Wholesale Electricity and Natural Gas Markets data

Currently, electricity products can be traded at more than two dozen hubs and delivery points in North America, and natural gas products can be traded at

Outdoor Power Distribution Navigating Dynamics

May 8, 2025 · The global outdoor power distribution market is experiencing robust growth, driven by increasing urbanization, the expansion of renewable energy infrastructure, and the rising

North America Outdoor LED Lighting Market

Jan 9, 2025 · The North America Outdoor LED Lighting Market is expected to reach USD 2.88 billion in 2025 and grow at a CAGR of 3.97% to reach USD

North America power markets short-term outlook: April 2025

Apr 21, 2025 · After a weak year in 2024, power prices have plenty of upside potential in 2025 and beyond. A lower gas supply environment has resulted in much stronger prices to begin the

Husqvarna USA | Chainsaws, Lawn Mowers, Zero

Husqvarna offers a full range of outdoor power tools including lawn mowers, chainsaws, robotic mowers and for both commercial & residential usage

Outdoor Power Equipment Market Size to Hit USD 62 billion

Jul 18, 2025 · The North America outdoor power equipment market size reached USD 13.64 billion in 2024. The efficiency, maintenance, and usability of outdoor power equipment are

Halifax North America

Shop at Halifax North America Stores for A Zillion Things Home across all styles and budgets. 5,000 products of furniture, lighting, cookware, and more. Free

North American Outdoorsman:

Aug 12, 2025 · Explore North American Outdoorsman for expert tips, gear reviews, and empowering stories celebrating North

Outdoor Power Equipment Market Trends and Forecast

Global Outdoor Power Equipment Market Size Was Valued at USD 126.45 Million In 2024, And Is Projected to Reach USD 185.69 Million By 2032, Growing at A CAGR of 4.92% From 2025 To

U.S. Outdoor Power Equipment Market | Industry

The U.S. outdoor power equipment market size was valued at USD 12.89 billion in 2023 and is anticipated to grow at a CAGR of 6.7% from 2024 to 2030

Outdoor Cords in North America: Market Dynamics and

Apr 22, 2025 · The global outdoor cords market is experiencing robust growth, driven by increasing urbanization and infrastructure development, coupled with rising demand for

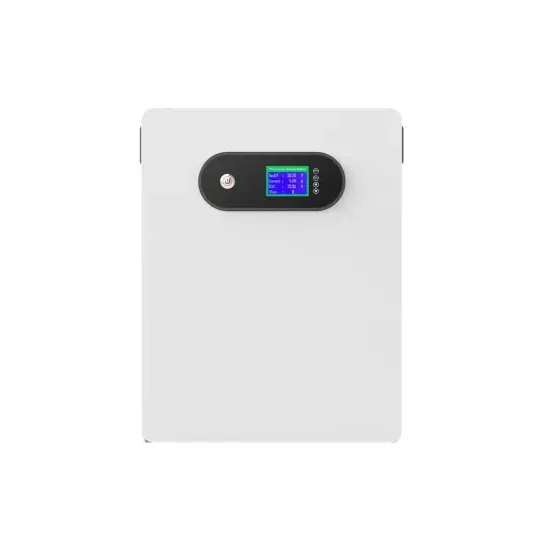

North America Outdoor Lithium Ion Battery Power Supply

Jun 28, 2025 · The North America Outdoor Lithium Ion Battery Power Supply Market is a pivotal segment in the broader energy storage and renewable energy industries.

U.S. Outdoor Power Equipment Market | Industry

Market Size & Trends The U.S. outdoor power equipment market size was valued at USD 12.89 billion in 2023 and is anticipated to grow at a CAGR of 6.7%

The 2025 US power market outlook | Wood

Apr 15, 2025 · Post-election LNG growth Natural gas has re-emerged as the big winner of the US election. The 2024 election cycle brought a policy shift in

Outdoor Large Capacity Emergency Power Supply Market

5 North America Outdoor Large Capacity Emergency Power Supply Market 2019-2024 5.1 North America Outdoor Large Capacity Emergency Power Supply Consumption and Revenue, by

AMERICAN OUTDOOR POWER

Specialties: "Locally owned and operated since 1993. Your one stop shop for sales, service and parts. Inventory includes Stihl chainsaws, trimmers, hedge

AE Outdoor Power | Lawn Mower Warehouse

Shop our large selection of lawn mowers, robotic mowers and snow blowers. Get the customer service you deserve. Experienced mechanics help with technical

Leading the transition: A critical agenda for

Sep 23, 2024 · Companies in the power tool and outdoor power equipment industry are facing revenue declines and margin pressures as they transition

Outdoor Power Equipment Ope Market

Furthermore, the presence of key market players and a well-established distribution network solidify North America''s leading position in the outdoor power equipment (OPE) market.

