Revenue prediction for integrated renewable energy and energy storage

Jun 1, 2022 · Revenue estimation for integrated renewable energy and energy storage systems is important to support plant owners or operators'' decisions in battery sizing selection that leads

BESS revenue in Australia''s NEM drops 40% on average in

Apr 15, 2025 · A reduction in price volatility has seen the battery energy storage system (BESS) revenue decrease by 40% in Australia''s National Electricity Market (NEM) month-on-month in

Tesla deployed 14.7GWh of energy storage in 2023

Jan 25, 2024 · Tesla''s energy storage and generation revenues have tripled since 2020, largely driven by deployments of Megapack battery storage systems.

Assessing Energy Storage Tech Revenue Potential: Strategic

Feb 24, 2025 · Owners of energy storage systems can tap into diversified power market products to capture revenues. So-called "revenue stacking" from diverse sources is critical for the

Current and Future Energy Storage Market Revenues

Jan 30, 2024 · The transition to variable renewable energy requires new approaches to provide grid reliability. Energy storage can contribute to reliability but it operates as

New Energy Storage Business Models and Revenue Levels

Jun 15, 2024 · <sec> <b>Introduction</b> Under the "dual carbon" goal, energy storage has become an important participant in regulating the electricity market and a key link

Business Models and Profitability of Energy Storage

Oct 23, 2020 · Building upon both strands of work, we propose to characterize business models of energy storage as the combination of an application of storage with the revenue stream

Energy Storage Project Revenue Risk: What

Aug 11, 2025 · ISO New England: revenue model based on winning an RFP with a utility in a bilateral offtake agreement, but there are no merchant storage

SES AI Accelerates Timeline for Revenue Growth and

Jul 28, 2025 · SES AI Accelerates Timeline for Revenue Growth and Profitability with Acquisition of an Energy Storage System Producer UZ Energy Launches SES AI into the $300B+ energy

Battery Energy Storage Systems Report

Jan 18, 2025 · This information was prepared as an account of work sponsored by an agency of the U.S. Government. Neither the U.S. Government nor any agency thereof, nor any of their

How does new energy storage affect the operation and

How does new energy storage affect the operation and revenue of existing generation? 7 6 5 Naga Srujana Goteti1*, Eric Hittinger2, 3, Brian Sergi4, Inês Lima Azevedo5 8 1Energy

Tesla''s energy storage business ''growing like

Oct 25, 2024 · "It won''t be long" before Tesla''s stationary energy storage business is shipping 100GWh a year, CEO Elon Musk has claimed.

Unlocking Energy Storage: Revenue streams and

Jun 24, 2025 · Solar and wind are expected to contribute approximately two-thirds of this growth, serving expanding electricity markets and new sectors. However, other energy-intensive

Unlocking Energy Storage: Revenue streams and

Apr 4, 2025 · Energy storage''s role in the clean energy transition ncing power fluctuations, and aligning supply and demand. Additionally, ESS provide grid ancillary services such as

How does new energy storage affect the operation and revenue

Mar 1, 2021 · Results suggest that marginal new storage increases coal generation and decreases natural gas generation in the West and Midwest, and does the opposite in New

AEMO: Arbitrage revenues in NEM up, FCAS

Jul 26, 2024 · AEMO says the NEM has seen energy trading revenues for battery energy storage systems (BESS) rise 97% year-on-year (YoY) to AUS$25.4

EVE''s 2023 annual report and 2024 first quarter report: The

May 6, 2024 · EVE''s 2023 annual report and 2024 first quarter report: The sales volume of energy storage batteries has grown rapidly, and the demand for consumer batteries has steadily

6 Emerging Revenue Models for BESS: A 2025 Profitability

Mar 31, 2025 · Explore 6 practical revenue streams for C&I BESS, including peak shaving, demand response, and carbon credit strategies. Optimize your energy storage ROI now.

Evolution of business models for energy storage

Apr 11, 2023 · Energy networks in Europe need energy storage to enable decarbonisation of the system while maintaining integrity and reliability of supply.

