A Brief Analysis Of The Reduction In China''s Photovoltaic Export Tax

Nov 18, 2024 · The Ministry of Finance and the State Administration of Taxation issued the "Announcement on Adjusting the Export Tax Rebate Policy", proposing to reduce the export

VAT Refund Eligibility for Photovoltaic Installations on Concession

Jun 13, 2025 · The request is admissible even if the asset is located on leased land. The VAT Group installing photovoltaic systems for use as capital goods can request a VAT refund on

退税调整丨部分光伏产品出口退税率从13%降至9% The

Nov 19, 2024 · The export tax rebate rate for some refined oil products, photovoltaics, batteries, andsome non-metallic mineral products will be reduced from 13% to 9%. The original text of

Budget 2024: Import Duty Exemption On Solar Gear To Cut

Jul 23, 2024 · The customs duty exemption granted to capital goods used for making solar cells and panels for up to 6 giga-watts of photovoltaic projects will help reduce the overall cost of

Photovoltaic Products

Nov 22, 2024 · China announced a major adjustment to its export tax rebate policy, effective December 1, affecting multiple industries including photovoltaic products. A joint statement

Solar Industry Confused About GST Rates and

Feb 4, 2022 · The increase in GST rate is aimed to address the issue of inverted duty structure for solar cell and module manufacturers to make them

India Imposes Anti-Dumping Duty on Solar Glass

May 8, 2025 · India levies anti-dumping duty on textured tempered glass from China PR & Vietnam to protect domestic industry. Effective for 5 years from

China adjusts its export policies with a 9% tax discount for

Jun 14, 2025 · In a joint statement issued by the Ministry of Finance and the State Taxation Administration, it was revealed that the export tax rebate rate for photovoltaic products, along

退税调整丨部分光伏产品出口退税率从13%降至9% The

Nov 19, 2024 · 二、将部分成品油、光伏、电池、部分非金属矿物制品的出口退税率由13%下调至9%。 1. Cancel the export tax rebate for aluminum, copper, and chemically modified

What is the tax rate for photovoltaic solar energy? | NenPower

Nov 2, 2024 · THE SIGNIFICANCE OF TAX RATE IN SOLAR ENERGY INVESTMENT The adoption of photovoltaic solar energy has significantly risen in recent years, driven mainly by

China Reduces Export Tax Refund Rate for

The export tax refund rate for certain products, including refined oil, photovoltaic products, batteries, and some non-metallic mineral products, will be reduced

Solar Photovoltaic Glass Market Size, Demand, Opportunities

The global solar photovoltaic glass market size is expected to reach USD 179.08 billion by 2033, growing at a CAGR of 29.87% from 2025 to 2033 And Asia Pacific dominates the market.

China cuts export tax rebate for solar products

Nov 18, 2024 · Starting Dec. 1, the rebate for unassembled solar cells (HS Code 85414200) and assembled PV modules (HS Code 85414300) will drop from

China''s solar photovoltaic policy: An analysis based on policy

Sep 15, 2014 · The rationale for China''s PV policy is still government management-oriented rather than industry efficiency-oriented. In the last decade, China''s photovoltaic (PV) industry has

Photovoltaic VAT tax rate will be reduced by 50%

It is also known that as an important part of the recent national plan for the revitalization of the photovoltaic industry, the value-added tax rate for photovoltaic power generation projects will

2025-2033年太阳能光电玻璃市场规模、份额、趋势及预测

Apr 1, 2025 · The global solar photovoltaic glass market size was valued at USD 17.30 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 78.50 Billion by

Understanding China''s Photovoltaic Export Tax Refund Policy

As of December 1, 2024, China''s export tax refund rate for photovoltaic panels stands at 9%, marking a significant reduction from the previous 13% rate. This policy adjustment applies

Government Proposes 0% Tax on Solar PV Modules

Jun 9, 2023 · According to the document, the government has recommended a 0% tax rate on various key components and machines utilized in the manufacturing process of solar PV

