

Optimization analysis of energy storage application based on

Nov 15, 2022 · BESS couple with RE can balance the generation and load, and provide auxiliary services. Thus, the technical and economic performance of this coupling system was

how to explain energy storage valley peak arbitrage

The peak-valley price variance affects energy storage income per cycle, and the division way of peak-valley period determines the efficiency of the energy storage system.

peak-valley arbitrage energy storage manufacturer ranking

Three Investment Models for Industrial and Commercial Battery Energy Storage Under the owner''''s self-investment model, the payback cycle of energy storage projects is the fastest. We

Germany Microgrid Energy System:

Feb 6, 2025 · Discover the Germany Microgrid Energy System, a 4.8MW/9.6MWh battery energy storage solution designed for peak-valley arbitrage and reliable

Peak-valley arbitrage energy storage | Solar Power Solutions

Peak-shaving cost of power system in the key scenarios of Driven by the peak and valley arbitrage profit, the energy storage power stations discharge during the peak load period and

energy storage achieves peak-valley arbitrage

Improved Deep Q-Network for User-Side Battery Energy Storage Therefore, energy storage-based peak shaving and valley filling, and peak-valley arbitrage are used to charge the grid at

6 Emerging Revenue Models for BESS: A 2025 Profitability

Mar 31, 2025 · 1. Peak-Valley Price Arbitrage Peak-valley electricity price differentials remain the core revenue driver for industrial energy storage systems. By charging during off-peak periods

can energy storage peak-valley arbitrage make money

Energy Arbitrage and Battery Storage: Revolutionizing the Energy arbitrage enables households and businesses to take advantage of time-of-use tariffs and reliable battery

The Development of Commercial and Industrial Energy Storage

Aug 9, 2023 · Economically, the price disparity between peak and off-peak hours is widening, leading to an enhanced revenue potential for peak and valley arbitrage models. This trend is

6 FAQs about [Prague Energy Storage System Peak-Valley Arbitrage Project]

What is Peak-Valley price arbitrage?

1. Peak-Valley Price Arbitrage Peak-valley electricity price differentials remain the core revenue driver for industrial energy storage systems. By charging during off-peak periods (low rates) and discharging during peak hours (high rates), businesses achieve direct cost savings. Key Considerations:

Does energy storage generate revenue?

Techno-economic analysis of energy storage with wind generation was analyzed. Revenue of energy storage includes energy arbitrage and ancillary services. The multi-objective genetic algorithm (GA) based on roulette method was employed. Both optimization capacity and operation strategy were simulated for maximum revenue.

What is the in-day optimization stage of distributed energy storage?

In the in-day optimization stage, based on the optimized output curve, taking real-time demand response into account, the real-time charge-discharge power of energy storage is adjusted dynamically with the goal of minimizing income loss, thus to realize adaptive adjustment of distributed energy storage and eliminate the risk of income loss.

What is the scale of the energy storage system and operation strategy?

The scale of the energy storage system and operation strategy was related to the technical and economic performance of the coupling system , . In order to reduce the extra cost of the BESS, it is necessary to conduct the optimization research of the BESS and RE coupling system .

What is a profit model for energy storage?

Operational Models: From "peak-valley arbitrage" to "carbon credit monetization," the profit models of commercial and industrial energy storage are becoming increasingly diversified. These new models not only provide investors and users with more choices and opportunities but also drive the continuous development of energy storage technology.

How does Bess generate revenue from electricity price arbitrage and reserve service?

It generates revenue though electricity price arbitrage and reserve service. The BESS's optimization model and the charging-discharging operation control strategy are established to make maximum revenue. The simulation study is based on one-year data of wind speed, irradiance, and electricity price in Hangzhou City (Zhejiang Province, China).

Industry Information

- Somali-style power station generator

- Palau Micro-controlled Energy Storage Container

- Miniaturized all-vanadium liquid flow battery price

- Seychelles Outdoor Power Supply

- Bissau Advantage Battery Cabinet Manufacturer Price

- Chemical reactions of vanadium flow batteries

- What is outdoor on the base station

- Inverter outputs high frequency square wave

- Thailand s communication network base station

- 3000w solar inverter in China in Turkmenistan

- Dubai thin film photovoltaic module prices

- Huawei Russia Energy Storage Container

- Solar Cache Storage Container

- Flywheel energy storage for communication base station on rooftop of Saudi Arabian house

