Global 4G & 5G LTE Base Station Market Outlook, In‑Depth

Jul 31, 2025 · The global 4G & 5G LTE Base Station market is projected to grow from US$ 37780 million in 2024 to US$ 19380 million by 2031, at a CAGR of -9.2% (2025-2031), driven by

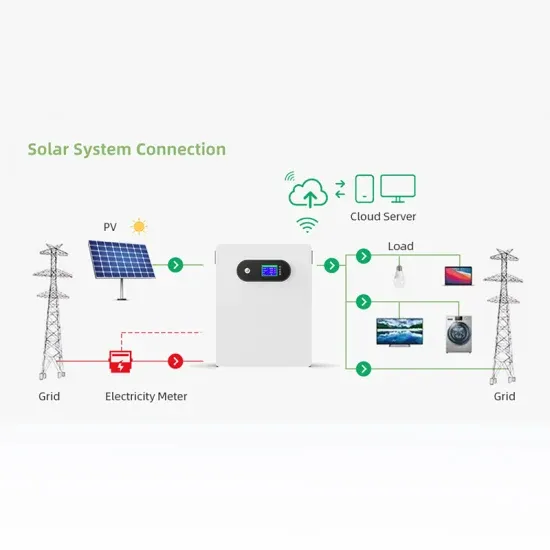

Tirana era base station energy storage

In today''''s 5G era, the energy efficiency (EE) of cellular base stations is crucial for sustainable communication. Recognizing this, Mobile Network Operators are actively prioritizing EE for

5G Base Station – WiSig Networks

Our Ecosystem WiSig Networks collaborates with semiconductor and processor companies to create reference platforms for 5G gNodeB, licenses its designs

5G Base Station Companies

The rollout of 5G networks is transforming the connectivity landscape, and the 5G Base Station Market is at the forefront of this revolution. 5G base stations form

5g network manufacturers

Dec 6, 2023 · The development and deployment of 5G networks involve a variety of technology and equipment manufacturers. Here''s a technical overview of the key components and players

Quick guide: components for 5G base stations and antennas

Mar 12, 2021 · 5G technology manufacturers face a challenge. With the demand for 5G coverage accelerating, it''s a race to build and deploy base-station components and antenna mast

5G Network Equipment Manufacturers

The 5G next-generation base transceiver station or gNodeB (gNB) connects subscriber user equipment (UE) devices to the mobile network. Many of the

Ambitious 5G base station plan for 2025

The move comes as the country charted its vision for industrial growth during a two-day work conference of the Ministry of Industry and Information Technology. With 4.19 million 5G base

5G base station manufacturer

Jul 14, 2025 · Chinese and European suppliers of base station equipment are expected to once again account for a global market share of more than 70% in 2021, and the top three suppliers

Base station energy storage tirana era

Sep 6, 2024 · This article aims to reduce the electricity cost of 5G base stations, and optimizes the energy storage of 5G base stations connected to wind turbines and photovoltaics.

Base station antenna manufacturer

Antennas for 5G and beyond -Macro and Small Cell applications Kaelus provide a range of innovative single and multi-band antennas that are class-leading in

Base Station Transmits: 5G

Aug 2, 2022 · The goal of Base Station Transmits is to discuss challenges faced by engineers and technicians who must optimize today''s wireless networks.

Report | Global 4G and 5G Base Station Market 2023 by Manufacturers

Chapter 2, to profile the top manufacturers of 4G & 5G Base Station, with price, sales, revenue and global market share of 4G & 5G Base Station from 2018 to 2023. Chapter 3, the 4G & 5G

Europe 5G Base Station Market Size & Outlook,

The 5g base station market in Europe is expected to reach a projected revenue of US$ 44,815.4 million by 2030. A compound annual growth rate of 33.8% is

Top 10 5G Infrastructure Companies

Jan 31, 2024 · Data Centre Magazine considers some of the leading companies in 5G infrastructure as they showcase a commitment to providing better

5g Base Station Market Size & Share Analysis

Jul 8, 2025 · The 5G Base Station Market is expected to reach USD 37.44 billion in 2025 and grow at a CAGR of 28.67% to reach USD 132.06 billion by 2030.

