How do tax credits influence the financing strategies for energy

Jan 10, 2025 · Influence of Tax Credits on Financing for Energy Storage Projects 1. Enhancing Project Economics and Attracting Capital Federal tax credits such as the Investme

Energy and Climate Solutions White Paper: Solar, Wind,

5 days ago · Maximum Current and Tech-Neutral ITC Credit: For stand-alone energy storage projects, utility-scale wind and solar projects, and utility-scale wind and solar + battery energy

Senate reconciliation bill draft keeps energy storage ITC

Jun 17, 2025 · US tax credits for energy storage projects could be retained even if solar PV, wind and electric vehicle (EV) incentives face cuts. The chairman of the US Senate Finance

How do tax credits impact the financial viability of standalone energy

Jan 11, 2025 · Tax credits significantly impact the financial viability of standalone energy storage projects by reducing the upfront costs and improving their overall profitability. Here are key

Clean Electricity Investment Credit

2 days ago · The credit is available to taxpayers with a qualified facility and energy storage technology placed in service after Dec. 31, 2024. The Clean Electricity Investment Credit

IRA sets the stage for US energy storage to

Nov 7, 2022 · The Inflation Reduction Act (IRA) signed into law in August significantly improves the economics for large-scale battery storage projects in

Investment tax credit for energy property under section 48

Jan 9, 2025 · Background The U.S. Treasury Department and IRS on December 4, 2024, released final regulations (T.D. 10015) relating to the investment tax credit (ITC) for energy

Senate Reconciliation Bill Draft Preserves Energy Storage ITC

Jun 18, 2025 · Senate Reconciliation Bill Draft Preserves Energy Storage ITC While Reducing Solar PV, Wind, and EV Incentives — In a recent development, US tax credits for energy

How to Claim the Energy Storage Tax Credit

Jun 18, 2025 · Navigate the federal tax credit for battery storage systems. Understand the key financial considerations and procedural steps to successfully claim this incentive. The federal

The State of Play for Energy Storage Tax Credits

Mar 7, 2025 · Energy storage was one of the major beneficiaries of the IRA''s new rules on both the deployment and manufacturing sides. The IRA enacted the

What the budget bill means for energy storage

Jul 10, 2025 · Storage projects that start construction before 2033 will remain eligible for both the ITC and PTC. Those beginning in 2025 can receive an

The State of Play for Energy Storage Tax Credits

Mar 7, 2025 · The energy storage industry has continued to progress over the course of 2024 and into 2025, buoyed in significant part by the federal income

US finalises 45X tax credit for batteries, solar

Oct 25, 2024 · This applies to the tax credits for component production, which amount to 10% of those production costs. The other significant tax credit for

US Senate budget bill proposal keeps cuts to

Jun 17, 2025 · A U.S. Senate panel proposed a full phase-out of solar and wind energy tax credits by 2028 but extended the incentive to 2036 for hydropower,

What are the new tax credit opportunities for energy storage projects

Jan 26, 2025 · Standalone Energy Storage Credit: Starting January 1, 2023, homeowners can claim a 30% tax credit for standalone energy storage systems of 3 kWh or greater, whether or

U.S. utility-scale battery projects sell tax credits

Feb 11, 2025 · Four utility-scale energy storage projects in Massachusetts have sold their Inflation Reduction Act investment tax credits for nearly $10 million.

What are the specific requirements for energy storage projects

Dec 29, 2024 · To qualify for the 30% tax credit for energy storage projects, the requirements can vary depending on whether the project is residential or commercial. Here are

Battery Energy Storage Tax Credits in 2024

Jan 12, 2024 · This guide unpacks the tax credits for battery storage included in the US Inflation Reduction Act (IRA).