Tesla Energy Revenue And Energy Profit Margin

Feb 6, 2025 · Explore Tesla energy revenue and profitability. Discover the automaker''s energy sales, gross margin, growth rates, and energy revenue to

Revenue of Beijing''s New-Type Energy Storage Industry

Dec 23, 2024 · China''s new-type energy storage sector is poised to achieve growth across the entire industry chain. The country produces over 70 percent of the world''s lithium batteries and

Electricity Markets and Long-Duration Energy Storage: A

Jun 3, 2025 · Within this context, this paper reviews the literature and industry practices to assess potential grid services for LDES, evaluates existing compensation mechanisms, and identifies

Riding the Battery Storage Revenue Rollercoaster

Apr 16, 2025 · Throughout 2024, and into early 2025, there has been a marked shift in the revenue stack for battery assets (Figure 1) away from one dominated by response services to

Fluence revenue drop, new 5MWh product and

May 9, 2024 · Fluence saw revenue fall in its Q2, while revealing a new 5MWh product and US module production for domestic content IRA incentives.

New Energy Expert Insights Part I: revenue reloaded in the

Jul 30, 2025 · In 2022, we sat down with Marija Petkovic, founder and Managing Director of Energy Synapse, to discuss the challenges and opportunities of incorporating Battery Energy

An update on merchant energy storage

Nov 17, 2021 · Introduction Storage technologies are facilitating the integration of variable renewable energy (VRE) resources and will play an increasingly critical role in the future. Thus

Tesla''s Energy Storage Business Is Quietly

Jun 6, 2025 · An energy boom few are talking about Tesla''s energy business delivered stunning results in 2024. Total energy generation and storage

Evaluating energy storage tech revenue

Feb 11, 2025 · Owners of energy storage systems can tap into diversified power market products to capture revenues. So-called "revenue stacking" from

Germany: 2-hour battery storage revenues 60

Sep 13, 2023 · The changing revenue stack for battery storage in Germany. Image: Entrix. The revenue advantage of 2-hour battery energy storage

Analysis of various types of new energy storage

May 28, 2024 · The results show that the case study energy storage plant has the highest revenue in the spot market, followed by the capacity market, and

New Energy Storage Business Models and Revenue Levels

Jun 15, 2024 · Under the current energy storage market conditions in China, analyzing the application scenarios, business models, and economic benefits of energy storage is

LG Energy Solution announces ESS revenue

Oct 29, 2024 · LG Energy Solution expects strong demand for energy storage and plans to release a high-capacity lithium iron phosphate product with 20%

Energy Storage: Batteries & Grid Solutions

2 days ago · Explore energy storage like batteries, pumped hydro, and power reserves. Learn how storage boosts grid reliability and expands renewable

Tesla''s 2024 energy storage revenue surpasses

Jan 30, 2025 · The cumulative revenue from the company''s energy generation and storage business stood at $10,086 million at the end of 2024, up by 67%

How Energy Storage Can Be a Revenue Stream for Utility

Feb 25, 2024 · New business models focused on energy sharing, community storage projects, and peer-to-peer energy exchanges may arise, offering utility companies a multitude of

Energy Storage News | Today''s latest by

4 days ago · Latest news on energy storage projects, BESS, capacity expansion, and regulatory updates across Europe, US & Canada, Latin America, and

Analysis of various types of new energy storage revenue

The results show that the case study energy storage plant has the highest revenue in the spot market, followed by the capacity market, and relatively low revenue in the secondary service

6 FAQs about [Energy Storage and New Energy Revenue]

How does energy storage generate revenue?

Energy storage generates revenue in America’s organized power markets through three main ways: platforms, products, and pay-days. However, different projects may tap these potential revenue streams in different ways, and investors should seek nimble developers who can navigate a complex and evolving regulatory and market landscape.

Do investors underestimate the value of energy storage?

While energy storage is already being deployed to support grids across major power markets, new McKinsey analysis suggests investors often underestimate the value of energy storage in their business cases.

How do I evaluate potential revenue streams from energy storage assets?