Three companies to own 74.5% of base station

Aug 8, 2022 · TrendForce believes, with the evolution of 5G deployment towards the core and Open RAN cloud, equipment manufacturers will strengthen

5G Energy Efficiency Overview

Base station resources are generally unused 75 - 90% of the time, even in highly loaded networks. 5G can make better use of power-saving techniques in the base station part,

10 RAN vendors: challengers, newcomers and

3 days ago · Utilising Nokia''s AirScale all-in-cloud base station, and subsequently, virtual baseband processing, with Intel''s processor-based

Top 10 global 5G infrastructure companies and

Jul 4, 2023 · As 5G continues to revolutionise the industry, we round up the Top 10 companies shaping the future of the technology - and those at the forefront

5G Base Station Market By Share, Size and Forecast 2028

The Global 5G Base Station Market is experiencing rapid growth and transformation as it plays a pivotal role in ushering in the era of 5G connectivity.

Base station energy storage tirana era

Sep 6, 2024 · To maximize overall benefits for the investors and operators of base station energy storage, we proposed a bi-level optimization model for the operation of the energy storage,

Technical Requirements and Market Prospects of 5G Base Station

Jan 17, 2025 · 5G base station chips play a critical role in the construction of 5G networks. As technology continues to advance, base station chips will demonstrate higher performance and

5G Wireless Infrastructure Solutions

Jun 17, 2025 · Qorvo is a leader in 5G through our expertise in RF design, R&D legacy and product development of integrated, complex technologies and

5g base station architecture

Dec 13, 2023 · 5G (fifth generation) base station architecture is designed to provide high-speed, low-latency, and massive connectivity to a wide range of devices. The architecture is more

SolidRun, Amarisoft Validate Compact Full 4G/5G Base Station

Jul 21, 2025 · SolidRun, a leading developer and manufacturer of high-performance System on Module (SOM) solutions, Single Board Computers (SBC) and network edge solutions,

5G Base Station Market Size, Share & Growth Report, 2030

5G Base Station Market Summary The global 5G base station market size was estimated at USD 33,472.5 million in 2023 and is projected to reach USD 253,624.3 million by 2030, growing at a

Kyocera develops AI-powered 5G virtualized base station for

Feb 18, 2025 · Features of Kyocera''s 5G virtualized base station 1. AI-powered base station functionality Using AI, the system dynamically manages traffic congestion and optimizes

Top 5G Base Station gNodeB Manufacturers & Vendors

Explore the leading manufacturers of 5G gNodeB base stations, including Nokia, Ericsson, Huawei, Samsung, and ZTE, and their contributions to the telecom industry.

Global 5G Base Station Market 2025 by Manufacturers,

According to our (Global Info Research) latest study, the global 5G Base Station market size was valued at US$ 37560 million in 2024 and is forecast to a readjusted size of USD 19080 million

Keysight Introduces 5G Base Station Test Solution

Oct 1, 2018 · A new test solution for 5G base station manufacturing should speed up the testing of new 5G New Radio (NR) infrastructure equipment, and

5G NR Base Station Classes: Type 1-C, Type 1-H,

This article describes the different classes or types of 5G NR Base Stations (BS), including BS Type 1-C, BS Type 1-H, BS Type 1-O, and BS Type 2-O.

5G Network Equipment Manufacturers: Modem, Base Station

Explore leading 5G equipment manufacturers for modems, base stations, RAN, and core networks. Discover vendors enhancing network speed and efficiency.