- 610kw inverter

- Photovoltaic power generation and wind and solar energy storage power station

- Guinea Home Energy Storage Devices

- Brazilian household energy storage battery manufacturer

- Lesotho PV combiner box

- Somalia lithium battery energy storage cabinet system manufacturer

- Just Outdoor Power Supply

- Hargeisa Photovoltaic Energy Storage Battery Solution

- Hot sale wholesale afriipower inverter producer

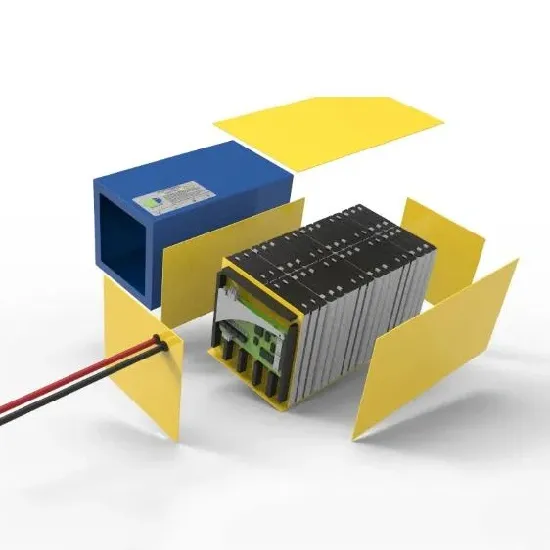

Commercial & Industrial Solar Storage Market Growth

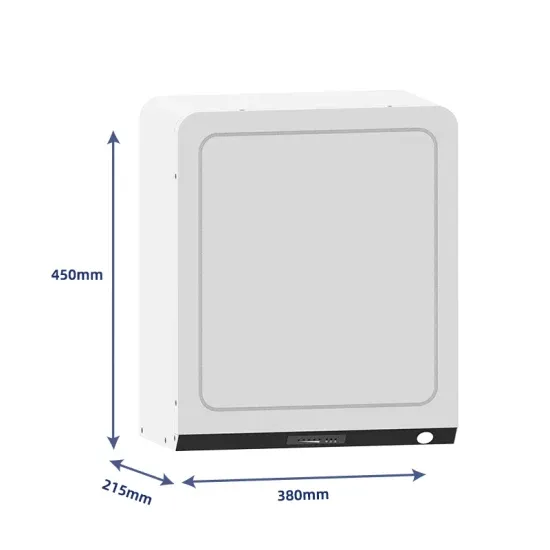

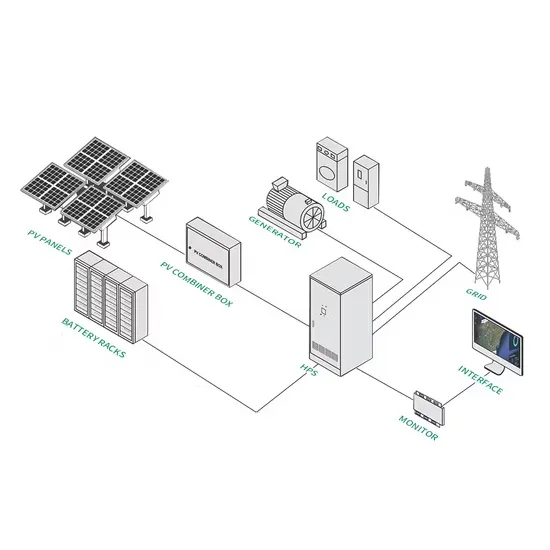

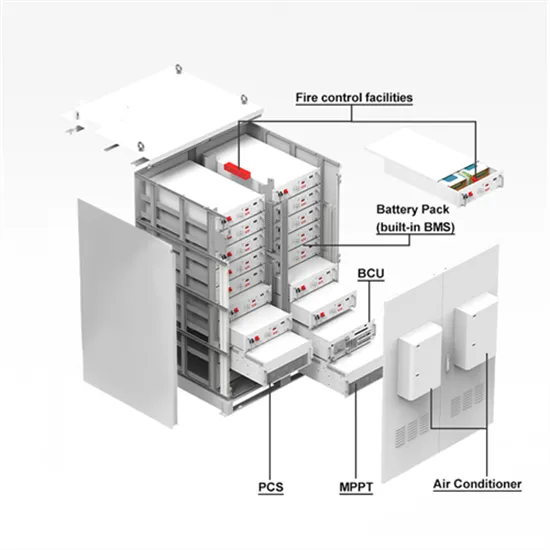

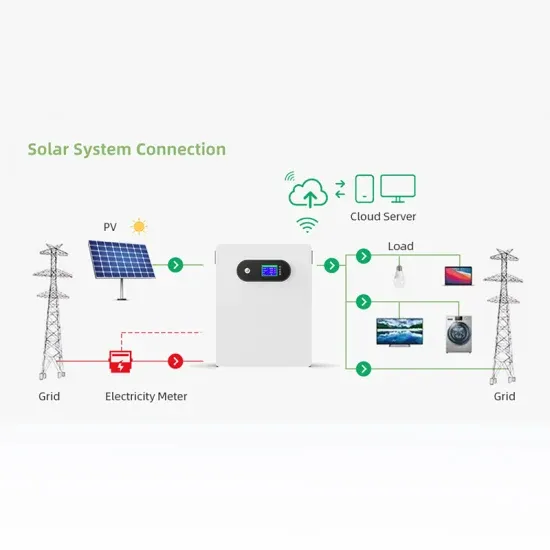

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

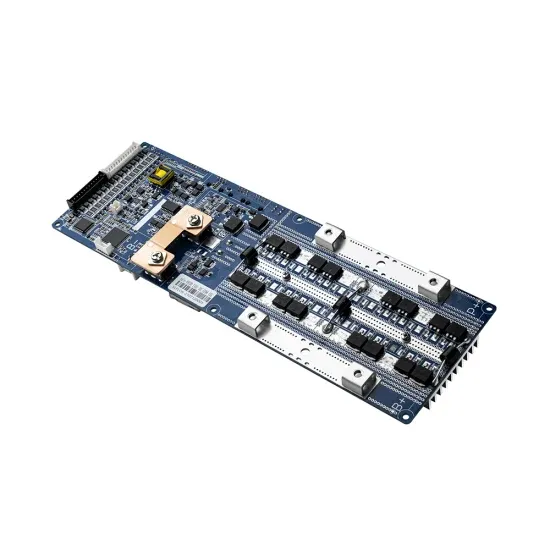

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.