Solar Photovoltaic Glass: Classification and

Jun 26, 2024 · Demand for solar photovoltaic glass has surged with the growing interest in green energy. This article explores ultra-thin, surface-coated, and

Solar Photovoltaic Glass: Features, Type and

Jun 27, 2023 · 1. What is solar photovoltaic glass?Solar photovoltaic glass is a special type of glass that utilizes solar radiation to generate electricity by

Five Points of Impact! China''s PV cuts 4% export tax rebate rate

Nov 18, 2024 · On November 15, China''s Ministry of Finance and the State Administration of Taxation announced a reduction in the export tax rebate rate for certain products, including

Global and China Photovoltaic Glass

May 21, 2019 · PV Glass Production Lines of Zhuzhou Kibing Group Co., Ltd R evenue and N et I ncome of H enan A ncai Hi -t ech C o., Ltd, 2013 -2018 Revenue and Gross Margin of PV

Global Solar Photovoltaic Glass Market Size, Share

Global solar photovoltaic glass market is projected to witness a CAGR of 29.77% during the forecast period 2025-2032, growing from USD 23.04 billion in 2024 to USD 185.33 billion in 2032.

1201 2/3612015-FPP Government of India Ministry of

Apr 3, 2021 · Subject: Provisional Concession Rates and Sales Tax Rates per MT of urea on account of implementation of New Urea Policy - 2015 for existing 25 gas based urea

FBR Lists Goods for Zero Rating of Sales Tax for

Dec 16, 2024 · The Federal Board of Revenue (FBR) has issued a detailed list of goods eligible for zero-rating of sales tax for the tax year 2025.

China''s Export Tax Rebate Rate Has Been

Nov 28, 2024 · China''s Export Tax Rebate Rate Has Been Lowered, Accelerating The Elimination Of Backward Photovoltaic Production Capacity China will

Customs Charges & Duties

The Fiji Revenue & Customs Service is the major funder of the National Budget. Apart from our primary mandate, FRCS continues to partner and support other

China to adjust or cancel export tax rebates for various

Meanwhile, the export tax rebate rate for some refined oil products, photovoltaic products, batteries and certain non-metallic mineral products will be reduced from 13 percent to 9 percent.

China to adjust or cancel export tax rebates for various

Meanwhile, the export tax rebate rate for some refined oil products, photovoltaic products, batteries and certain non-metallic mineral products will be reduced from 13 percent to 9

Solar Photovoltaic Glass Market Size, Share and Recent Value

Mar 19, 2025 · The solar industry continues to evolve with innovations in efficiency, aesthetics, and application versatility. Bifacial solar PV glass, which captures light from both sides to

China to decrease PV product export tax rebate

Nov 20, 2024 · From 1 December 2024, the export tax rebate rate will drop from 13% to 9% on some PV and batteries products. Image: Rinson Chory, via

IRD : Environment-friendly Vehicles

To encourage the business sector to purchase more electric vehicles, hybrid vehicles and other environment-friendly commercial vehicles, the Financial Secretary proposed to accelerate the

China''s Overhaul of Export Tax Rebates to Further Squeeze

(Yicai) Nov. 18 -- The lower tax relief on certain exports that the Chinese government revealed at the end of last week is expected to put further pressure on the country''s photovoltaic

6 FAQs about [Photovoltaic glass sales tax rate concession]

Does China's PV cut 4% export tax rebate rate?

China's PV cuts 4% export tax rebate rate a big deal On November 15, China's Ministry of Finance and the State Administration of Taxation announced a reduction in the export tax rebate rate for certain products, including refined oil, photovoltaic (PV) products, batteries, and some non-metallic mineral products, from 13% to 9%.

Which PV products have reduced export tax rebate rates?

According to the above-mentioned government announcements, PV products included in the list of products with reduced export tax rebate rates are for PV cells, either installed or not in modules.

Does China have a tax rebate for solar panels?