Solutions for Base Station Components | Syensqo

Aug 18, 2025 · Innovation for Next-Gen Base Stations Base stations are critical in communication for wireless mobile devices, as they serve as a central point in connecting devices to other

5G Base Station Companies

Mordor Intelligence expert advisors identify the Top 5 5G Base Station companies and the other top companies based on 2024 market position. Get access to

Types of 5G NR Base Stations and Their Roles in

May 7, 2025 · Conclusion Each type of 5G NR base station plays a distinct and crucial role in building a reliable, high-performance 5G network. From wide

Global 5G Base Station Industry Research Report

The 5G base station is the core device of the 5G network, providing wireless coverage and realizing wireless signal transmission between the wired

6 FAQs about [Tirana 5g base station manufacturer]

Which region dominates the 5G base station market?

The Asia-Pacific region continues to dominate the global 5G base station market, with a projected CAGR of approximately 38% from 2024 to 2029. This region represents the most dynamic and fastest-growing market, led by significant deployments in China, Japan, South Korea, and India.

Why did Qorvo start 5G?

Qorvo’s early start in 5G comes from our legacy of R&D and product development in the defense and aerospace markets, as well as a being a leading supplier of sub-6 GHz RF solutions to the world’s leading 2G, 3G and 4G base station manufacturers.

What is 5G radio access network (ran)?

The deployment of 5G antenna systems and 5G radio access network (RAN) components further underscores these benefits, ensuring comprehensive coverage and connectivity. The 5G small cell segment continues to dominate the global 5G base station market, commanding approximately 60% of the market share in 2024.

How many 5G base stations are there in China?

The market is witnessing significant developments in base station technology and deployment strategies. By September 2023, China had built 3.189 million 5G base stations, with 22.6 5G stations per 10,000 people, demonstrating the scale of infrastructure deployment possible.

What is the fastest growing segment in 5G base station market?

The 5G macro cell segment is emerging as the fastest-growing segment in the 5G base station market, projected to grow at approximately 40% during the forecast period 2024-2029.

What is Europe's 5G base station growth rate?

Europe has demonstrated remarkable progress in 5G base station deployment, with a substantial growth rate of approximately 38% from 2019 to 2024. The region's market development is characterized by strong governmental support and strategic initiatives across multiple countries, particularly in the United Kingdom, Germany, France, and Italy.

Industry Information

- A small communication base station in Central Africa has uninterrupted power supply