Evaluating potential revenue streams from flexible assets, such as energy storage systems, is not simple. Investors need to consider the various value pools available to a storage asset, including wholesale, grid services, and capacity markets, as well as the inherent volatility of the prices of each (see sidebar, “Glossary”).

Are energy storage returns undervalued?

Such complexity means the expected economic returns are often undervalued, especially if shortcuts are taken to simplify the analysis. Adopting a holistic approach that considers all revenue streams across a broad range of external events could improve the outlook of energy storage returns.

Do storage additions affect renewables?

While the complementary relationship between storage and renewables is well-known, the effect of storage additions is not necessarily limited to renewables. This work models the system effects of new storage on the generation, operating income, and retirement of power plants at three levels of increasing complexity.

How important are ancillary services to energy storage?

Ancillary services that stabilize the power grid typically represent 50 to 80 percent of the full storage revenue stack of energy storage assets deployed today. This is observed across multiple mature storage markets but is expected to decrease to less than 40 percent by 2030.

Industry Information

- Energy storage project capacity standards

- How much does the Portonovo BESS portable power supply cost

- Sungrow brand inverter manufacturers

- Outdoor power supply wmt

- London base station photovoltaic energy storage

- 90v photovoltaic thin film module

- Annual power generation of wind solar and energy storage in Baghdad

- Mobile Wireless Outdoor Base Station

- Honiara Energy Storage Container Power Plant Operation

- How to recruit energy storage container photovoltaic solar energy

- Ankara Solar Water Pump Factory

- How much does photovoltaic energy storage cost

- French portable energy storage battery company

- Production of graphene energy storage batteries

- Tunisia inverter grid connection standard

- Skopje Mobile Photovoltaic Folding Container Wholesale

- Details of the positive outdoor power supply

- What are the industrial energy storage devices in Shanghai

- China wholesale rv circuit breaker producer

- Solar powered mobile container power supply principle

- How to use the battery of communication base station

- How to distinguish battery cabinets and power cabinets

- How many watts does an off-grid inverter carry

Commercial & Industrial Solar Storage Market Growth

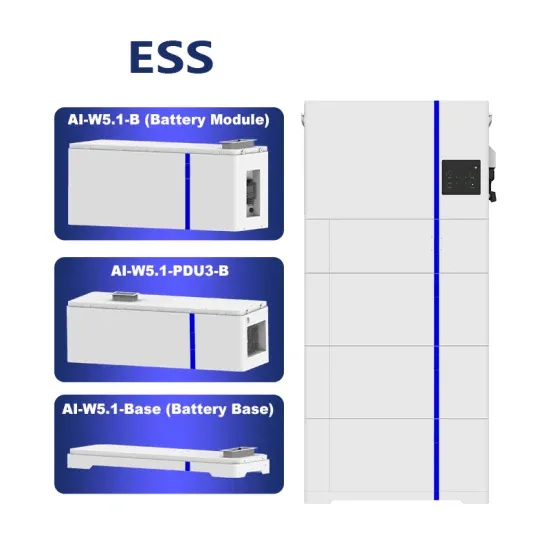

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

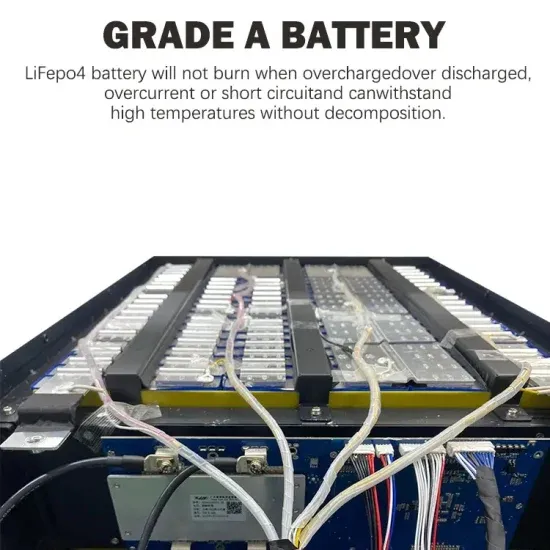

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.