U.S. Department of the Treasury Releases Final

Dec 4, 2024 · Final rules will provide additional clarity and certainty for project developers, helping to produce more clean power, build a strong clean energy

What types of energy storage projects qualify for the highest tax credits

Feb 12, 2025 · The tax credits can significantly enhance the financial viability of energy storage projects, making them a more attractive option for developers and investors, particularly given

US Energy Storage Market to "Sustain Momentum" as Tax Credit

Jul 10, 2025 · The U.S. energy storage sector is expected to continue expanding after the enactment of the FY2025 Budget Act, which secures Investment Tax Credit (ITC) eligibility for

US House budget bill ends clean energy tax credits

May 23, 2025 · The US House of Representatives has narrowly passed a piece of reconciliation legislation, which could significantly impact the clean energy

GOP Battery Storage Credits Extended, Other Clean Energy

Jun 17, 2025 · Senate GOP Plan Preserves Battery Storage Credits, Phases Out Other Clean Energy Incentives Senate Republicans propose maintaining tax credits for battery storage

ENERGY STORAGE PROJECTS

2 days ago · Accelerated by DOE initiatives, multiple tax credits under the Bipartisan Infrastructure Law and Inflation Reduction Act, and decarbonization

US Energy Storage Market to "Sustain Momentum" as Tax Credit

Jul 10, 2025 · Developers accelerate construction as industry navigates foreign content restrictions and shifting clean energy priorities The U.S. energy storage sector is expected to

What role do tax credits play in the financing of standalone energy

Dec 18, 2024 · The credit is non-refundable but can be carried forward to future years if not fully utilized. Investment Tax Credit (Section 48): Commercial energy storage projects, including

How do tax credits for energy storage systems work

Dec 10, 2024 · How Tax Credits for Energy Storage Systems Work Tax credits for energy storage systems are designed to incentivize the adoption of clean energy technologies by reducing the

§48E and §45Y tech-neutral tax credits: Guide + FAQs

5 days ago · The tech-neutral clean energy and manufacturing tax credit regime went into effect on January 1, 2025. Learn all about §48E and §45Y tech-neutral tax credits.

Energy storage ITC requires complex, costly tax

Mar 28, 2023 · Eolian made the first use of tax equity financing to get the ITC for standalone BESS projects in February. Image: Eolian The investment tax

How does the transferability of tax credits affect financing

Jan 15, 2025 · In summary, the transferability of tax credits offers a streamlined approach to financing energy storage projects, enhancing flexibility, efficiency, and accessibility for both

What are the specific tax credits available for commercial energy

Dec 10, 2024 · Duration and Eligibility: Tax credits under Section 48 apply to commercial and utility-scale energy storage projects. After 2024, some proposals suggest the commercial

How to Claim the Energy Storage Tax Credit

Jun 18, 2025 · The total qualified expenditures are entered on this form to calculate the 30% credit, which then flows to Schedule 3 of the Form 1040 to reduce the final tax liability.

Clean Electricity Investment Credit

2 days ago · The Clean Electricity Investment Credit is a credit available under the investment tax credit businesses and other entities that invest in a qualified clean or renewable energy facility

What are the main differences between investment tax credits

Jan 21, 2025 · Eligibility: Energy storage projects are now eligible for ITC even on a standalone basis, thanks to the Inflation Reduction Act of 2022. Previously, storage was only eligible if co

Future of US clean energy tax credits under

Mar 20, 2025 · Trump''s upcoming budget reconciliation bill could take aim at clean energy tax credits, meaning projects need to move on construction soon.

FACT SHEET: How the Inflation Reduction Act''s Tax

Oct 20, 2023 · The Inflation Reduction Act modifies and extends the clean energy Investment Tax Credit to provide up to a 30% credit for qualifying investments in wind, solar, energy storage,

The One Big Beautiful Bill Act: Key Takeaways for Clean

Jul 21, 2025 · The CEIC for energy storage has the benefit of the same deferred phase down, even in the case of batteries co-located with solar or wind projects, which should permit

"Prohibited Foreign Entity" restrictions in the OBBBA restrict

Jul 21, 2025 · "Prohibited Foreign Entity" restrictions in the OBBBA restrict tax credits in connection with Chinese investment in US-based energy storage projects

Inflation Reduction Act Creates New Tax Credit

Dec 27, 2022 · Energy storage installations that begin construction after Dec. 31, 2024, will be entitled to credits under the technology-neutral ITC under new

6 FAQs about [Credit for energy storage projects]

Who can claim energy storage credits?