Outdoor Power Distribution Market''s Tech Revolution:

Apr 3, 2025 · The global outdoor power distribution market is experiencing robust growth, driven by the increasing demand for reliable and efficient power infrastructure in diverse sectors.

Outdoor Power Equipment (OPE) Market

5 days ago · The Outdoor Power Equipment (OPE) Market is a dynamic sector within the broader landscape of outdoor and garden products. It encompasses

North America Outdoor Power Equipment

The outdoor power equipment market in North America is expected to reach a projected revenue of US$ 27,578.0 million by 2030. A compound annual

North American Power and Renewables Dataset | S&P Global

The North American Power and Renewables dataset, originated from IHS Markit, provides historical and forecast data for North American Power and Renewables. Data is available for

Outdoor Power Equipment Market Share, Outlook, Size 2023

The market size for outdoor power equipment was USD 25.9 billion in 2021, and it is projected to grow at a CAGR of 6 percent during the forecast period.

North America Outdoor Full Scene Power Market Size,

Jul 1, 2025 · The North America Outdoor Full Scene Power Market plays a vital role in the region''s infrastructure, providing critical energy solutions to outdoor environments.

Outdoor Power Distribution Market

North America dominates the outdoor power distribution market, driven by aging grid infrastructure and extreme weather events requiring resilient energy systems.

North America (NA) Power Market Analysis | Energy Aspects

Visualise complex data with our US Power Plants dashboard. Also view datasets covering North American price forecasts, power balances, power plant projects, power plant retirements and

Global Outdoor Power Distribution Market Research Report

Feb 14, 2025 · The Outdoor Power Distribution market size, estimations, and forecasts are provided in terms of output/shipments (K Units) and revenue ($ millions), considering 2024 as

Outdoor Power Equipment Market Size & Share

The North America outdoor power equipment industry accounted for 35.28% of the global overall market share in 2024. The regional market''s growth is

6 FAQs about [North American outdoor power prices]

Who makes outdoor power equipment?

The U.S. market for outdoor power equipment is populated with several global and country manufacturers, leading to a high frequency of product launches. For instance, in February 2023, Ariens, a brand of AriensCo, launched the RAZOR walk-behind mower.

Which country has the largest outdoor power equipment market in 2023?

The U.S. accounted for 25.33% of the revenue share in the global outdoor power equipment market in 2023. The country is witnessing a shift towards greener and more efficient offerings to comply with government regulations and lower the emissions caused by conventional gas-powered equipment.

How many electricity and natural gas hubs are there in North America?

Currently, electricity products can be traded at more than two dozen hubs and delivery points in North America, and natural gas products can be traded at more than 120 hubs. The data posted under EIA's agreement with ICE represent seven major electricity hubs and their corresponding natural gas trading hubs.

Why is outdoor power equipment so popular?

The current trends of remote and hybrid working models, as well as flexible working hours among businesses in the U.S., have ensured that people have more free time on their hands to indulge in gardening and landscaping, thus strengthening the U.S. market demand for outdoor power equipment.

Which segment dominated the outdoor power equipment market in 2023?

The residential segment held a larger share in the U.S. outdoor power equipment market in 2023, owing to increasing sales of products such as lawn movers, chainsaws, and trimmers to homeowners.

What data does EIA provide about natural gas prices?

The data posted under EIA's agreement with ICE represent seven major electricity hubs and their corresponding natural gas trading hubs. This market information includes daily volumes, high and low prices, and weighted-average prices. Natural gas historical data are available back to March 2014.

Industry Information

- Solar power solutions factory in Iraq

- Turkmenistan energy storage battery container factory is in operation

- Solar energy storage cabinet companies

- Al jameel switchgear in China in Hungary

- Barbados RV lithium battery bms structure

- Industrial and commercial energy storage solution for French administrative buildings

- China 5kwh hybrid inverter for sale Buyer

- 500Kw inverter directly connected to the grid

- Battery requirements for container energy storage power stations

- Wellington lithium battery station cabinet manufacturer with the most

- Macedonia 12v to 220v inverter

- 20kv photovoltaic grid-connected inverter

- Photovoltaic inverter in Rotterdam the Netherlands

- Energy Storage Financing BESS Price Trend

- Battery size specifications for communication base stations

- Athens energy storage cabinet battery life

- Sri Lanka solar power tiles

- High quality home circuit breaker for sale company

- 48v outdoor power smart box

- Solar 400W Inverter

- Container battery cabinet manufacturer

- North Korea lithium battery management

- What is the appropriate inverter PV voltage

Commercial & Industrial Solar Storage Market Growth

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.