China’s Ministry of Finance and State Taxation Administration have announced a reduction in the export tax rebate for photovoltaic products. Starting Dec. 1, the rebate for unassembled solar cells (HS Code 85414200) and assembled PV modules (HS Code 85414300) will drop from 13% to 9%.

How does China's rebate rate affect photovoltaic exports?

This represents a 4% decrease in the rebate rate for photovoltaic exports, significantly impacting China's PV market, which heavily relies on exports.

What is the new export tax rebate rate in 2024?

Starting from 1 December 2024, the export tax rebate rate for some refined petroleum products, PV products, batteries and some non-metallic mineral products will be lowered by four percentage points, from 13% to 9%.

How will a PV export rebate affect cash flow?

For large-scale PV exporters, the rebate reduction will affect cash flow, but the overall impact will be less significant than for SMEs. Although the export rebate amounts for large companies might reach billions of RMB, the share of rebate income in their total operations remains relatively low.

Industry Information

- Current life of energy storage batteries

- Solomon Islands Solar Photovoltaic Panel Installation Project

- Mexico Monterrey professional lithium battery pack factory price

- Co-build 5g base stations with Hetong Communications

- UPS battery cabinet for wind power

- Photovoltaic flexible bifacial photovoltaic modules

- Haiti Outdoor Energy Storage Power Supply

- Netherlands inverter manufacturers

- Cylindrical lithium battery benchmark products

- What are the equipments of Iraqi energy storage power station

- Battery refresh bms

- 3 types of base station power supply equipment

- How many kilowatts of solar photovoltaic are suitable

- Zambia original outdoor power supply price

- Base station wind power integration method

- Acceptance Specifications for Communication Engineering Base Stations

- AC and DC Uninterruptible Power Supplies

- Can a 12v inverter use a 36v battery

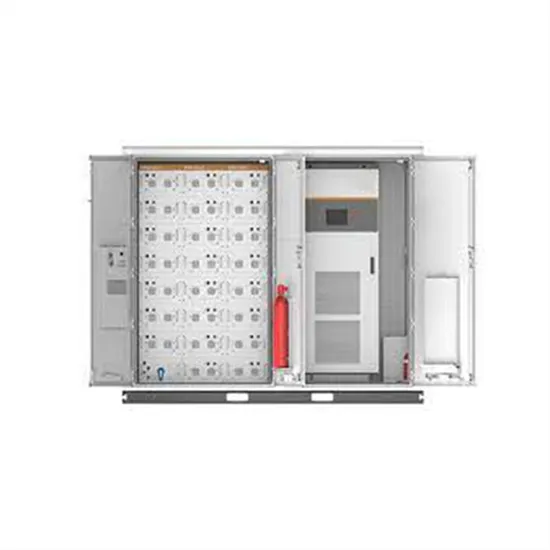

- Libya Industrial and Commercial Energy Storage System

- Korea EK lithium battery energy storage

- Maldives emergency communication base station flow battery

- Inverter price What is an inverter

- Liechtenstein Sunshine Energy Storage Power Supply Price

Commercial & Industrial Solar Storage Market Growth

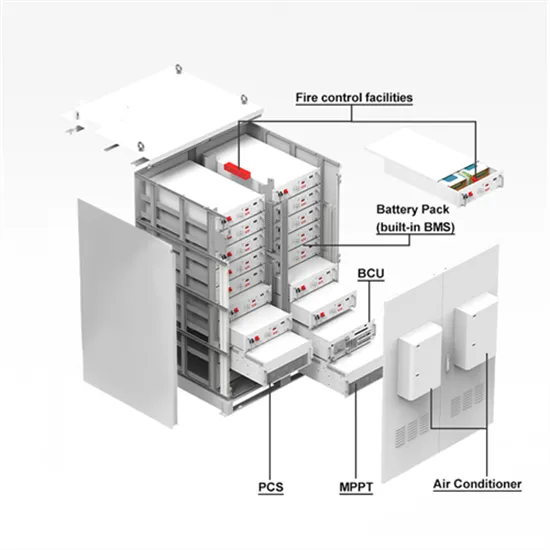

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.