Taxpayers with a qualified facility and energy storage technology placed in service after Dec. 31, 2024 may claim the credit. Elective payment and transfer of credits may be available to certain applicable entities to include tax-exempt organizations and government entities.

What is the clean electricity investment credit?

The Clean Electricity Investment Credit is a newly established, tech-neutral investment tax credit that replaces the Energy Investment Tax Credit once it phases out at the end of 2024. This is an emissions-based incentive that is neutral and flexible between clean electricity technologies.

Do energy storage projects qualify for a new ITC?

Energy storage projects placed in service after Dec. 31, 2022, that satisfy a new domestic content requirement will be entitled to a 10% additional ITC (2% for base credit).

What is the ITC rate for energy storage projects?

Energy storage installations that begin construction after Dec. 31, 2024, will be entitled to credits under the technology-neutral ITC under new Section 48E (discussed below). The base ITC rate for energy storage projects is 6% and the bonus rate is 30%.

Is energy storage eligible for the IRA ITC?

Standalone energy storage is not eligible for this credit, but energy storage installed in connection with wind and solar projects may be eligible. In addition to all the changes for the ITC, the IRA also revised the Section 25D credit homeowners use for residential energy storage projects, such as batteries.

When does the clean electricity investment credit phase-out start?

The credit is available to taxpayers with a qualified facility and energy storage technology placed in service after Dec. 31, 2024. The Clean Electricity Investment Credit phase-out starts for the later of 2032 or when U.S. greenhouse gas emissions from electricity are 25% of 2022 emissions or lower.

Industry Information

- Wholesale pv breaker isolator in Kuala-Lumpur

- Suriname New Energy Photovoltaic Glass

- High quality isolator breaker in Kyrgyzstan

- Can micro inverters be produced globally

- Austria Wind and Solar Energy Storage Project

- Moldova smart inverter manufacturer

- Solar panels for power generation and energy storage batteries

- 100kw solar inverter for sale in Sri-Lanka

- What is the maximum size of a cylindrical lithium battery

- How many inverters are needed for 100mw photovoltaic

- Kuwait s new solar air conditioner

- Sri Lanka energy storage station energy saving equipment

- Small size photovoltaic panels and prices

- Yaounde portable ups uninterruptible power supply

- Containerized generator set procurement

- Kathmandu new energy battery cabinet communication power supply

- What is the use of fully loaded photovoltaic inverters

- Outdoor power supply large capacity two degrees of electricity

- Ghana solar communication base station bidding

- Juba Station Energy Storage System Quote

- Battery cabinet power spectrum density

- How big an inverter do I need for 60 panels

- Camping outdoor power supply affordable

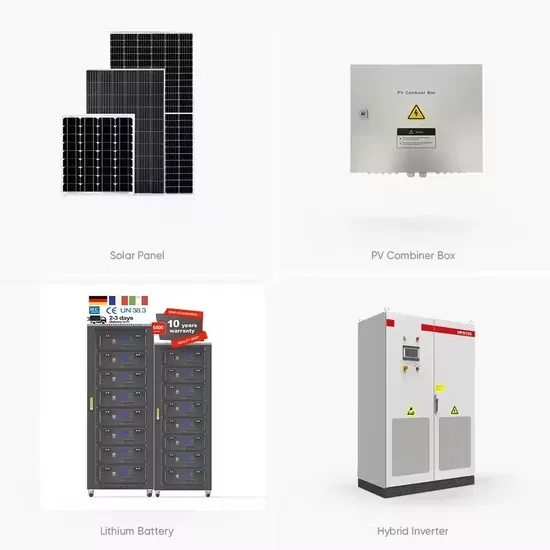

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.