- Astana communication base station wind and solar hybrid control screen

- How many kilowatt-hours of electricity is the energy storage solution mwh

- Which companies have Latvia Telecom PV sites

- Cheap factory price safety breaker manufacturer

- Differences between double-glass modules and ordinary modules

- What is acpd for communication base station lithium-ion batteries

- 2025 China Hybrid Energy 5G Base Station Hybrid Power Supply

- Iraqi industrial energy storage battery brand

- Photovoltaic energy storage cabinet outdoor solar energy

- Which lithium battery is the best for energy storage in Skopje

- How much does a photovoltaic tile cost in Monterrey Mexico

- Amman portable energy storage battery customization

- Which company in Madrid has the most photovoltaic sites

- Italy Milan Energy Storage Outdoor Power Cabinet Manufacturer

- Several generators at the Bridgetown photovoltaic power station

- Container energy storage configuration

- Djibouti Solar Power System

- Uninterruptible power supply retail price in London

- Indonesia 5G base station outdoor cabinet manufacturer

- Household solar lights regular products

- Hot sale factory price current breaker supplier

- 7 5v to 12v inverter

Commercial & Industrial Solar Storage Market Growth

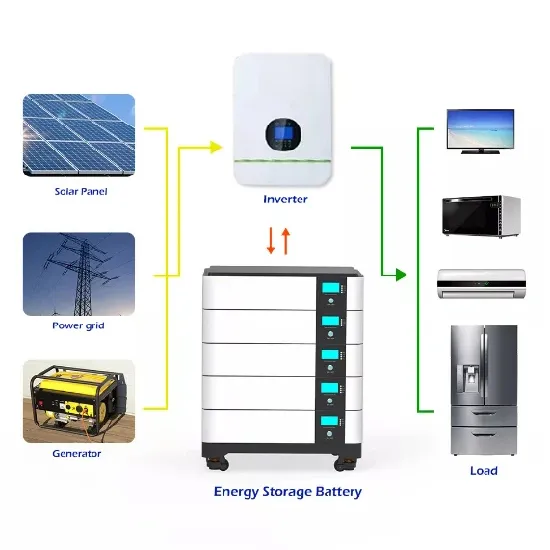

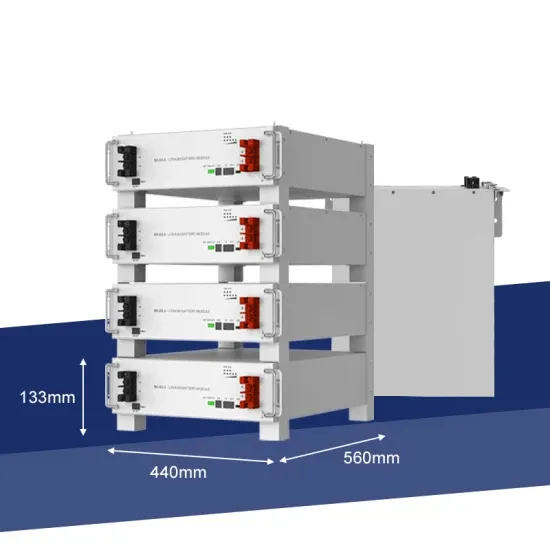

The global commercial and industrial solar energy storage battery market is experiencing unprecedented growth, with demand increasing by over 400% in the past three years. Large-scale battery storage solutions now account for approximately 45% of all new commercial solar installations worldwide. North America leads with 42% market share, driven by corporate sustainability goals and federal investment tax credits that reduce total system costs by 30-35%. Europe follows with 35% market share, where standardized industrial storage designs have cut installation timelines by 60% compared to custom solutions. Asia-Pacific represents the fastest-growing region at 50% CAGR, with manufacturing innovations reducing system prices by 20% annually. Emerging markets are adopting commercial storage for peak shaving and energy cost reduction, with typical payback periods of 3-6 years. Modern industrial installations now feature integrated systems with 50kWh to multi-megawatt capacity at costs below $500/kWh for complete energy solutions.

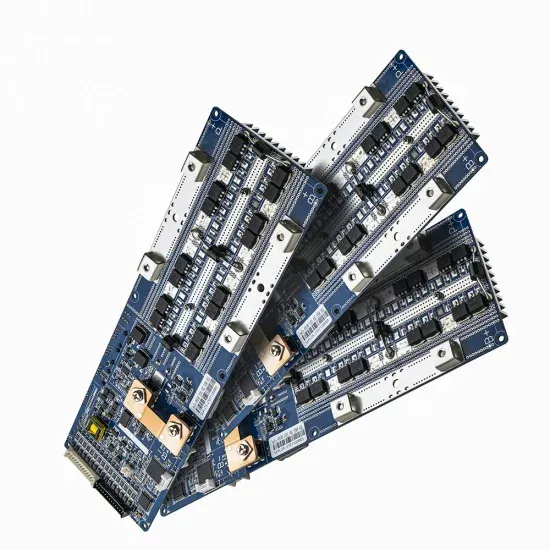

Solar Battery Innovations & Industrial Cost Benefits

Technological advancements are dramatically improving solar energy storage battery performance while reducing costs for commercial applications. Next-generation battery management systems maintain optimal performance with 50% less energy loss, extending battery lifespan to 20+ years. Standardized plug-and-play designs have reduced installation costs from $1,000/kW to $550/kW since 2022. Smart integration features now allow industrial systems to operate as virtual power plants, increasing business savings by 40% through time-of-use optimization and grid services. Safety innovations including multi-stage protection and thermal management systems have reduced insurance premiums by 30% for commercial storage installations. New modular designs enable capacity expansion through simple battery additions at just $450/kWh for incremental storage. These innovations have improved ROI significantly, with commercial projects typically achieving payback in 4-7 years depending on local electricity rates and incentive programs. Recent pricing trends show standard industrial systems (50-100kWh) starting at $25,000 and premium systems (200-500kWh) from $100,000, with flexible financing options available for businesses.